[Editor’s note: This is a guest post from Mark Lusky of Mark Lusky Communications, a writing and marketing communications firm, operating since 1982. He specializes in ghostwriting expert advice articles, blogposts and other bylined content for clients, along with writing e-books, whitepapers, case studies, websites, opinion pieces and other communiques—incorporating marketing skills and perspectives acquired as a regional marketing director for Ringling Bros. and Barnum & Bailey Circus. He will be attending LendIt in San Francisco this April.]

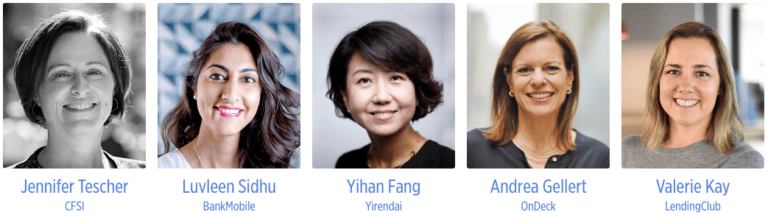

LendIt Fintech’s Fintech Women of the Year 2019 award finalists champion the causes of diversity, equality and education—and shout it from the rooftops. In the process, they’re demolishing glass ceilings for women and other diversity-challenged groups.

They are dedicated to achieving gender, ethnic and racial equality. And they are educating a variety of audiences— including borrowers, investors and the Fintech industry—about ways to grow and thrive by becoming savvier and open to all people.

These finalists are changing not just their world—but the whole world.

Promote diversity, respect, collaboration

Valerie Kay, Chief Capital Officer at LendingClub, is responsible for overseeing LendingClub’s Investor Group. She addresses the need for diversity, inclusion, mutual respect and collaboration. She emphasizes the vital importance of diversity to drive better workplaces, happier customers and more profits.

Kay notes, “We as executives have a responsibility to create opportunities that will raise the next generation of leaders – this includes creating diverse working environments where our employees feel that their voices matter. Diversity is more than gender – it’s about diversity of ethnicity, background, experiences, sexual orientation, and more. At LendingClub, we believe that bringing different perspectives together, regardless of gender, in an environment of mutual respect and collaboration delivers better outcomes for our customers. We believe that this drives innovation and success. My advice to companies: start with the problem you’re solving. Give opportunities for varying voices and actually listen. Don’t let your bias guide your decisions. Elevate the great ideas that help your target audience.”

Andrea Gellert, Chief Revenue Officer and Chief Marketing Officer of online small business lender OnDeck, says she sees good progress being made by Fintechs in finding female candidates at all levels including C-Suite and board positions. She points out, “There are more female founders than there used to be. We are moving at a much more accelerated pace than previous industries did in terms of female management.”

Deeds drive the bus toward equality

For Jennifer Tescher and Yihan Fang, accomplishments and setting an example help make the case for viewing Fintech’s women as empowering role models for others.

Tescher, Founder, President and CEO of the Center for Financial Services Innovation (CFSI), is an authority on consumer financial health. Through her organization’s guidance and education, Tescher has educated the financial services community to improve their products and services to underserved consumers, and provided insights, direction and education for these consumers to become better borrowers.

She points out, “We have built a financial health framework and measurement methodology, and today dozens of companies are working with us to measure the financial health of their customers and employees and use the learnings to inform strategy, product design and customer experience. Five years ago, we launched the Financial Solutions Lab with a $25 million partnership with JPMorgan Chase. The Lab invests in early-stage fintech companies that are building solutions to pressing financial health challenges, like volatile incomes, lack of emergency savings, managing medical expenses and many others.”

Fang, CEO of Yirendai, has been a major force in entrenching Fintech in China. The company also focuses on the underserved, in this case investors and individual borrowers. The first publicly listed Fintech company from China, Yirendai is described in Crunchbase as: “…the consumer finance arm of Chinese peer-to-peer (P2P) lender CreditEase. It is focused on providing an effective solution to address largely underserved investor and individual borrower demand in China through an online platform that automates key aspects of its operations to efficiently match borrowers with investors and execute loan transactions.”

Her stewardship has been the catalyst for developing a top-notch team in financial services and technology. She notes that there was “no Fintech when I started in 2011. We built a team and trained them, [making Fintech] a habit for consumers in China.”

“Give a [wo]man a fish…

…and you feed [her] for a day; teach a [wo]man to fish and you feed [her] for a lifetime.” This is adapted from the widely-known quote by the philosopher Maimonides.

American Banker describes Luvleen Sidhu as the “Co-Founder, President and Chief Strategy Officer at BankMobile, a completely digital bank, offering a checking and savings account aimed at helping the underbanked, millennials and middle-income Americans have an affordable, effortless and financially empowering banking experience.”

In addition to her “day job,” Sidhu also mentors Fintech startups and facilitates establishment of computer centers in India to educate rural women.

She teaches, she mentors, she helps people help themselves. A powerful force in Fintech, she cites ability to pivot quickly to create new opportunities and open, transparent and safe leadership/management meetings as major achievements. She points out that Fintech can help drive opportunities for women, including helping them finance their businesses. A BankMobile vision is to help fund women entrepreneurs along with other “minorities.”

There’s always a “but”

Acknowledging the advancements and accolades for these finalists, however, shares the spotlight with the sobering reality that there is still a long way to go.

Notes Tescher, “Fintech is challenged by the fact that women are underrepresented in both ‘fin’ and ‘tech.’ Having said that, parity for women is not a sectoral problem; it’s a structural and cultural problem across sectors. Consider the fact that despite all of the women who were elected to Congress last year, women still only make up 25% of that body. Last time I checked, women account for about half of the population.”

Adds Gellert, “The reality is that as long as we have to discuss gender it means that we aren’t where we want to be yet. We still have a gap that needs bridging in terms of both numbers of women and their compensation.”

Weighing in on women and men in Fintech

Fintech needs to evolve so that women can be viewed for contributions without tying them to gender. Kay says it’s “extremely important…Of course the male-dominated fintech industry should evolve and it will when more women are in leadership positions…For women to be seen for their contributions beyond their gender, we need to break down the ‘bro’ culture that has defined Wall Street and the tech industry for decades.”

She adds, “I’m in a unique position to help elevate and foster the next generation of female leaders and you better believe it is something that I actively do every day. This is one of my passions. When it comes to equal access, opportunity and compensation it’s important for people no matter the gender to not only advocate for themselves but to find their mentors that will advocate for them and extend that seat at the table.”

Gellert emphasizes that female leaders in Fintech need to focus on being role models and active stewards for women entering the industry. She points out, “That means being active recruiters ourselves and ensuring diverse candidate slates in our recruiting processes. That means engaging and mentoring women when they come to our companies. That means ensuring that we are working with our compensation teams to be mindful of existing compensation gaps.”

Gellert adds, “That also means being aware of different behavioral norms for men and women. In my experience it is absolutely the case that men ask for promotions and raises far more frequently than women do—in a world biased towards action that means that men are more likely to get more just because they ask for it more.”

Fang points out, “It doesn’t matter what gender. I never feel I’m different. I don’t feel gender [should be] an issue. On my top management team, half or more are women.”

Sidhu says it’s time to think more innovatively in the industry and move on from gender discrimination. She advocates “diversity to transcend all players in the Fintech ecosystem. Fintech can be instrumental to drive quality for opportunity. So many other industries can do same thing.” People need to be more open to conversations, such as equal pay for women. Fintech can help support women by financing their businesses, she adds, noting, “In my organization, we promote women who are exceptional, and reward with leadership-level recognition and compensation.”

Accountability for gender equality, diversity

Notes Kay, “Yes there is more work to do; however, we’re starting to make strides in leveling the playing field. Today there are many prominent recognition programs, such as the Bloomberg Gender-Equality Index, that hold companies accountable. This initiative recognizes 230 companies, of which 96 are financial firms, for their commitment to transparency in gender reporting and advancing women’s equality.

She adds, “The index includes companies from 10 sectors, headquartered across 36 countries and regions. Collectively, these companies have a combined market capitalization of USD 9 trillion and globally employ more than 15 million people, of which 7 million are women. Programs like these that showcase all the ways in which the world’s top companies are promoting diversity throughout their organizations provide an even greater platform for recognition and awareness.”

Me Too Movement ramps up awareness

Sidhu comments that the Me Too Movement cast a light on women’s struggles and inequality: “The Me Too Movement shed light on the problem. I’m not happy it had to come into being. The silver lining is that it brought the whole country together to understand that issues exist. [This drove] awareness. Awareness drives change.”

It’s a marathon, not a sprint…and everyone needs to get in on the race

Tescher points out, “We are working hard to identify and invest in women founders. But to be clear, that is only one small action step relative to what’s needed to change structures and cultures. Moreover, women didn’t cause this problem. It shouldn’t be on us alone to solve it.”

These Award finalists are helping demolish the glass ceiling and creating a new culture of diversity, equality and education in Fintech along the way.

The Fintech Women of the Year award winner will be announced Tuesday, April 9th along with awards in 18 other categories. LendIt Fintech has a variety of Women in Fintech Special Programs that will be happening at their 2019 event and throughout the year.