By most accounts, 2022 was a challenging year. Following historical highs in 2021, the fintech sector has been caught in a turmoil of stunted VC investment, plummeting valuations, and round after round of layoffs.

According to the F-Prime State of Fintech report released earlier this week, valuations have dropped to below historical averages, following the astronomical peak the previous year.

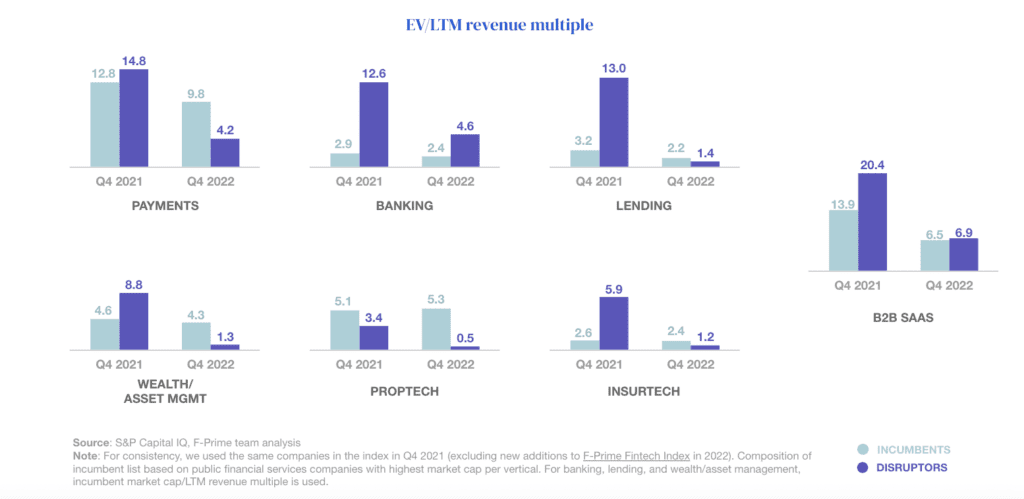

Public investors re-appraised many fintech companies, and their valuation multiples shifted. Their focus moved to traditional financial services businesses, with a 71% drop in average fintech multiples.

Though acquisitions occurred, M&A also dropped across the sector, falling from $320 billion in 2021 to $116 billion in the first three quarters of 2022 as the market adjusted to the new valuations.

Public market corrections affected the private market, and funding rounds continue to drop. F-Prime reported that Stripe, Klarna, and Checkout.com were the worst affected, all a shadow of their former selves.

However, breakouts have beaten the trend, with the likes of FNZ and Deel more than doubling their valuations within 2022.

“2022 was a very different year than 2021. In many ways, it’s been very sobering,” said F-Prime Capital Senior Associate Abdul Abdirahman to Banking Dive.

The outlook is gloomy, but F-Prime found areas where the market has refocused.

B2B SaaS And Payments Most Resilient

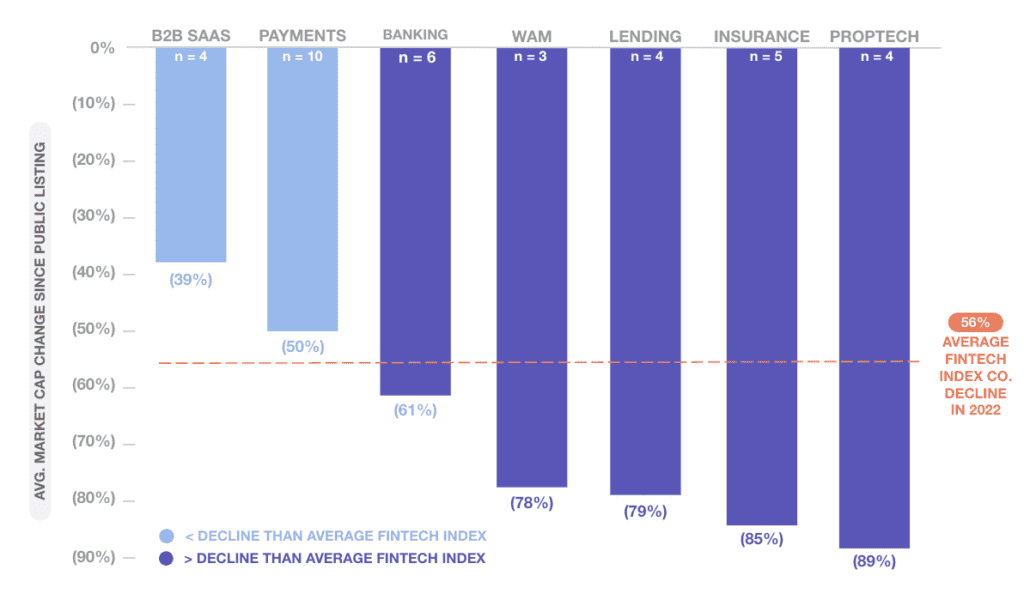

While the market cap of all verticals of fintech had declined, bringing the average decline to -56%, some sectors were worse hit than others.

B2B SaaS and Payments were the least affected, showing a decline of 39% and 50%, respectively. The worst hit in the two sectors were Duck Creek Technologies and Paymentus, both showing declines of over 70%.

“B2B SaaS companies have more of a recurring revenue and generally have longer contracts. They also sometimes have diversified revenue streams,” said Abdirahman.

Of all the verticals, prop-tech and insurance saw the steepest decline. Lending was also badly hit, Affirm being the worst affected, with a drop of 84%. These areas had high exposure to recent rate rises and saw revenue growth decline due to low origination volume.

Less than half of the Fintech Index companies were profitable over the past year, the majority being in the payments space.

RELATED: Job cuts and missed targets: Affirm’s earnings call

Defining value in the context of financial services

The report noted that, as a whole, market valuations adjusted in 2022 to become more comparable to those of incumbents, at times negatively affected due to instances of fintechs’ capital inefficiency.

F-Prime has often seen this trend when fintechs are brought onto public markets and assessed as financial service companies. The report cited the likes of Funding Circle and Lending Club, which dropped in value severely during the year after their IPO.

However, it noted there was evidence of outliers that the report called “true disruptors”. Both Block and Shopify, after going public, survived an initial drop in valuation to reach new highs.

The report stated that the distinction between “better versions of existing financial services” and “truly disruptive approaches” is in the process of being refined.

In each vertical of fintech, F-Prime identified areas that could maximize this disruptive potential. Embedded finance, applied to different sectors, showed a significant capacity for enhancing the benefits of fintech over traditional financial services.

Growth Despite Correction

Within the doom and gloom, F-Prime did attempt to show some light at the end of the tunnel.

Revenue of the fintech sector had grown by an estimated 15%, from $136 billion in 2021 to $155 billion in Q3 2022. The report found that even scaled companies grew at high rates, Opendoor showed the highest of 272%, while others also grew significantly.

“Despite the correction, there is still reason for excitement. Fintech companies have captured less than 10% of US industry revenue with tremendous room for growth,” stated the report.

Six main trends were identified for the sector going into 2023.

Payments orchestration – F-Prime identified a need for merchants to offer different options for payments while balancing fraud and risk within a single engine.

Vertical fintech – They expect more vertical software companies to emerge and seamlessly offer embedded fintech solutions.

Private asset Infrastructure – Infrastructure and distribution tools to facilitate greater access and data insights in the alternative assets space.

Novel consumer data APIs – Increasing accessibility of consumers’ financial data across platforms could give rise to more personalized financial products.

Instant payment rails – Significant growth in real-time payments globally. Many opportunities exist for fintechs to build real-time fraud detection, chargeback facilitation, and on/off ramps.

Crypto compliance – Following a year of fraud, hacks, and volatility, regulators will step in to ensure security is top of mind for all crypto participants.