It’s no secret that men and women have a financial gender gap.

A new report from the Financial Health Network reveals that governments and businesses have almost three trillion reasons to close it.

The Gender Gap in Financial Health, written in conjunction with the Principal Foundation, explored why women continue to fare worse financially than men. They describe an interconnected set of issues that have hampered women’s financial security.

“It’s an exciting project,” Financial Health Network’s senior director of research Meghan Greene began. “You hear in the news about women’s persistent income gap challenges. This was a fascinating opportunity to go beyond income and get a more comprehensive picture of how women manage during the pandemic.”

Since the mid-20th century, women have been making significant economic progress, but those gains have slowed and, in some cases, been reversed in the 21st century. Labor force participation rates have plateaued. The wage gap persists at 82 cents on the dollar, with the gulf wider for women of color. That gap is present in 98% of all occupations.

The cumulative effect of that gap over a woman’s average working life is significant, adding up to hundreds of thousands of dollars. That influences ownership, with women owning 40 cents for every dollar owned by men.

COVID-19 highlighted what we already knew

The pandemic brought these longstanding issues to the forefront, Greene said. It highlighted the imbalance of caregiving responsibilities between men and women. It laid bare the lack of support that can help women remain in the workforce, such as paid leave and enhanced childcare options. Many women in part-time work need benefits that enable them to contribute at home and work.

“All of these are interconnected,” Greene said. “Income impacts our ability to save for retirement and have savings.”

The pandemic worsened a longstanding problem. After controlling for income and additional demographic factors, women are five percent less likely to be financially healthy than men. The financial vulnerability gap – the rate of folks who struggle in most areas of their financial lives, is wider at seven points (24% vs. 17%).

Women said they have worse spending, saving, borrowing, and planning outcomes.

- 28% say they’re in worse shape than they were before the pandemic;

- 56% of women pay all bills on time (64% of men);

- 34% are confident they are on track to meet long-term financial goals (42% of men);

- 61% either have no debt or a manageable amount (69% of men);

- 38% are at least moderately confident their insurance policies will cover them in an emergency (47% of men); and

- 58% agree that their household plans ahead financially (66% of men).

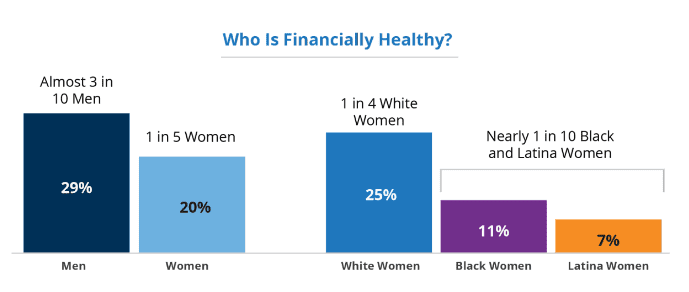

The problem is much, much worse for women of color. While only 25% of white women report being financially healthy, that is miles better than the 11% of Black women and seven percent of Latinas. Those married or living with a partner are almost twice as likely (24% vs. 13%) to be financially healthy, yet at either rate, they are still well behind married or partnered men (32%). Only four percent of women with low household incomes are deemed financially healthy.

Four systemic challenges to attaining financial health

Income disparities and discrimination

Women are more likely to earn $30,000 annually or less than men due to the wage gap, occupational segregation, unequal caregiving responsibilities, and other factors. They are less safe on the job, too. Forty percent have been subjected to sexual harassment. Nearly as many, 36%, said they had been discriminated against because of their gender. These figures may be lower than the actual rates.

Many women who have experienced sexual harassment may feel they have nowhere to turn. Even after controlling for marital status, race, income, and age, those who report being subjected to all forms of harassment at work were seven percentage points less likely to be financially healthy than women who said they were not subjected to harassment.

“We found that being subjected to harassment on the job is associated with materially lower financial health,” the report states. “Importantly, causality could work in both directions: Women who are more financially vulnerable may be more likely to work in places where they are subjected to sexual harassment, and sexual harassment could lead to a series of costs and financial strains that result in increased vulnerability, including job loss. Furthermore, some studies suggest that workplace harassment increased during the pandemic, disproportionately affecting frontline workers.”

Limited support for care

During the pandemic, 70% of women with children under 18 took such steps as reducing their hours worked, taking a leave of absence, or switching to a less demanding job due to parenting commitments, higher than the 55% of men who took the same step. Close to half (45%) of those caring for a child or adult with disabilities took the same action. More than half of women with kids under 12 and working less than full-time wish to work more but cannot due to the cost and reliability of childcare.

The pandemic worsened as childcare centers closed (nine percent permanently) and experienced staffing issues that highlighted the poor salaries paid to childcare workers, often women. Greene said an affordable childcare bill was discussed at the federal level but hasn’t progressed. Some states, such as Montana, are beginning to act.

“Childcare workers typically earn low incomes, and there is significant turnover,” Greene said. “Paying them fairly for the critical work they do is essential.

“Families are discussing if it is worth it for the mother to work if her salary is used to pay for childcare.”

Burdensome debt

The toll adds up.

- 39% of women report unmanageable debt levels compared to 31% of men;

- 51% of Black women say they carry unmanageable debt levels;

- One-third of women with household student debt is “very concerned” about their ability to pay off debt, nearly double the rate of 18% of men;

- 29% of women say their households have past-due medical bills versus 22% of men;

- 44% of women under 30 say debt has delayed a home purchase, marriage, and having children; 34% of men under 30 say the same; and

- 39% of Black and 36% of Latina women have altered their life trajectories due to debt, compared to 26% of white women.

Greene said that the current student loan payment moratorium had been a blessing, but it is ending soon, and this too will hurt women. Almost two-thirds report outstanding student loan debt. Their student loan debts take longer to pay off because of the pay gap and the fact that many take time off from their careers to care for children.

“The current system isn’t sustainable,” Greene said, adding those funds could have been used for housing and retirement savings. The moratorium allowed people to invest in their homes and pay down debt. The anxiety over how to pay those debts is returning.

“Many are questioning whether their education was worth it,” Greene said.

Insufficient retirement savings

It’s no wonder that thoughts of retirement are but a pipe dream for many.

53% of working-age men are confident they will have enough money for their retirement compared to 42% of women

35% of non-retired women aged 50-64 have $0 in personal savings

Women are less likely to have long-term investment products in their name, leaving them increasingly vulnerable to relationship changes and long-term debt

Five steps governments can take to reduce the financial health gap

Enact legislation to close the wage gap and assure a living wage

Existing laws do not fully protect women from unequal pay and discrimination. Many full-time workers don’t earn a living wage.

Build a better care infrastructure

If the pandemic hasn’t sent the message that we need a better care infrastructure for children, elders, and persons with disabilities, nothing will. Such a system will include more affordable care, paid leave, and better pay for childcare workers.

Expanding retirement plan availability and portability

Some states are developing programs to increase the availability of retirement plans to more people and therefore improve savings. Follow the Center for Retirement Research, an organization that tracks these state and federal efforts.

Rethink Social Security

Based on a recipient’s 35 highest-earning years, Social Security shortchanges women, who receive 80% of the amount men get. Mothers receive even less. Suggested changes include adjusting the spousal benefit or introducing a caregiver credit. The National Institute on Retirement Security has additional suggestions.

Increase the affordability of higher education

Five steps businesses can take to help reduce the financial health gap

Creating supportive workplaces

There are many ways employers can increase their support for employees, Greene said. One is ensuring salary transparency by increasing the visibility of what people are paid for their work. This further restricts the ability to ask for salary histories during interviews.

More information is available at TIME’S UP, ideas42, and the Employer FinHealth Toolkit.

Expanding benefits

Make benefits and retirement plans available to part-time workers. Expand healthcare plans to help people avoid medical debt.

Supporting financially struggling employees

Employers can offer support through financial coaching, debt management assistance, emergency savings and grant programs, and student loan repayment contributions.

Ending harassment and supporting survivors

Employers must create safe workplaces. They can assess present risk factors for harassment, enact comprehensive policies and hold offenders accountable. Some can start with more seriously enforcing programs that are already in place.

Leveraging behavioral lessons

Employers can leverage behavioral insights when designing benefit programs, and fintechs can play a role by offering auto-enrolment and auto-escalation plans along with benefits such as student loan debt assistance. They can refer to the Employer Toolkit section “Designing for Engagement” for help.

“There’s a critical role employer can play in ensuring women have equal footing with men,” Greene said. “The tools and roadmap often exist on paper but not in practice.”

Enacting these steps isn’t just good for women; it’s good for the economy.

“There’s almost $3 trillion that can be added to the economy by closing these gaps,” Greene concluded.