The SME sector faces ongoing hardship as the world progresses into its post-COVID reality.

Following significant disruption to growth in 2020, SMEs seemed to bounce back in 2021, remaining below the sector’s 2019 value. Some believe the full effect of the pandemic is still yet to be seen.

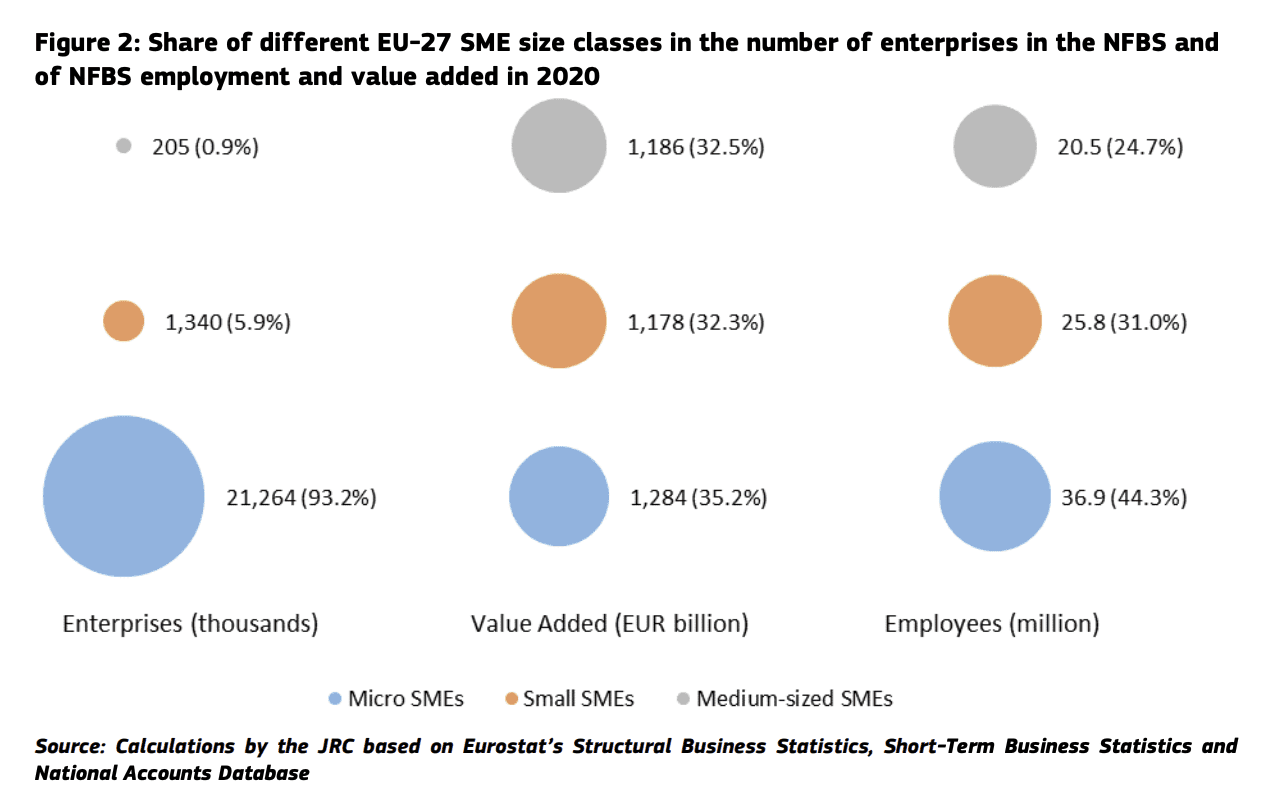

Micro SMEs make up the majority of the European SME sector, accounting for between 90-95% in all of the EU member states. They also account for the largest share of SME employment, genuinely earning their title as “the backbone of our economies.” Micro businesses were the hardest hit during 2020 and continue to struggle with rising costs.

Vibrant, a Danish fintech that allows customers to turn Android mobile devices into points of sale (POS), targets micro SMEs as its primary customer base, aiming to bring card payments to even the most remote areas of Europe. Today the results of their €4 million seed round, with plans to expand further into Europe and aid SME recovery.

“Digital payments now dwarf cash as the default type of transaction,” said Kasper Krog, Vibrant’s CEO. “This immense growth of contactless payments was accelerated by the Covid-19 pandemic, which affected many small businesses terribly.”

“As these companies find their feet again, we want to empower them with the digital tools they need. We believe in liberating merchants from the legacy of cash and expensive card machines. Mobile devices can act as pocket terminals for any small trader, which is the next chapter in the future of the cashless society.”

Mobile POS becoming a critical sector

The mobile POS sector has steadily risen in the past few years. According to Statista the transaction values are expected to show an annual growth rate of 15.74%, reaching $5.4 trillion by 2026. In 2020 it was found that 54% of businesses worldwide had used mobile POS for processing transactions, and many predict the adoption rate to have accelerated due to the pandemic.

According to Visa, 52% of European SMEs currently do not engage in card payments. Long wait times for card terminals, high fees, and complicated setup account for many reasons.

Related:

“Mobile POS apps are a way of democratizing payments and improving accessibility,” said Krog. “Today, in many cases for traditional POS systems, you need to sign lengthy contracts, you pay a lot of money for expensive hardware, and you can easily wait three to six months to get your payments set up.”

“It’s all about if you need to start your shop today. Vibrant’s system works out of the box. We accept Visa and MasterCard across Europe and can serve it immediately.”

Krog also explained that Vibrant’s app poses an opportunity for easy scaling. “The scalability is insane. We have one client, a theme park that was heavily affected by the pandemic and had a lot of outdated equipment they needed to renew. They signed on with us one day, and the next day they had the system on 100 different outlets in the park, just by syncing it with the mobile devices.”

A focus on micro SMEs

The mobile aspect of the technology creates vast opportunities for temporary events and remote locations. Although Vibrant works with larger companies such as theme parks and music festivals, they have built themselves towards micro SMEs. It is here Krog feels they retain its edge in the highly competitive market.

“SMEs are highly underserved for tech,” he said. “We have started with payments, but we are currently building a product catalog facility, meaning people can pay and order instantly. In the future, we want to integrate loyalty systems.”

They see cash as their leading competitor citing information from Visa and Mastercard that there is still over €1 trillion in cash, which has the potential to be digitalized.

“We believe in a future where cash is going to be less and less,” said Krog. “About 95% of customers have a Visa or Mastercard card in their wallet who we can serve immediately. There is so much untapped potential still in Europe. We are in a trillion-dollar economy. when you look at what we’re trying to achieve.”