The COVID19 pandemic saw a wave of digital adoption and innovation. Businesses, seemingly overnight, pivoted to a mainly remote workforce, e-commerce skyrocketed, and financial services saw the largest ever digital user base.

In its wake, it has become clear that consumers’ expectations are forever changed, and businesses are having to pick up the slack. Incumbents upped their partnerships with fintechs in response to a heightened need for digital solutions and innovation. Mergers and Acquisitions (M&A) were at an all-time high in 2021, but as we move further into 2022, activity has slowed.

Both parties could, however, benefit from continued collaboration, say experts. The combination could override the difficult economic landscape ahead.

Fintech continues to show growth

The CCAF, World Bank, and World Economic Forum found growth in nearly all fintech sectors post COVID19. Although fintech investment was significant in 2019, after a brief dip, it reached new highs in 2021. Revenue has continued to increase. At a rate of 19.8% CAGR, market valuation is set to reach $332.5 billion by 2028, having met its pre-COVID projected valuation three years early. Increasingly, governments worldwide are including fintech in political and economic agendas for development, and many see the sector as the answer to global issues.

Accelerated by COVID19, fintech innovation is disrupting a multi-jurisdictional, multi-level way, and incumbents are getting involved.

“As the markets ramped up, investment started to really ramp up,” said Angel Lorente, Founder of Fintech Connector during a Driving Fintech Forward webinar. “We saw an explosion of innovation, particularly for companies that realized there was a move away from real-world to the online world.”

“A number of institutions, banking institutions, started to realize that if they didn’t have a program in place, or weren’t talking to fintechs of the world, looking at different solutions, they were going to be at a competitive disadvantage to those institutions.”

“I really think that we have seen an evolution in moving from the competitive to now more than cooperative collaboration phase.”

Increased M&A

In the last two years, M&A between fintechs and incumbents has risen. Despite the rest of the banking and capital market sectors taking a significant hit in 2020, fintech M&A remained steady, rising from 160-216 transactions between 2019 and 2021. Deal value for US-based targets as of December 31 increased 12% year over year to $1.16 billion, compared to $1.03 billion in 2020.

The two sectors of the financial industry have much to gain from each other. Fintechs, with dynamic teams and a focus on innovation, have ease of movement to bring new products to market. In contrast, incumbents have a legacy of trust, experience, resources, and regulatory compliance.

“Over the last decade or so, financial institutions have really started to recognize in order to stay relevant, they’ve got to innovate,” explained Kamales Lardi, Managing Director Switzerland of Valtech. “Within the organizational structures that I’ve worked with large financial institutions. Innovation is definitely a challenge. They cannot innovate. They cannot transform quickly enough to keep up with the pace of market development.”

“Coming in from the fintech side, it’s become extremely important for startups to collaborate with the big institutions because of the regulatory environment that exists. The resources required in order to establish themselves.”

“They can grow to a certain extent, but to become truly commercialized and international as a service provider, they’ve got to connect and engage with the larger institutions.”

Challenges with team structure face mergers

The move isn’t however, all plain sailing. The differing structures of incumbents and fintechs can pose logistical problems.

“One of the overarching elements is definitely culture,” said Lardi. “Larger financial services institutions are the sort of giant machines that run with certain cogs in place and takes a long time for them to make decisions. On the other hand, you have this very dynamic fintech culture that tends to jump on opportunities and respond very quickly.”

“They’ve also got typically leadership teams that are much younger, and more in tune with the hybrid digital customer base so they know what channels to use and how to engage with them. The other big thing is around the structure of leadership. Fintechs usually have flatter organization structures whereas decision-making control structures in the larger institutions tend to be more layered.”

“I’ve typically seen that when they start to collaborate, they end up in a clash and typically result in either conflict or not resulting in the outcomes they’re looking for. I think these elements if they’re not addressed and not managed in the right way we end up in situations where the giant tends to swallow the smaller companies or smaller teams.”

The outlook for 2022 and beyond

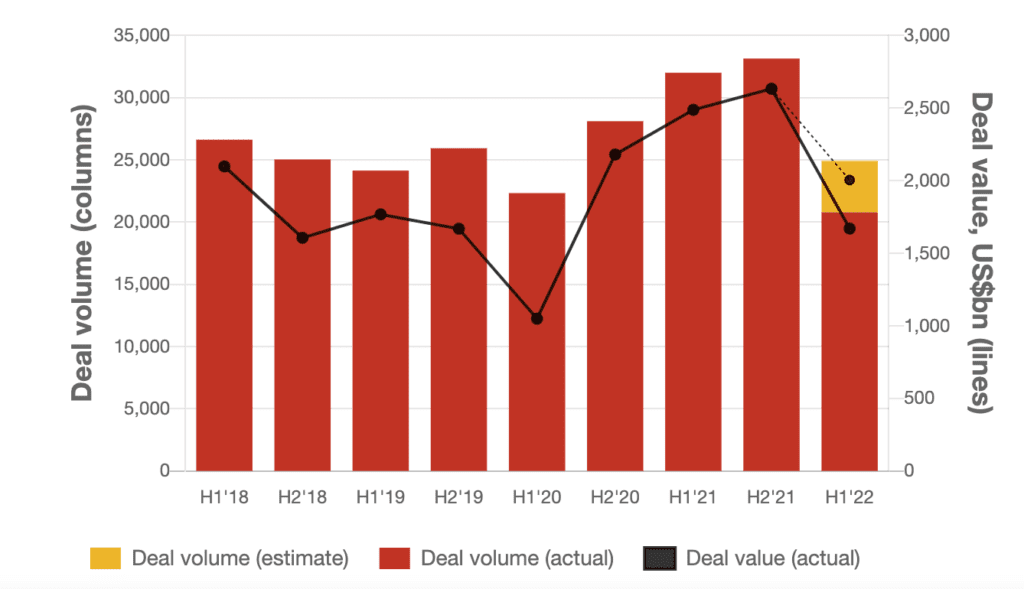

As the world moves further into 2022, facing increased challenges, the outlook of the M&A market becomes uncertain. Last year saw a banner year for M&A, and already second-quarter reports show a significant reduction.

Despite this, a survey by PWC published in late June 2022 showed that the reduction has, so far, only reached 2019 standards. Financial services are at the forefront of the sector, they reported, and activity should remain consistent although valuations may drop.

“We’re entering a period of time right now that it’s going to present challenges,” concluded Lorente. “I think innovation is going to continue it might just not be at the fastest pace, meaning that would be the way that we’ve seen it in the past.”

“We’ve seen every other day, some partnerships happening or things happening in the industry. Innovation will continue to happen. It’s just a matter of fintech companies continuing to keep their fingers on the pulse, understanding what they’re offering, and then being able to approach the right people.”

RELATED:

5 reasons why fintech M&A is hitting new highs

Fintech Nexus USA 2022: Reflections on BaaS and the benefits of bank-fintech partnerships

Citi partners with METACO for digital asset opportunities

SEBA joins LGT Bank in journey into crypto