DeFi is slowly but surely changing the face of the financial sector. Web3 and the associated blockchain technology have brought to light the drawbacks of traditional finance.

Many companies are aware of the benefits. Major firms such as JP Morgan and Goldman Sachs have announced exploration into Web3 mechanisms as financial tools. A recent Citi report predicted that the metaverse economy’s total addressable market could reach up to $13 trillion by 2030.

Related:

Investment in crypto assets has seen a significant shift. The number of crypto assets under management in hedge funds increased by 8% between 2021 and 2022, and consumer interest in investment is still high despite the ongoing crypto winter. In GlobalData’s 2022 Financial Services Consumer Survey, it was found that 77.4% of respondents invested in cryptocurrencies for yield, while only 18% owned them as a payment tool.

Moving away from investment, Web3 technology as a tool in traditional finance has been slightly slower to take hold. However, although still unexplored territory for many, Web3 is increasingly proving its worth to financial institutions.

Web3 has shown to benefit financial institutions

Although we are early in the evolution of Web3, with many use cases yet to uncover, as I am reminded by multiple experts in the space (with the use of the story of the mobile phone/smartphone evolution), already several applications of the emerging technology have become clear.

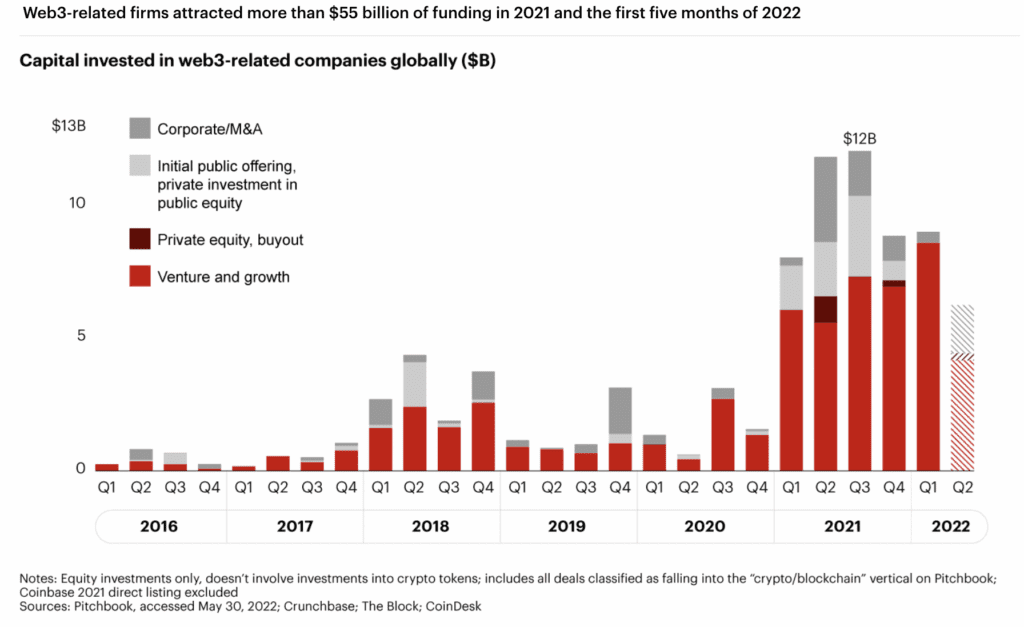

A report by Bain showed significant investment from the private sector in the infrastructure surrounding financial markets, reaching $45 billion. In an interview with Forbes, Richard Walker, a partner at the firm, said the financial services industry is “really building the foundational rails and assets” and is poised to introduce blockchain.

The payments sector has been a significant area of exploration. In a survey conducted by TD Bank, 90% of respondents felt blockchain would have a positive effect on the payments industry. Issues with cybersecurity and slow cross-border settlement times have brought traditional finance to consider the benefits of the technology.

According to the survey, 29% of respondents felt blockchain could create more robust audit trails, while 43% thought it would improve the speed and efficiency of payments.

In the recent downturn, the merits of DeFi protocols in lending products have also been celebrated, leading to the creation of products previously unseen even in traditional finance.

Opportunities within payments and lending are just two functions facilitated by tools used within DeFi. Distributed Ledger Technology (DLT), smart contracts, and developments in the establishment of digital identity, to name a few, have posed possibilities for advancing financial services.

So what’s the hold-up?

Subject to extensive regulatory requirements, traditional players within the financial services industry are slow to adapt, making adopting new technology a drawn-out process.

“When banks try to work with third-party tech or fintechs, it’s a 12-month process just to select them,” said Karan Jain, CEO of NayaOne. “If you’ve got young companies coming through, they die while they wait because the sales lifecycle is too long.”.

Fintechs are often skirting the border of regulatory requirements and are agile compared. Working within the fast-paced startup product cycle, many use niche markets to their advantage, and adopting innovative new technologies can be a selling point.

RELATED: The power of partnering fintechs with incumbents

Whole sectors have now been built around the emergence of blockchain, with DeFi protocols forming the infrastructure.

Consumer interest in the sector continues to grow, and PWC reported last year the total locked value peaked at $37 billion, up from $1 billion in 2021.

The unregulated nature and relative immaturity of DeFi and Web3 make it risky territory for traditional financial services. Nestled within a legacy of trust, infrastructure changes could have significant implications.

A lack of understanding and confidence in new technology could delay an onboarding process that is already extensive. However, as more regulatory announcements are made, the landscape is becoming slightly less murky, paving the way for adoption.

Streamlining Web3 onboarding processes

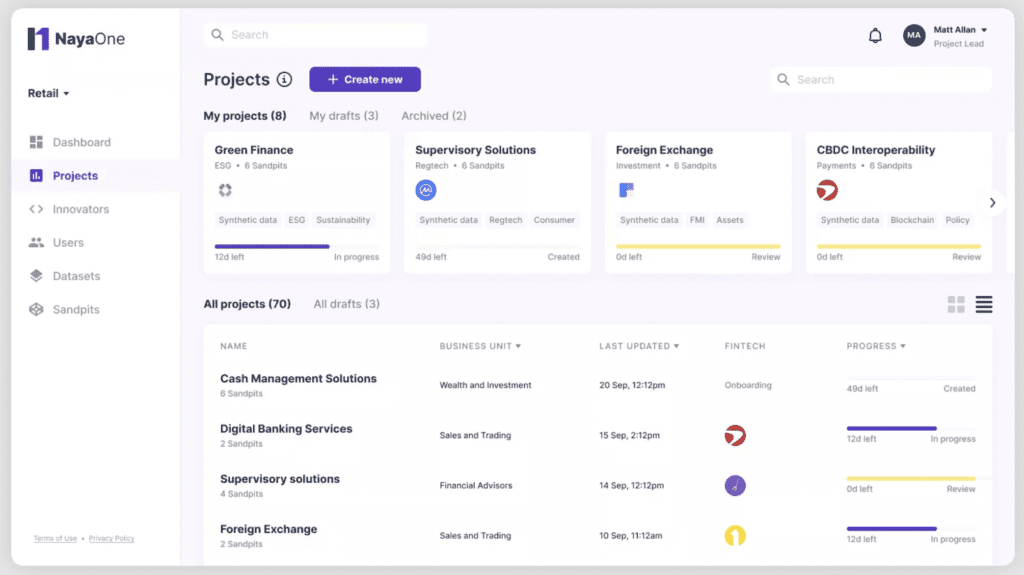

To streamline onboarding, NayaOne has developed a digital sandbox and marketplace for financial services to test out new technology providers before committing. This could have significant implications for the adoption of Web3 technologies.

“You can go to the sandbox and evaluate, discover and scale to production,” said Jain. “You could use it to discover and evaluate different Web3 companies and select them according to how they will be part of your future finance stack.”

The company provides test data to allow financial institutions to test the new technology according to their needs, reducing the selection process to several hours rather than weeks.

In onboarding the companies to their marketplace, NayaOne assesses each company along similar parameters to that of a financial institution.

“We ask the essential questions that separate the people with an idea from people with the product, Jain continues. “When they go to the marketplace, we do an everyday random ping to the product. Just to make sure it’s there and working. If they’re on the marketplace, their products are ready to be consumed and bought.”

NayaOne works with various technologies and tool providers; for them, Web3 is the next step for financial services. Although Jain recognizes that the company is early in facilitating the onboarding of Web3 technologies, he believes that time is of the essence.

“Jumping on now is a competitive advantage,” he said. “If your customers want a Web3 product and your peer onboards the technology before you, you can lose market share. It’s about the bottom line; you could lose your customer base, not just in crypto, but other business as well.”

“If they’ve got cash with you, if they’re doing trading with you, or if they’re doing something else, and they want to trade bitcoin, and you don’t offer that service, they’re going to go elsewhere.”

NayaOne will speak about this transition at the Fintech Nexus’ Merge event in London later this month.