“(Last year) was a challenging year for Upstart, and we’re not happy with the results we’re sharing today,” said Upstart’s CEO, Dave Girouard, in the company’s earnings call. “In many ways, last year was the perfect storm for our business model.”

“Having said that… 2022 was, in some ways, a gift because it laid bare some parts of our business that we needed to improve.”

Whether the year was, a gift remains to be seen, as the Upstart earnings report showed a significant downturn across the board.

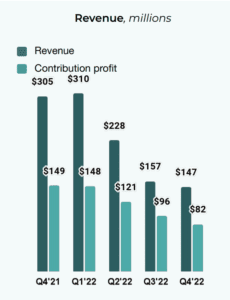

Fourth quarter revenue was particularly hit, showing a 52% loss from Q4 2021 following a downtrend present throughout the year.

Contribution profit for Q4 was also down by 45% year on year, although up by 12% for the entire year.

However, that was the highlight of the financials for the full year. Net income and Adjusted EBITDA for the year were also down, the latter dropping by $194.7 million to $31.2 million.

This came as no surprise. Upstart has had a rocky year, cutting 20% of its workforce on February 1, 2023. Girouard also announced that the development of the company’s small business loans product was to be scaled back for the foreseeable future.

What went so wrong?

Girouard quickly reminded listeners that the company had, for the most part, been profitable throughout its time as a public company.

Like many others on recent earnings calls, he put the losses down to the ongoing challenges in the macroeconomic environment. Chief Financial Officer, Sanjay Datta, echoed this sentiment, outlining their expectation that the conditions would continue into Q1.

“The near-term outlook continues to be tied to the macro economy. And despite some of the encouraging trends, we continue to price loans with a conservative assumption of further degradation in the macro environment.”

In early July 2022, American Banker reported that the company indicated it was seeing less demand from loan buyers, causing the marketplace to become “funding constrained.” A later report, released earlier this month, on announcing Upstart’s round of layoffs, quoted analysts’ explanations that the cost-cutting measures resulted from an abundance of aggressive growth in a risky environment.

“The issues we’ve had to date are almost entirely related to the funding side. Some of it is macroeconomic, and some of it, frankly, is on us and things we need to fix,” said Girouard.

“There’s some continuing pullback on funding sources, particularly those more reliant on leverage and liquidity… Then the loss of our balance sheet as a funding source was not the majority of our funding source, but it plays a factor.”

He continued to state his enthusiasm for the company’s product, assuring that the challenging conditions had allowed the company only to enhance its capabilities.

The “gift” that keeps on giving

Despite scaling back on the small loan product, Girouard was confident the challenging year had created significant benefits for Upstart’s tech, improving risk separation and accuracy.

He explained the environment had caused the company to consider the funding side of the company, and they were now in talks with potential long-term funding partners.

“Having secured funding, committed funding over longer periods to us is fundamental,” he said.

He also stated that the challenging conditions had allowed the company to “upgrade their model’s ability to understand and react to macroeconomic conditions.” In the previous quarter, he had announced the company’s intention to productize their Upstart Macro Index (UMI) for measuring conditions’ impact on credit.

He explained that the conditions had added value to the model’s understanding, and the company would soon provide a tool for real-time insights into the financial health of American consumers.

While Girouard remained optimistic, the Q1 guidance was cautious.

Revenue is expected to be around $100 million, while income will remain at a loss of $145 million. Adjusted EBITDA is set for a loss of $45 million.

RELATED: Fintech Ticker Table