In North America, the issue of diversity within the financial workplace has improved in the past few years.

A report conducted by McKinsey and LeanIn.org found that at an entry level, women accounted for 52% of the workforce and had also significantly improved at senior levels. Despite this, female representation is still low, especially for women of color. From entry to C-Suite, the number of women of color fell by 80%.

Although representation varies according to the sector, the results are clear; there is still much work to be done to enhance diversity within the financial services industry.

The issue affects not only the people who aim for a career in the financial sector but also the engagement of the general public with companies and the development of varied, innovative solutions to improve the whole of the general population.

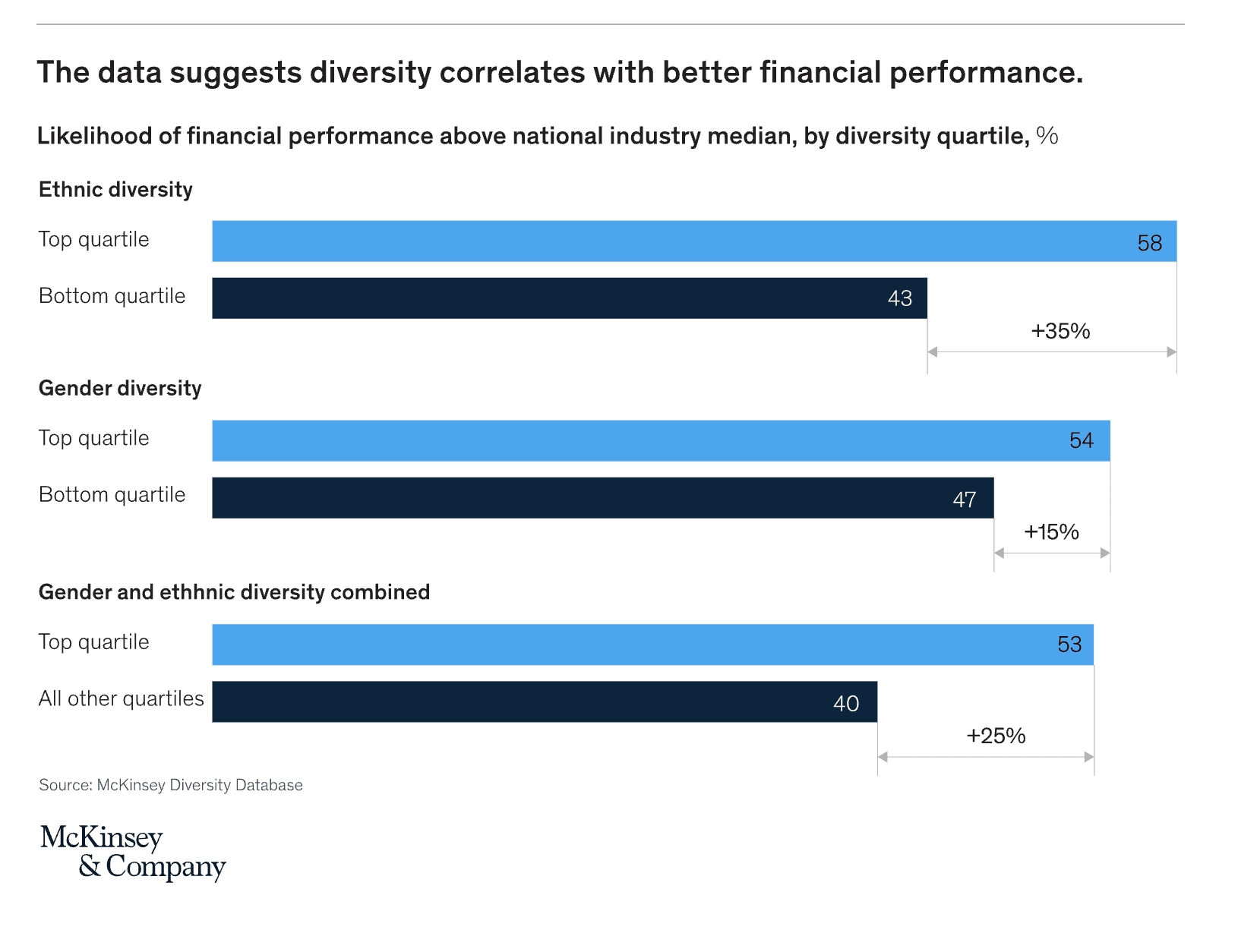

McKinsey reported back in 2015 a correlation between greater diversity and increased profits. They stated, “Our latest research finds that companies in the top quartile for gender or racial and ethnic diversity are more likely to have financial returns above their national industry medians.”

“While correlation does not equal causation, the correlation does indicate that when companies commit themselves to diverse leadership, they are more successful.”

Various reports and surveys since, carried out by entities such as the Harvard Business Review, have corroborated this conclusion.

Diversity problem not only in recruitment

As we see that entry-level percentages are now relatively equal, it seems that the problem lies not only within the employment itself. It is the access to the culture surrounding the employment that for many is so essential to climbing the career ladder.

According to Women in Consumer Finance (WCF), the issue comes from three primary sources; access to a professional network, problems with confidence, and lack of career examples.

The annual event focuses on targeting these issues and improving female access to employment opportunities in a holistic and immersive way.

Stephanie Eidelman, CEO and WCF conference co-chair, said, “It feels like everything I’ve done has led me to Women in Consumer Finance. I have often found myself to be the only woman in a room or one of just a few.”

“As I think back on my career, I realize that nobody ever really took me under their wing. Although I’ve achieved success, I can’t help but wonder how it might have been different if I had a stronger hand guiding me along the way. “

“Women in Consumer Finance is designed to be that guiding hand for anyone who needs it.”

Tackling diversity issue head on

Established in 2017, the WCF event aims to bring a community of female finance professionals together, enrich the sector, and support ambition.

The WCF sees a lack of opportunity to access the same social networks as men in the sector, resulting in a disadvantage when applying for promotions, especially at a senior level.

They have found there to be a general lack of confidence when applying to senior-level roles and a lack of leading female role models for entry-level women to follow and learn from.

With the use of the event as a focal point, they have various programs which tackle these issues during the conference and throughout the year. Through the Magic is in the Connection and The WCF Advisory Board programs, they target the problems of networking, confidence, and mentorship head-on with small focus groups matched together by the WCF administration.

In addition, they have introduced the use of the Storyboard, an online platform for articles and testimonies, providing insight and guidance for female professionals.

Work with the broader community

The co-chairs of WCF, Stephanie Eidelman and Shelly Sheppick, both come from established backgrounds, dedicated to improving the community’s access to career prospects. Sitting on the boards of LIFT and For The Good, they integrate the work they do with WCF into these initiatives.

The two charities focus on empowering women and families to lift themselves out of poverty and financial exclusion.

LIFT provides families with life coaches tailored to family needs to achieve long-term goals and professional connections to create financial stability. For the Good is based in Kenya and is directly involved in improving girls’ education, encouraging inclusion in secondary education, and financial independence as they grow into womanhood.

“We partner with hand-picked organizations where we can make a real impact to help support women and girls,” said Eidelman. “We support them both financially and via exposure through the conference and inspiring content during the year.”

‘Stop being grateful and be great’

The event targets deep-rooted issues and preconceptions with a three-day networking experience. Ranging from group activities and excursions to panel discussions and team-building seminars aimed at building connections, the conference sets out to enrich the professional outlook of the attendees.

The personal focus on active network building within small groups and story sharing is said to create a friendly and intimate atmosphere.

Testimonials from women at all levels of the career ladder praise their approach, valuing the opportunity and the importance of the event in their professional path during the following year.

“This is not a passive listening exercise but rather a 100% immersive experience. There is nothing else like it. In short, we take a unique approach to building confidence, connection, and careers.” concluded Eidelman.

RELATED LINKS :