It wasn’t a sudden move. The rebranding of TransUnion‘s business products is part of an ongoing evolution.

The Feb. 21 unveiling of seven verticals, called ‘global solutions lines,’ was the latest step by the information and insights company as it continues to expand beyond its traditional business as a consumer credit reporting agency. TransUnion is one of the big three credit bureaus along with Equifax and Experian.

The rebranding effort comes a little more than a year after TransUnion completed the purchases of technology firms Neustar and Sontiq. The Chicago-based TransUnion bought Neustar — an identity resolution company with leading solutions in marketing, fraud and communications — for $3.1 billion, and Sontiq, known for its digital identity protection and security tech, for $638 million. Both deals closed on Dec. 1, 2021.

However, the motivation to reorganize and rebrand TransUnion’s business products was more than just spurred by the Neustar and Sontiq deals. They are a part of the ongoing efforts by TransUnion to evolve, grow, keep up with and anticipate the changing needs of the marketplace.

“The impetus for this wasn’t just the acquisitions of Neustar, Sontiq and others, but a lot of organic initiatives that we’ve had over time,” Tim Martin, TransUnion’s chief global solutions officer, said on Tuesday. “We have a lot of great products now to help our B2B customers and their consumers.”

‘Global solutions lines’ in seven verticals

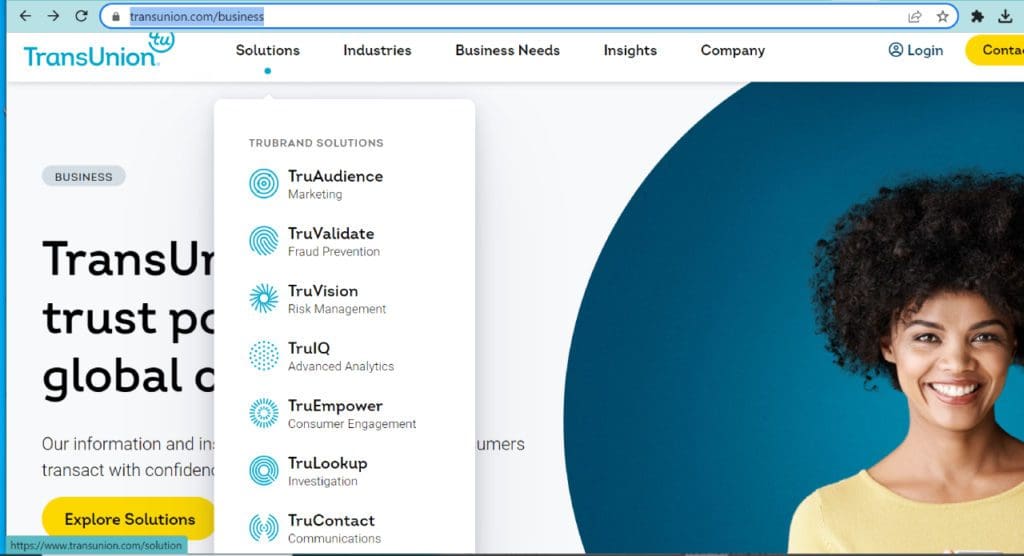

TransUnion’s newly organized seven business product lines are:

- TruAudience — privacy-enhanced, identity data enriched, omnichannel audience targeting and advanced marketing and media performance analytics.

- TruValidate — fraud prevention and identity proofing products.

- TruVision — risk management products that help clients identify and manage best-fit customers across the account lifestyle.

- TruIQ — advanced analytics products and services that provide custom insights for faster and better data-driven decisions.

- TruEmpower — consumer engagement products that help businesses understand, manage and protect consumers’ financial health and identity through credit and identity protection tools and education.

- TruLookup — investigative products that deliver actionable information for faster due diligence or issue resolution.

- TruContact — communications and contact center products help restore trust in communications, enhance customer outreach with authoritative identity, and streamline delivery of telecom connectivity services.

Martin said it was time for TransUnion to evolve and reorganize/rebrand the products into the seven lines “based on where we were in our maturity.”

“We’ve grown up a lot, we’ve done a lot of acquisitions, we’ve developed a lot of good products,” said Martin. “The markets have changed, like the rise of the fintechs. It was time for us to pull those together under more meaningful, understandable sets of umbrella brands to hopefully make it easier for our customers to do business with us.”

One-stop shop of sorts

TransUnion’s revamped solutions lines could greatly appeal to fintech or any businesses looking to address several related identification services needs, be they existing, established customers or startups looking to put the basics in place, said Liz Pagel, senior vice president and head of TransUnion’s consumer lending business.

“If you’ve got somebody that’s bootstrapping a business and just getting started, they might come to the TransUnion website first and try to figure out how we can help them,” said Pagel. “They might not realize that we have all of these TruAudience solutions or the breadth of the types of things that you can do, so that helps, and that helps that first impression that we get and helps them distill down what is kind of an overwhelming number of products and solutions that we have for them, so they can figure out what questions to ask when they get a hold of us and get in the door.”

Crafting their story

Next up: Getting the word out that TransUnion offers these products and has expanded beyond its traditional credit-risk business. For Rachel Klein, TransUnion’s vice president of global brand management and marketing, that has meant crafting the firm’s story about moving beyond its core business of assessing risk “into so much more than that.”

“A couple of years ago, we actually embarked upon the development of a far more crisp, corporate narrative that helps position us in the marketplace,” said Klein. “So what do we actually do? We make trust possible over all sorts of different use cases: credit risk, fraud, marketing, lots of different things.

“Then we realize that while that was crisp and helped explain what we did, we weren’t being crisp about why we were different, how we were different and what we sold. So it started with that … then that’s what brought us to today with the development of the seven lines. It all links together with what started two years ago.”