Be warned, if you are a DeFi first-timer, the plays made by TradFi companies may not be what you think.

Many experts believe it is doubtful that the TradFi and DeFi intersection would even be considered DeFi since TradFi is unlikely to hold decentralization as its focus. This would mean that many DeFi ventures made by TradFi could fall into the realm of CeFi.

(There are likely a dozen more _____Fi abbreviations in the works, too, in case you are counting.)

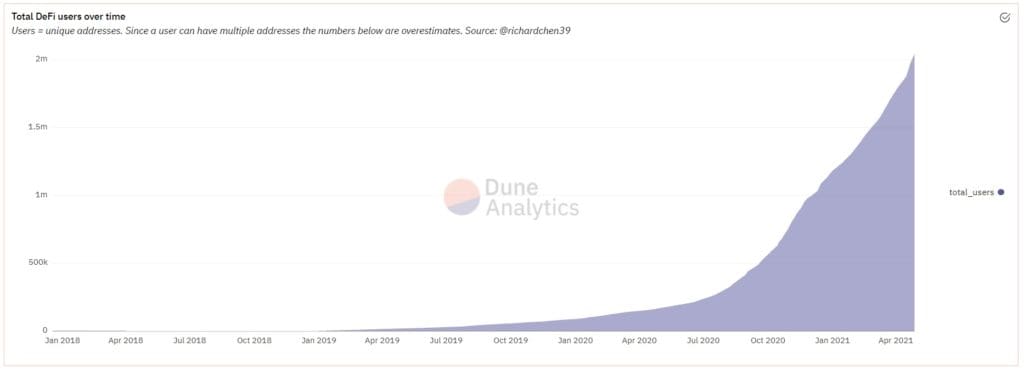

The movement of TradFi towards DeFi adoption to some degree is here. Between 2020 and 2022, the DeFi market grew by 865%. In a study conducted by Intertrust in the summer of last year, institutional investors expected to hold between 7%-10% of their assets in crypto within the next five years.

In another avenue, large financial institutions have announced their exploration of digital assets, including BlackRock, JP Morgan, and Goldman Sachs, to name a few. Even governmental bodies are taking an interest.

Experts are bracing themselves for the breakthrough.

“We’re on the verge of mass scale adoption through innovations that make it easier for people. We haven’t had the one yet, but I think it’s not far off. Hopefully, we’re at the close edge of institutional adoption, followed by mass scale. It’s an exciting time,” said Kirill Bensonoff, Co-Founder and CEO of New Silver.

Made for the people, governed by the people

DeFi purists, by definition, hold total decentralization in the highest regard.

“The entire reason you know we’re here is decentralization,” said Daniel Keller, Co-Founder, and CSO of Flux. “People are waking up to the need for a platform that can’t be censored and can’t arbitrarily be taken down for no reason at all. One that doesn’t rely on any one central entity. It’s by the people for the people.”

Although decentralization could bring strength to a business by not having a central point of failure, pure decentralization would nullify the existence of a CEO and governing board. Therefore, any intersection between DeFi and Tradfi is technically unlikely to fall under the “DeFi” precedent unless the TradFi company was to relinquish all control and hand it over to the community as a whole.

RELATED: The critical differences between CeFi and DeFi and why rash regulation could damage development

“We’re on this continuum of centralization to decentralization,” said John Sun, Founder and President of Spring Labs. “There’s no absolute decentralization. I don’t believe in that as a concept. So now the question is, we’re on this continuum. Does TradFi want to make a play?”

“I think DeFi will bring a movement towards more decentralization of the financial services and ecosystems. It will not be absolute again, but I think it will move financial services towards decentralization. I think that’s the way to think of it rather than thinking of as traditional finance moving blockchain towards more centralization.”

For many, it is clear that the decentralization aspect of DeFi has its merits, despite not choosing to adopt complete decentralization.

“I think institutions are interested in it to a degree,” said Bensonoff. “I think they’re interested in it as a way to gain potential efficiencies, to have a ledger that anyone can access to make things faster and more transparent, where needed. But they’re not interested in the way of governance. “

“They may still adopt some of that, but they’re not going to have token holders all over the world govern the protocol they’re using; that would be just too dangerous and require some drastic change.”

“They need to be able to control things again because of regulation and their responsibility. Let’s say something happens; with a decentralized governance structure, they would have no control over it. They’re still responsible.”

“So I think they’re interested in the technology part more. I’m not saying that they are not interested at all in governance, but I think it’ll have to adapt to more of a centralized management option.”

DeFi brings advantages to TradFi

Instead of governance upheaval, TradFi companies looking to make a play within the DeFi, in many instances, could be looking to gain from the technological advantages DeFi.

“With decentralized systems, generally, you have a little more confidence in the set of rules that you’re playing by because no one party can arbitrarily change what the rules are,” said Sun. “That’s been the biggest proposed argument for decentralization – The lack of ability for a single party to change the rules of the game all of a sudden.”

He explained that although he believed the early attraction of the technology to be increased yield, the market has increasingly shown the heightened risk that comes with it. The remaining attraction to seeing growth is the additional efficiencies, and conveniences DeFi could bring.

“I think it is going to take a leap of faith for a lot of traditional finance companies to want to build and use DeFi products; a lot of the technologies are still as of yet a bit untested,” he said.

“This latest crunch in the crypto markets validated quite a bit of the technology that we’ve come to rely on. There wasn’t a single DeFi platform that lost underlying value for its holders. The liquidation bots worked as perfectly as we could have expected through some very major price corrections.”

“Meanwhile, the CeFi institutions putting on risk and taking offers manually with risk managers get blown up. There are several examples of these situations, either through liquidity crunches or mismanagement of risk. That, if anything, is a pretty shiny example of what DeFi technologies can build and what’s possible to build with in the future.”

…and vice versa

However, the development of DeFi technologies is still in its relative infancy. Many conveniences of having a centralized point of responsibility are still to be developed.

“Centralization brings more stability and ability to affect longer-term changes that a decentralized system may not be able to adapt to, ” said Sun. “There are just more conveniences that make products more useful.”

“For example, if your credit card was stolen today, the chances are you would not be on the hook for the charges that were incurred while your credit card was stolen. That’s very hard to replicate in a decentralized ecosystem.”

“I’m sure as DeFi develops, this will change. It just doesn’t make sense for the average consumer yet. If I’m a user and have a choice between a centralized card with all of these creature comforts and conveniences versus using a decentralized card that’s philosophically along the lines of what I’m trying to do but doesn’t have all the conveniences. I mean, I’d choose the centralized card all the time.”

For Sun, the development that will bring DeFi into the mainstream usage of average consumers may come from the intersection with TradFi. Aspects such as regulatory compliance considerations are still, for the most part, yet to be tackled by DeFi. It’s these considerations that could push them into mass adoption.

“You look at the meteoric growth of DeFi,” he continued. “It went from literally nothing in late 2017 to its peak $300 billion value. But then you think about how that pales to even a moderately sized fund in the TradFi world. You can see why there needs to be TradFi for this vision to reach the next stages of growth.”

TradFi still faces challenges in the adoption of DeFi

The issue with regulation is one of the major considerations which hold DeFi back from institutional adoption and use by the general public.

“In DeFi, there is little or no regulation right now,” said Bensonoff. “So TradFiI think is having uncertainties. If TradFi is going to develop something, they want to be able to deploy a lot of capital there, do it for a long time, and be as safe as possible. Today, I think that that’s what’s lacking in DeFi.

“They don’t know if there will be new regulation tomorrow and everything will change. Or there won’t be any regulation, and it will be a “wild west.” They’re worried about that.”

“To me, that’s the most immediate challenge. Once there’s regulatory clarity, I think TradFi will be eager to go all in.”

Current Optimised Areas of intersection

So, where do experts see the best points of adoption?

Dashboards/wallets

“Using deep protocols in crypto is inconvenient,” said Bensonoff. “I think we need a breakthrough to make crypto as convenient as using the app without the possibility of losing money and forgetting or losing your access keys. When somebody invents a wallet that can be completely foolproof at that point, people will start really using it.”

This focus on improving accessibility is echoed by Bo Brustkern, CEO, and Co-Founder of Fintech Nexus, who calls wallets “the entry point” for TradFi to DeFi and believes dashboards to be absolutely crucial, despite being late to develop. For Bruskern, for TradFi’s journey into DeFi, “The best play is not to build or to buy, but to collaborate and learn.”

Securitization

“People are taking what already exists and improving that versus creating something brand new. I think the frameworks already exist; we’re just improving them,” said Bensonoff. “The frames come from Trad fi mostly.”

“There is already a framework in traditional finance for real-world asset securitization. In the case of Centrifuge, they took that framework, and they’re just improving on it by building an on-chain and allowing, you know, blockchain to address technological values there. I use the example of Centrifuge because it was one of the first protocols of bringing real-world assets into DeFi.”

Securitization is an area other leaders in DeFi have seen the potential for disruption.

“I think folks have been looking for ways to disrupt things like markets in financial services for a while, and I think securitization is certainly one of these things, where the existing processes are still a little cumbersome,” said Sun.

“I think there’s a way to build a marketplace with greater true data transparency. The buyers know exactly what they’re getting, and the product structure and the sellers can access this marketplace directly. A way to skip the middleman essentially is to pick these assets directly, put them in this marketplace, and then for folks who need that yield exposure to be able to take that off the marketplace directly to construct a portfolio with the exact risk and yield characteristics they are looking for.”

“That’s one vision for a platform that can replace a large amount of securitization within the financial services ecosystem today. Many other models have been thrown around, both on-chain and off-chain. Who knows if it will happen in the short term, but it’s certainly a product or a problem we’re actively working on at Spring Labs.”

Compliance tools

For Sun, Compliance is an area that could make the most difference for TradFi adoption. Innovation in compliance tools could adjust existing mechanisms to work within DeFi.

“Compliance work products probably are going to be a big driving force behind DeFi blockchain growth in the coming years,” he said. “Right now, not many are ready for primetime yet. I think there are a lot of thorny regulatory issues that don’t have answers yet. And so you’re seeing the biggest players sit on the sidelines just starting to explore; they’re not participating realistically.”

“I think the solution to regulatory uncertainty, without throwing the baby out with the bathwater, is compliance products or products that have some awareness of the compliance context behind the transaction instead of just the transaction itself.”

Spring Labs have launched their Quadrata Passport to solve issues with KYC and AML on the blockchain.

Standing on the shoulders of giants

Sun and Bensonoff agree that the models that could push DeFi towards mas institutional adoption come from the existing models in TradFi.

“TradFi is a big word because there are many uses,” said Bensonoff. “In traditional finance, there’s investing, trading, money transfer payments, things like that. So it’s a huge description of a lot of different things. I think DeFi is improving what already exists.”

“Some things are definitely new, but I think overall, the major frameworks are already there. DeFi didn’t invent money transfer, it didn’t invent trading, but it did bring on-chain capabilities. They just brought a potentially better way of doing it.”

“Whatever format TradFi engages with DeFi, it’s on the back of all the technological efficiencies and savings,” said Sun. “I don’t know if DeFi has changed any fundamental math regarding finance; I strongly suspect it hasn’t. However, it has promised greater efficiencies and greater interoperability between various platforms. And I think that’s the basis for traditional finance companies to interact with DeFi.”

“I think, ultimately, if more folks are willing to believe in the technology, build on it and test it out, that’s how blockchain as a category moves forward.”