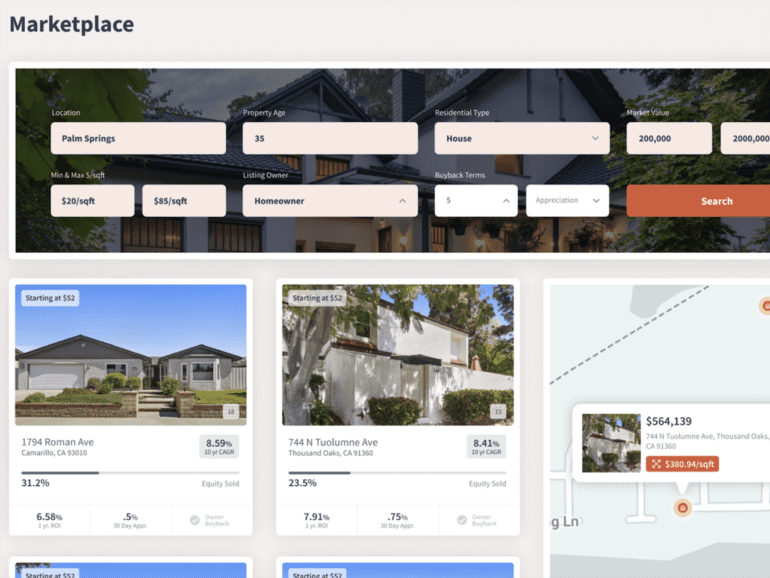

Vesta Equity is a home equity marketplace that allows homeowners to access their equity without borrowing while providing tokenized, residential real estate investment opportunities.

It works because of its owners’’ faith in the future of blockchain technology and Web3.

Joining Vesta Equity is simple for homeowners, co-founder and COO Imran Rahaman explained. They create an account, and once their identity is verified and KYC and standard checks are performed, they create the listing. A site inspection and photography (if selected by the homeowner) are scheduled.

Then the homeowner determines how much equity they want to access, whether for investing, college tuition, home improvements, or other purposes.

A new option is VestaEquity’s mortgage exit solution, which allows the homeowner to designate a minimum dollar amount required to pay the house off (or more if they wish and equity room is available). Funds are held in escrow until each listing reaches its target.

The homeowner retains ownership and can offer equity dividends over 20 years.

Why Vesta Equity chose the Algorand blockchain

Co-founder and CEO Michael Carpentier said he has long been fascinated by blockchain’s potential and quickly saw its ability to tokenize an asset cost-effectively easily. It integrates well with other business elements, like land titles, that will eventually hit the blockchain. He felt it fit well in a home equity market that desperately needed updating.

Each opportunity at Vesta Equity is registered on the Algorand blockchain. A smart contract record offers decisions and transaction details. Carpentier said they considered several blockchains but opted for Algorand because of its simplicity, the quality of its founding team, and opportunities within the Algorand ecosystem.

“A critical part of this was integration into a stablecoin, and in the US, in the case of US transactions, it was USDC done by Circle. We had to have that as part of the mix, and there was a perfect fit with Algorand to execute on that cost-effectively.”

Anticipating regulation, incorporating that into the design

Count Vesta Equity among the companies whose founders designed the company from the ground up with scrutiny in mind. Carpentier said they decided this falls under Regulation D and will continue on that basis until a regulator chooses otherwise. Stick to existing rules, regardless of your opinions on the type of offering.

He believes regulators must consider these new asset classes carefully and clearly define the rules. Vesta Equity currently operates under a Regulation D assumption and is progressing toward Regulation A so more people can invest.

“There was no need to go back and explain to the regulators what we’re doing,” Carpentier said. “Can we build a business and work within these rules? If we can, this business has incredible potential for success once the barriers start being removed or clarified.”

Also read:

Vesta Equity’s tokenization education strategy

With tokenization being a relatively new concept, did Vesta Equity have to educate investors and homeowners? They took two perspectives, Carpentier explained. When meeting with VCs, there was some discussion about the meaning behind tokenizing real-world assets as opposed to digital ones. Some were wary of a new technology that was being linked to fraud. Vesta Equity’s solution is education on its website and the founders’ willingness to meet with investors and homeowners.

Vesta Equity was built to be market agnostic, Carpentier added. Bull or bear, buyer or seller, provides the tools that allow parties to transact. The site has attracted $20 million in property, including a $3.6 million Virginia home. Listings tend to be in the high six figures and into seven figures.

Many conversations lead Carpentier and Rahaman to know they are onto something.

“We’ve talked to a lot of homeowners,” Carpentier said. “They’re tired of the debt treadmill, and they want out. They want out even if they’ve got a low-interest loan on the house right now.

“Low-interest loans are a thing of the past for the foreseeable future. That will become a fact of life for the next 10 years, so they want out, which is a way to get out.”

Where blockchain will improve real estate

Rahaman sees blockchain as just scratching the surface of its potential in real estate and maintaining property registries on blockchains, conducting KYC and AML on it. Blockchain allows turning multi-stage processes into point-and-click.

“For us in the blockchain, there are a few projects like that that we’re paying attention to. Once they start to evolve a lot more for the next few years to decades, then they’ll be able to materially impact both the efficiency of our business and also just being able to take the idea of having a tokenized asset and then being able to make that very portable as a result.”