In less than a month, the long-awaited FedNow real-time payments system is set to launch, aligning the US monetary system with much of the rest of the world.

While the Clearing House, for some time, has had its own real-time payments network widely available, the adoption of FedNow marks the first attempt at a federal upgrade of the banking system. It is expected to be far further reaching. This could be a significant shift in a nation that still makes prolific use of cheques and traditional banking methods.

However, the U.S. is late to the party. Elsewhere, real-time payments have been integrated for some time, and global outliers are already steaming ahead.

Real-time payments taking off globally

According to ACI Worldwide’s Prime Time for Real-Time study, already overall real-time

transaction volumes around the world grew 63.2% in 2022. Transactions reached a high of 196.0 billion and are set to reach 511.7 billion by 2027, accounting for 27.8% of all electronic transactions globally.

“You get a lot of benefits from real-time payments rails, even the economy as a whole,” said Alexandre Pinto, VP of Product, Banking, at Pismo. “Research shows that when you have a very efficient payment rail, like banks in Brazil, money moves so quickly, increasing the country’s GDP. The money moves faster. People transact easier, and so on. So it’s very good for the economy as a whole, for the society as a whole.”

In an earlier study, ACI Worldwide found that, in many cases, real-time payments had been a driver for economic development. Allowing an increased speed in money transfer had tremendous potential to improve financial inclusion, particularly in digitally-led gig economies, while alleviating cash flow and liquidity issues.

“Established drivers, such as financial inclusion, remain as relevant as ever,” said George Evers, Senior Vice President of Real-Time Products at Mastercard. “It has been proven that, combined with the perpetual motion of mobile utilization and the digitization of everything, real-time payment systems offer a foundation for economies to be more dynamic. As such, market participants not already exposed to a real-time system soon will be.”

With its PIX network launched in 2020, Brazil is one of the leaders in global real-time payments systems, second only to India. Growth has been extensive, amounting to 228.9% between 2021 and 2022, and the nation has the largest forecasted GDP facilitated by real-time payments, predicted to be 2.08% by 2026. Adoption is expected to be at 51.8% by 2027

India, in contrast, saw 76.8% growth in the same time frame but already has an established ecosystem, registering 89.5 billion real-time transactions in 2022. In 2026, real-time payments are predicted to make up 1.12% of the country’s GDP. However, current predictions for adoption are only at 18.2% of the population by 2027.

The introduction of the networks has sparked a wave of innovation. In India, Brazil, and other nations that have introduced real-time payments, mobile wallet usage is rising, and financial institutions have shifted into gear to utilize the new technology.

India’s Unified Payments Interface (UPI) layered on top of their original real-time payments network, allowing for increased payment facilitation, introducing QR codes use of mobile numbers and digital ID into the ecosystem. The development boosted adoption further, growing the number of use cases.

“The journey to real-time for payments is an inextricable and obvious destination for all payments irrespective of whatever rail they travel on,” said Peter Hazou, Director of Business Development in Financial Services at Microsoft.

“The real-time world around us is prompting the banking system to modernize its infrastructure and processes to accommodate real-time activities and the data that travels with them.”

“Real-time payment capabilities are becoming table stakes for banks innovating to serve client needs. They are core to product development and data insights and should be central to banks’ modernization roadmaps.”

However, so is fraud

A primary drawback to real-time payments is that they are instantaneous; disputes and transaction mistakes become increasingly difficult to rectify. This has caused fraud cases to flourish.

As payment limits increase and the technology evolves, fraudsters find new ways of committing financial crime,” wrote Cleber Martins, Head of Fraud Management for Banking ACI Worldwide.

“As banks have bolstered fraud prevention strategies, fraudsters have targeted the weakest link — the consumer. The availability of real-time transactions leaves banks, processors, and financial intermediaries vulnerable to attack, with a tiny window to prevent fraudulent transactions and scams.”

Studies have found that while traditional fraud methods involving stealing bank details have reduced, “confidence tricks” and Authorised Push Payment (APP) scams have almost doubled. Digital wallet hacks had also increasingly become a method of choice for fraudsters.

India, while a global leader in real-time payments, has also experienced increased instances of fraud.

According to complaints registered on the National Cybercrime Reporting Portal, UPI fraud rose by 23% in 2022. APP scams doubled in the past year while other payment fraud types decreased.

The resolution to this, according to experts, is the development of a real-time fraud detection system to complement the increased speed of payments.

Banks and financial institutions, as the technology providers, could implement targeted descisioning models to protect transactions. These could involve contextualizing the transaction initiators and receivers, allowing the models to determine when payments could result from fraud.

And where does the US currently fit in?

In the U.S., real-time payments are still a tiny part of the payments ecosystem, which could be used to the advantage of the sector.

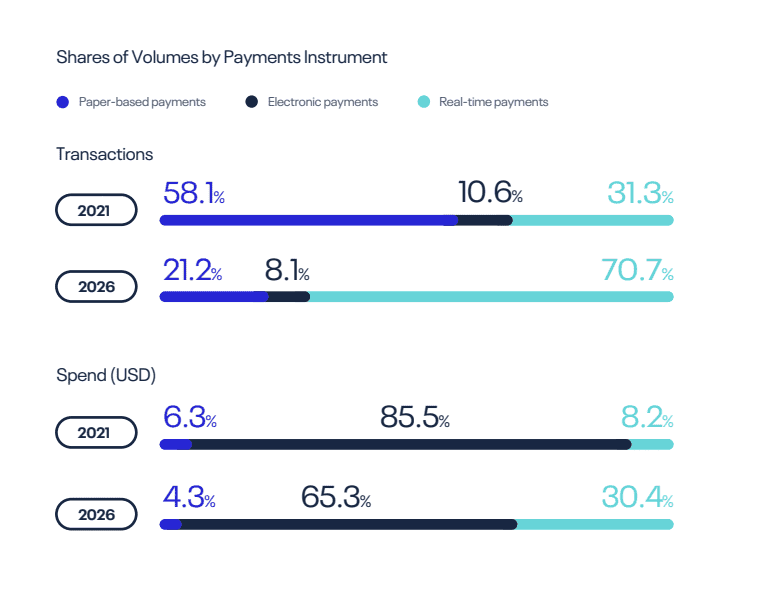

Although real-time payments networks are live, transactions only make up 1.2% of the total payments volume. Paper-based payments make up 17.9% of transactions, and electronic payments account for 81%.

However, with the launch of FedNow, the sector is expected to rise 32.6% between 2022 and 2027. Just under half of the adult population already regularly uses digital wallets and electronic payment is widely accepted.

Fraud does continue to be an issue when approaching the space. While current regulation states that banks must reimburse victims of unauthorized fraud, the same is not true for authorized fraudulent payments.

In the case of real-time payments, globally, most fraud falls into this area.

“There is no reason to assume that without action, the U.S. will not follow the path to crisis levels of APP scams as seen in other markets, with APP scams almost tripling from 7.4% in 2021 to 18.6 percent of all fraud in 2022,” according to the ACI Worldwide fraud report.

Related:

The delay in adoption may bring benefits in combatting real-time related fraud.

Learning from other nations’ issues, strategies to counteract rising rates of real-time fraud could be developed in conjunction with the institutional adoption of the payment rail.