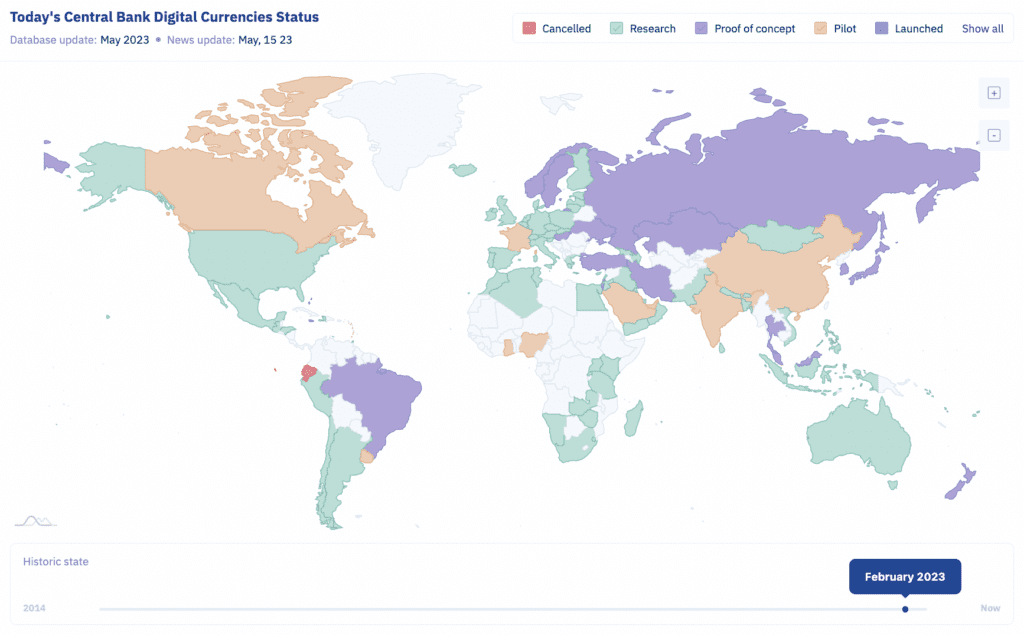

A global exploration of central bank digital currencies (CBDCs) is underway, with some charging ahead in their investigations.

According to the Atlantic Council, 120 countries making up 95% of the world’s GDP are researching CBDCS. As of March 1, 2023, 65 countries are in the advanced stages of development, and over 20 have launched pilots. Some islands in the Caribbean have already established a definitive model.

Many believe digital currencies’ benefits could push societies into the next wave of financial services development. Promises of greater access to financial services, faster and cheaper payments, and the potential to strengthen governments’ benefits policies all drive investigation toward a cashless utopian dream.

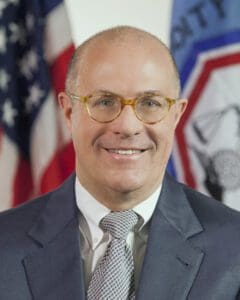

“Ultimately, the vision for digital currency is much more than that,” said J. Chris Giancarlo, former chairman of the CFTC and co-founder of the Digital Dollar Foundation at Consensus 2023. “It’s nothing less than the prospect of a fully networked and integrated economy, with digital currencies as operating systems and digital tokens as their value components.”

Many argue that central bank-backed digital currencies could provide safer access to the new currencies than those offered by the private sector.

However, there are doubts. The European Union recently published its final consultation on a digital euro and is set to decide on a future rollout later this year. Despite the prospect of a digital euro being more likely, questions still hang in the air concerning CBDCs’ added value to the payments system and their privacy.

“The question we have to ask is why are we doing it, and with what goal,” said French lawmaker Aurore Lalucq. “We’re jumping onto the digital bandwagon because it’s fashionable and trying to deliver it with forceps … I think you need to be extremely careful.”

Although the U.S. is not so far gone with its investigation, it is also having trouble convincing stakeholders. Seen by some as the only ‘real’ digital currency, CBDCs have been caught at a crossroads and made into an electoral bargaining chip.

CBDCs as a political statement

Although the idea of a U.S. dollar is in preliminary investigations, CBDCs have already been catapulted into political debate.

Less than a week ago, Florida Governor Ron DeSantis signed a bill to ban the hypothetical currency after months of publicly voicing his outrage. The bill was announced in March. Now, Florida legislation that seeks to define money explicitly states that it does not include CBDCs.

In the months before signing, DeSantis has said he believes CBDCs are part of “woke politics” seeking to get rid of crypto.

“You’re opening up a major can of worms, and you’re handing a central bank huge, huge amounts of power, and they will use that power,” he said in his announcement of the bill to ban CBDCs in Florida.

“Anyone with their eyes open could see the danger this type of an arrangement would mean for Americans who want to exercise their financial independence and would like to be able to conduct business without having the government know every single transaction they’re making in real-time.”

He is not alone; other states have also voiced intentions to implement similar bans.

While DeSantis’ signing was not unexpected, commentators are reeling at how the currency, still a long way from a decision to implement, had become such a talking point.

“The CBDC has become sort of the symbolic issue,” said CoinDesk Executive Director of Global Content, Emily Parker. “For some of these people, it stands as this tool for state surveillance.”

Privacy is not tackled with denial

The concern is not unfounded. However, it is also not a new concern.

An increasingly digital society has brought thousands of digital data points into the sphere for collection. Private companies and governments have already documented access to online personal and financial data.

While this data fuels, in many cases, the creation of innovative solutions, particularly in fintech, it is also being used increasingly to influence decisions tailored to individuals. The refrain “Data is Power” has been heard in more than one interview with industry leaders, many seeing it, not without reason, as a positive tool for development.

However, with every foray into increased data access comes the issue of privacy, meaning that extensive privacy controls would have to be implemented regardless of whether the central bank backs a digital currency.

“Let’s be clear, absolutely clear,” said Giancarlo, “there is nothing inherently superior about non-sovereign digital currency and protecting privacy over central bank digital currency, nothing whatsoever. Both will be massive honeypots of users’ financial data, creating the opportunity for wide-scale mischief and abuse.”

He referenced U.S. regulators’ draft stablecoin bill published on April 14, 2023.

The bill was the first U.S. crypto oversight legislation drafted due to months of debate and was dubbed by Representative Patrick McHenry as an “ugly baby” of a bill.

Giancarlo highlighted that little heed had been paid to the privacy of stablecoins in the draft legislation. However, in the few pages regarding CBDCs, the subject was broached.

“It’s entirely foreseeable that private sector sponsors of cryptocurrencies and stablecoins, or even commercial services of digital dollars, such as wallet providers, could be put under government pressure to conduct surveillance, activity report, and disable financial transactions with disfavored groups and activities,” he said.

“This can be done in the same way that we now know the U.S. government has had full access to everything on Twitter, including private direct messages between users fit for purpose stablecoin legislation must protect American citizens financial rights to privacy.”

His point? That the privacy and control issue did not solely pertain to the subject of CBDCs. It continues to be a consideration affecting the whole digital currency sector.

Related:

“Thus, what I would call the fashionable debate today, between CBDCs on the one hand and stablecoins on the other, is passe. It was always a false choice, and it’s really moot,” he continued.

“What is clear is that both sovereign and non-sovereign digital currency is coming and coming very quickly…Americans, even Floridians, cannot shield themselves from Central Bank digital currency.”

Regardless of state bans and the U.S.’s decision to create a digital dollar, digital currencies have been established and are on the rise. U.S. regulators’ reluctance to regulate, instead of attempting to enforce crypto out of existence, could again be the key to its safe development.

Within careful regulation and investigation lies the power to protect users from the vulnerability of their increased data exposure, thus becoming a step towards tackling the privacy issue of CBDCs.

Whether users trust that privacy protection? Now that’s a whole other can of worms.