An industry consortium in the UK is launching a CBDC retail pilot featuring a live stablecoin asset.

“We are looking carefully at how a UK central bank digital currency (CBDC) might work. But we have not yet decided to introduce one,” the Bank of England explains.

Their website mentions names such as ‘digital sterling’ or ‘Britcoin’ and emphasizes the difference between CBCDs and cryptocurrencies.

Together with HM Treasury (HMT), they set up a Central Bank Digital Currency Taskforce to oversee their work. They are also working closely with other public authorities.

Jim Mignano, a former technology consultant and current assistant policy researcher at RAND specializing in the intersection of cyber, finance, and international relations, takes a positive approach to the initiative “The project acknowledges that multiple, coexisting new digital payment systems are becoming increasingly plausible. It also appears to recognize that experimentation and consultation will be vital to illuminating and overcoming technical, commercial, and regulatory barriers to implementation. I will be watching for lessons from the project about striking the appropriate balance of publicly and privately administered systems, interoperability between systems, and harmonizing standards across jurisdictions. It could also offer valuable lessons for making finance more inclusive, primarily through fostering an industry that embraces contributions from diverse walks of life at all levels of responsibility. The UK has long been a leader in financial innovation, and Project New Era is poised to continue this trend into the era of new digital payments.”

The landscape

In March 2020, the Bank of England published a discussion paper on CBDC and outlined one possible approach to design a central bank digital currency. In July 2021, they published their responses and produced a webinar based on feedback from the payments industry, academics, and other interested parties.

In June 2021, they set out their thinking on the possible opportunities and risks it could bring to the discussion paper on new forms of digital money.

In November 2021, with HMT, they set out the next steps for a UK CBDC. These next steps include consultation in 2022 to help them assess the case for a UK CBDC. Furthermore, it will examine whether more work needs to be done to develop an operational and technological model.

How will it work?

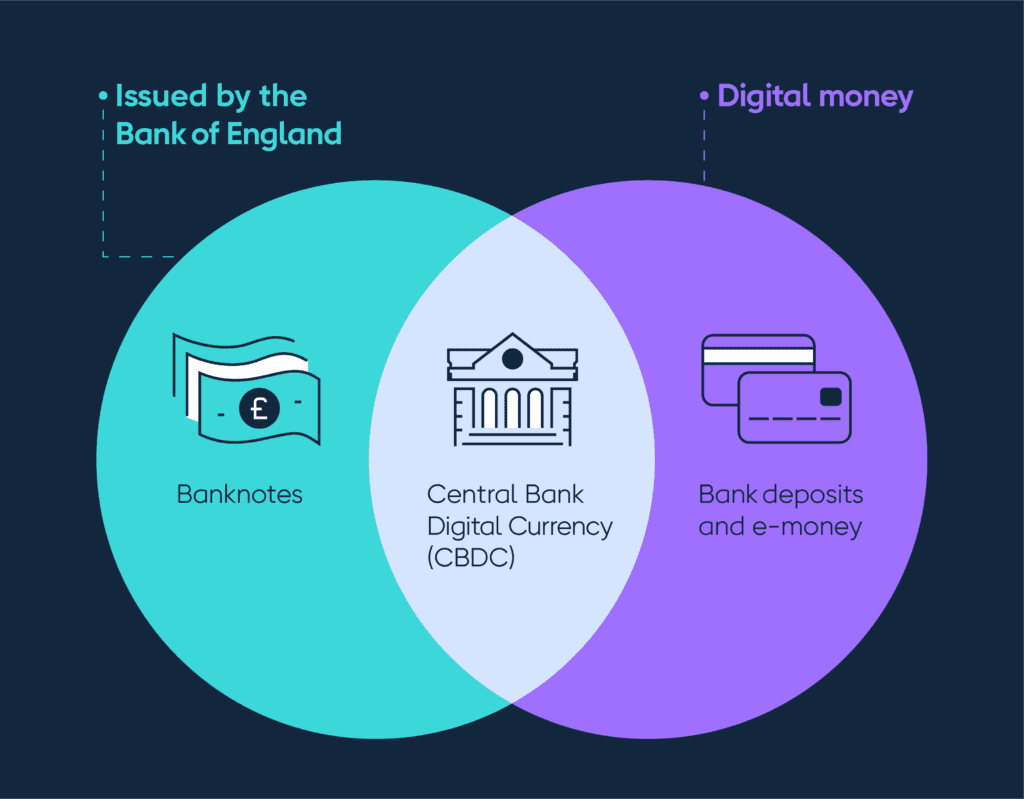

The Bank of England already produces digital currencies for banks and other financial institutions to use (reserves), but this proposal would create a digital currency for all citizens.

However, Molly Elmore, an analyst focused on the future of money, digital assets, blockchain & geopolitics, points out, “there are very few advantages for citizens if nations move towards retail CBDCs. Currently, most people use digital cash to pay for goods and services using credit cards, debit cards, and Venmo. Citizens currently have choices, so if you are unhappy with your bank or credit card provider, you can switch to another competitor offering a similar service. If there is a CBDC, consumer choice is gone. Countries only have ONE central bank with control over the monetary policy. Unless you are in a position to move to another country, you cannot simply switch central banks.”

Massimo Buonomo, an international AI, metaverse, and blockchain expert and former advisor to UN Economics Commission For Europe, added his thoughts.

“CBDCs are not in place except in a few countries. Even there, they are not used extensively but just in pilot cases. Those centralized systems are good for Know Your Client (KYC) and Anti-money laundering (AML) purposes. In other words, the money supply continues in the hands of centralized institutions. I would say that both decentralized cryptocurrencies cannot be compared fully to international payment systems because they obey different rules and have different aims. Of course, KYC/AML issues should be considered when discussing bitcoin and stablecoins. Also, volatility is less an issue for stablecoins than for bitcoins. However, stablecoins have to be seriously audited to see whether they have serious assets that back the stablecoins in circulation.”

Motivations behind CBDCs

But what the payments system looks like and the motivations behind their production as digitalization continues can be a concerning question for central banks and citizens worldwide.

To this point, Elmore points out the potential political consequences of CBDCs. “Citizens aren’t likely to want an unelected group of central bankers deciding what we can buy or what we even owe in taxes. In most countries, including the US and the UK, the central bank officials are not elected, so you can’t vote out corrupt or ineffective central bank leaders.”

To illustrate the potential impact of CBDCs, she uses China as an example. “China has been using retail CBDCs to subdue and control their citizens. A social credit score system is connected, so if a citizen speaks against the state, their bank account can automatically be fined. It’s not likely that Chinese citizens find such a system beneficial. However, they weren’t given a choice. If you have a choice and live in a country where the voting population can voice their interests, say no to retail CBDCs.”

According to the European Union, Institute for Security Studies, the Chinese government is already using blockchain to gather evidence against dissidents online.

In their report ‘China’s Blockchain and Cryptocurrency Ambitions, ‘ the authors examine how blockchain-based platforms have been used to gather evidence on online media defaming Chinese revolutionary martyrs. Blockchain could also ensure that data in the social credit system is always accessible and cannot be changed by unauthorized actors. This is not that far-fetched as, in December 2019, a seminar was organized in Beijing with the title ‘blockchain technology helps China’s new social credit system.’

Thus to Elmore’s concerns, there is some precedent.

She continues, “If retail CBDCs solved a painful and expensive problem in society, it would be worth discussing to see if the pros outweigh the cons. But for citizens, they don’t. Wholesale CBDCs are a very separate issue, where funds are sent between banks using the blockchain. They fill a vital role and will improve the costs and efficiency of sending money around the globe. But retail CBDCs, even though they might sound similar, are pretty different.

China’s motivation can still be multifaceted, as the Carnegie Endowment for International Peace points out.

That China has only a two percent share in the world’s foreign exchange reserves, and therefore CBDCs may be their way of making a dent in the U.S.-dominated global financial system.

In the report ‘China’s Digital Yuan: An Alternative to the Dollar-Dominated Financial System,’ the authors suggest that the digital yuan could prove to be China’s most influential and noteworthy attack on the US, which may also be a factor behind establishing a CBDC.

“To challenge the dollar’s hegemony and internationalize its currency, China will have to move away from the dollar and the payment rails dominated by the dollar. The best way to simultaneously do both would be by introducing greenfield payment rails like CBDC. But to do so, China will have to work out agreements and mechanisms for exchanging its digital yuan with the rest of the world. As CBDCs are a relatively new technology with no international standards and design, China could become the standard setter.”

UK motivations

The Bank of England states that the motivation behind their consideration of CBDCs are because the way people choose to pay for things is changing. People are using cash less and have new ways of paying for items due to the fintech revolution and open banking.

According to UK Finance, during 2020, the number of contactless payments made in the UK increased by 12%to 9.6 billion. Over a quarter (27%) of all UK payments were contactless payments. 83% of people in the UK now use contactless, with no age group or region falling below 75% usage. There are over 135 million contactless cards in circulation, covering 88%of debit cards and 81%of credit cards.

These changes mean new opportunities and risks for which the Bank of England needs to plan.

However, the Bank of England notes, “we know some people like to use cash. So, if we did create a CBDC for the UK, we’d keep issuing cash too. That way you could choose how you’d like to pay for something.

What’s next?

The Bank of England is speaking to businesses and communities to determine what impact a CBDC would have on them.

They also work with international partners and organizations such as the Bank for International Settlements. And they are working with finance ministries and central banks in other countries, specifically in the G7.

They also have the Engagement and Technology Forum to move this forward.

The CBDC Engagement Forum looks at all aspects of a central bank’s digital currency apart from the technology it might use.

The forum helps them understand the practical challenges of designing, implementing and operating a CBDC, which include:

- How a currency will be used (‘use cases’)

- Functional needs of users

- The role of the public and private sectors

- Financial and digital inclusion

- Data and privacy implications

It consists of representatives from financial institutions, civil society organizations, and merchants. They this forum jointly with HM Treasury.

CBDC Technology Forum examines the technology that a central bank might use to create a digital currency. The forum enables them to involve people with a wide range of expertise and perspectives. This helps them understand the technological challenges of designing, implementing, and operating a CBDC.

The forum’s members come from various financial institutions, universities, fintechs, infrastructure providers, and technology firms.

Applications for both forums have closed.