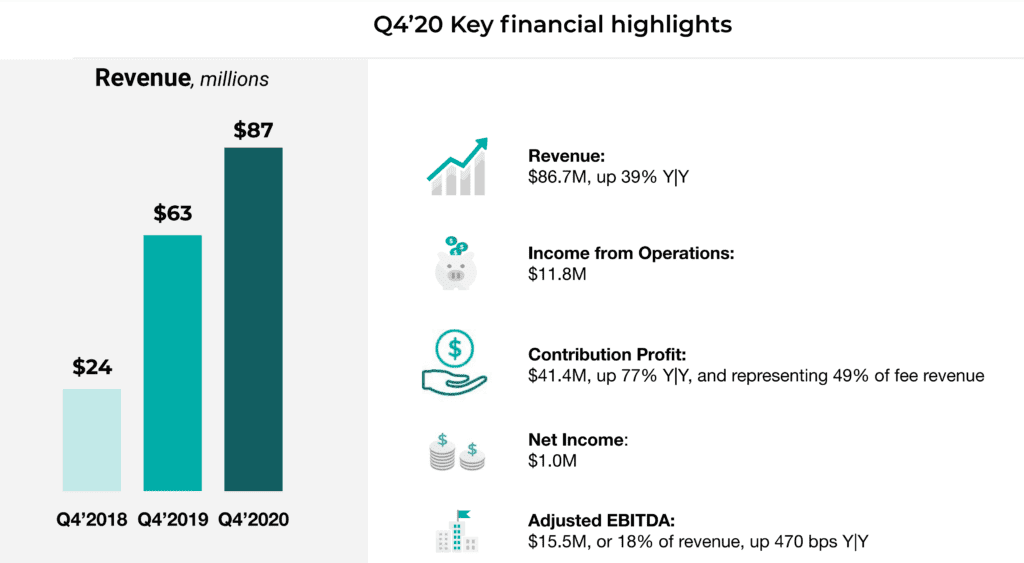

Today, Upstart released their first quarterly earnings since their IPO in December. And it was a very strong quarter indeed. Analysts were expecting $73.5 million in revenue for the quarter but Upstart delivered $86.7 million. What was particularly impressive is that this was also up significantly from the Q4 2019. It seems that the pandemic has been little more than a speed bump for the company, unlike many other online lenders.

The above graphic shows some of the highlights from their Q4 2020 number and below are highlights from the 2020 calendar year:

- Revenue. Fiscal year 2020 total revenue was $233.4 million, an increase of 42% year-over-year. Total fee revenue was $228.6 million, an increase of 43% year-over-year.

- Lending Volume and Conversion Rate. Bank partners originated 300,379 loans across our platform in 2020, up 40% year-over-year. Conversion on rate requests was 15.2% in 2020, up from 13.1% in the prior year.

- Income from Operations. Fiscal year 2020 income from operations was $11.8 million, an increase of 357% year-over-year.

- Net Income and EPS. For the fiscal year 2020, GAAP net income was $6.0 million and adjusted net income was $17.5 million. Accordingly, GAAP diluted net income per share was $0.00, and diluted adjusted net income per share was $0.23 based on the weighted-average common shares outstanding during the period. In the fiscal year 2019, GAAP net loss was $0.5 million and adjusted net income was $3.3 million.

- Contribution Profit. Fiscal year 2020 contribution profit totaled $105.1 million, or 46% contribution margin, compared to $48.9 million, or 31% contribution margin in fiscal year 2019. Contribution profit grew 115% year-over-year.

- Adjusted EBITDA. Fiscal year 2020 adjusted EBITDA totaled $31.5 million, which represents a 463% year-over-year increase compared to a fiscal year 2019 adjusted EBITDA of $5.6 million. The fiscal year 2020 adjusted EBITDA margin was 13% of total revenue, and the adjusted EBITDA margin was 3% in the fiscal year 2019.

In his prepared remarks Upstart CEO Dave Girouard said the company was going to be launching a Spanish language version of their product, highlighting the fact that few lenders have this already. While there are obviously lenders focused on the Spanish-speaking market many of them rely on physical locations for traffic and are not optimized for online lending.

In the Q&A section of the earnings call an analyst asked a question on Credit Karma and the changing relationship there. While it was not widely reported, late last year Upstart declined to be part of Credit Karma’s Lightbox product. This is where Credit Karma hosts the lender’s credit model internally so when borrowers apply for a loan on Credit Karma the company can know with certainty not just whether or not they are approved but the interest rate and loan terms. Several lenders are participating in this program but Upstart decided against it. Girouard said this was no big deal, they are still getting plenty of volume from Credit Karma outside of Lightbox and that the whole thing was just a sideshow.

Also asked in the Q&A was information on Upstart’s bank partners. They shared that three new banks have come on board since the IPO and they now have a total of 15 bank partners. Girouard also shared that one of the banks they recently on-boarded was a 90-day process start to finish.

Upstart Acquires Auto Software Firm Prodigy Software

The unexpected news with this first earnings call was the announcement that Upstart is making its first acquisition and it is in the auto space. Prodigy Software is a technology company that provides an end-to-end digital platform for car dealerships. Interestingly, it is not a lender but because it is an end-to-end platform it works with existing lenders today. More than $2 billion in auto sales have been powered by the Prodigy platform so they will already have a huge amount of data on auto buyers.

Upstart has said in the past that auto lending is going to become a new area of expansion and they made their first auto loan in September last year. CEO Dave Girouard said on their earnings call that, while they have expanded auto lending to 14 states, this year will be spent primarily doing testing and will not have a material impact on revenue. But with the Prodigy acquisition they will be in a good position to ramp this up quickly when they are ready. Terms of the deal were not disclosed but it is expected to close by the end of Q2.

Upstart Firing On All Cylinders in 2021

When Upstart announced plans to go public I don’t think many people expected the company to be where they are at today. Their $4.4 billion (as of today) market cap puts them at several times the size of GreenSky or LendingClub and with a significantly faster growth trajectory. The stock was up 47% in after hours trading not so much on the results themselves but on the aggressive guidance they provided for 2021. The company said they expect around $500 million in revenue for 2021 whereas analysts were expecting just $359 million. They have now set the expectation for this rapid growth, so they have to deliver. They clearly would not have done so if they were not highly confident in their projections.

Dave Girouard has been saying to me for years that Upstart was a completely different animal to the other online lenders. Their unique approach to underwriting and the bank partnership model they have been pursuing was unlike any other company in the industry. Right now, he is proving to be right. It is great to see a fintech lender have such success in the public markets. In many ways Upstart went public at the perfect time. With the stratospheric valuations of the buy-now-pay-later platforms and other fintech companies at stratospheric levels Upstart looks cheap by comparison.

Upstart has come a long way since it launched offering income share agreements in 2013. We covered the story when they switched to term loans, away from ISAs, in 2014 and have stayed in close contact with the company since then. For many years they really were the “upstart” to the dominant players LendingClub and Prosper. Now, the tables have turned and Upstart has, in many ways, become the industry leader. It will be fascinating to watch them execute this year. If they can hit or exceed expectations then they will cement their place at the top of the fintech lending industry.