Saturating the headlines, the failure of Silicon Valley Bank happened at breakneck speed.

RELATED: Silicon Valley Bank: Closed by regulators to protect deposits

“Every event has a sponsor, and some folks have already printed T-shirts saying the “Silicon Valley Bank Run 2023″ as if it was a fun run. I think the sponsor of this run was fear,” said Ryan Gilbert, founder of Launchpad Capital. “And the fear was driven by an absolute lack of communication that was louder than what was being effectively trumpeted over social media and other actions.”

In the first failure of this size to play out on the social media stage, everyone had an opinion, and FUD was rife, supercharging the bank’s demise.

The panic somewhat subsided at the announcement that the FDIC would fully protect deposits, leaving the industry to reflect on how such a thing could have happened. The heavily regulated banking sector was supposed to protect from failures and incumbent banks, the cornerstone of trust in the system.

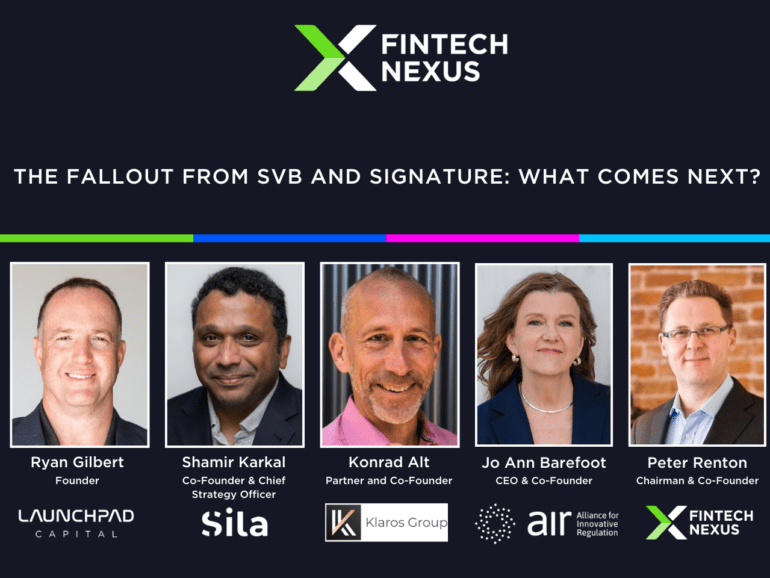

One week on from the trigger of the bank run, Fintech Nexus hosted a webinar to discuss the events and where the industry can go from here.

SVB concentration risk

An investigation into how the SVB got into such a precarious situation was launched earlier this week, and the blame game is underway.

Some have turned to the high concentration of VCs and Startups within the bank, which, on hearing of the bank’s plans to sell securities and shares, scrambled to move their funds from the institution.

Shamir Karkal, Co-Founder and CEO of Sila, said the concentration risk was more to do with the company’s high level of smaller businesses, which by default included startups.

“The effect of that was that they ended up with a very high amount of uninsured deposits,” said Karkal. “Usually, a bank of that size has a few million depositors. SVB had less than a thousand because it was heavily corporate.”

“For the vast majority of retail depositors, FDIC insurance covers them completely. There’s never any reason to run on the bank. FDIC insurance doesn’t cover your costs if you’re a medium-sized, even a small business. Once you get past 10-20 employees, you’ll probably end up more than the FDIC insured amount.”

“If 95% of your deposits are from corporate customers. That’s a real concentration risk, independent of Silicon Valley Bank.”

Konrad Alt, Partner and Co-founder of Klaros, agreed, stating, “That’s a very common model in the banking industry.”

The question was posed on whether higher insurance would cover this. However, the speakers felt that fear had been the main driver of the crisis, spreading even to those who had been insured.

Alt said the implication that customers’ action of transferring the deposits to “safer” locations was in some way immoral was, however, wrong.

“We all have the perfect right to feel comfortable about where our money is,” he said. “The decision to pull money in a moment of crisis because you’re worried about your future is a completely rational and okay thing to do.”

Was there a lack of regulatory oversight?

Like many in SVB’s aftermath, the conversation turned to the regulators and whether their bank oversight was sufficient.

Jo Ann Barefoot, CEO and Co-Founder of the Alliance for Innovative Regulation, said she hoped this crisis would be the wake-up call needed to show that regulators require more information and faster.

“That might not have saved that SVB exactly how this unfolded. But when we think about contagion to other parts of the industry…a considerable amount of bank deposits exceed the insurance limit.”

She explained that regulators usually obtain information from quarterly reports that may be insufficient within the current landscape. She felt a push to digitize information could have made a difference to the outcome and may help avoid similar collapses.

However, Alt felt that access to data may not have been the issue.

“As a former regulator, I agree that it would be a better world if regulators have more timely data,” he said. “On the other hand, if you think about SVB, in particular, you didn’t have to be a regulator at all to spot that there was a lot of interest rate risk at that bank a long time ago. And it wasn’t due to a lack of timely data that happened.”

“That’s not the core problem in SPD. I’m not sure what the core problem was, but somewhere in the supervisory process and somewhere in the management process, the risk that was readily apparent to outsiders got missed or wasn’t taken seriously.”

“There needs to be a close examination of the review process at SVB.”

Looking to the sale of SVB

The search for a buyer of the bank brought the hole left by the bank’s collapse for startups to light.

Karkal lamented the possible inability to find a suitable acquirer. Sila is a customer of SVB, and since the bank’s failure, the business has looked at diversifying its banking stack to manage any other possible risk. However, the search for a bank to parallel SVB had been difficult. He explained that SVB’s unique understanding and service to startups had been a great driver of its success.

“One of the great things about SVB was they understood startups,” he said. “If it isn’t taken over by someone similar in the industry, it will create a tremendous hole.”

Gilbert echoed this opinion.

“The extent of the value that Silicon Valley Bank brought to the ecosystem also went beyond capital access,” he said. “It was an understanding by the bankers of how innovation works. It was their willingness to be partners in risk, and I think prudent risk. This is a model that’s worked for the past 40 years and also extended to sectors of the economy beyond tech.”

The speakers on the call were concerned about the future sale of the bank. They discussed whether national banks of similar size would have limitations in acquiring SVB due to the risk involved in dealing with startups.

“A smaller bank can’t take the concentration risk, presumably, and a bigger bank might or might not be able to import what’s good about this particular bank without undoing it,” said Barefoot.

A way out of the crisis

In the meantime, startups have been left to pick up the pieces, and many are concerned about their options in the future.

Much of the broader conversation has turned to possible derisking methods for smaller companies and their capacity to implement safeguards.

“It’s simply not a reasonable expectation that the people who manage money for small businesses should keep an eye on the safety of their bank,” said Alt.

While many larger companies have implemented methods to diversify risk, the ability of smaller businesses to do the same is significantly reduced.

Karkal explained that since the bank’s fallout, Sila had been exploring sweep accounts.

“One of the techniques that people can do, and is, what a lot of much larger companies which have treasury management teams do, is sweep funds into a money market fund,” he said.

“At a 2000-person company, definitely you can assign a couple of people to just manage that process and make sure it happens efficiently. But it’s much harder in a smaller business.”

However, while this concern for how to move forward was prevalent, the speakers highlighted the possibility of innovation due to the lessons brought forth by the crisis. From automation of treasury management to the construction of regtech tools, many ways forward out of the chaos had already become apparent.