A study conducted by AI tax solution, April, found that understanding the system was more of an issue for taxpayers than time spent filing.

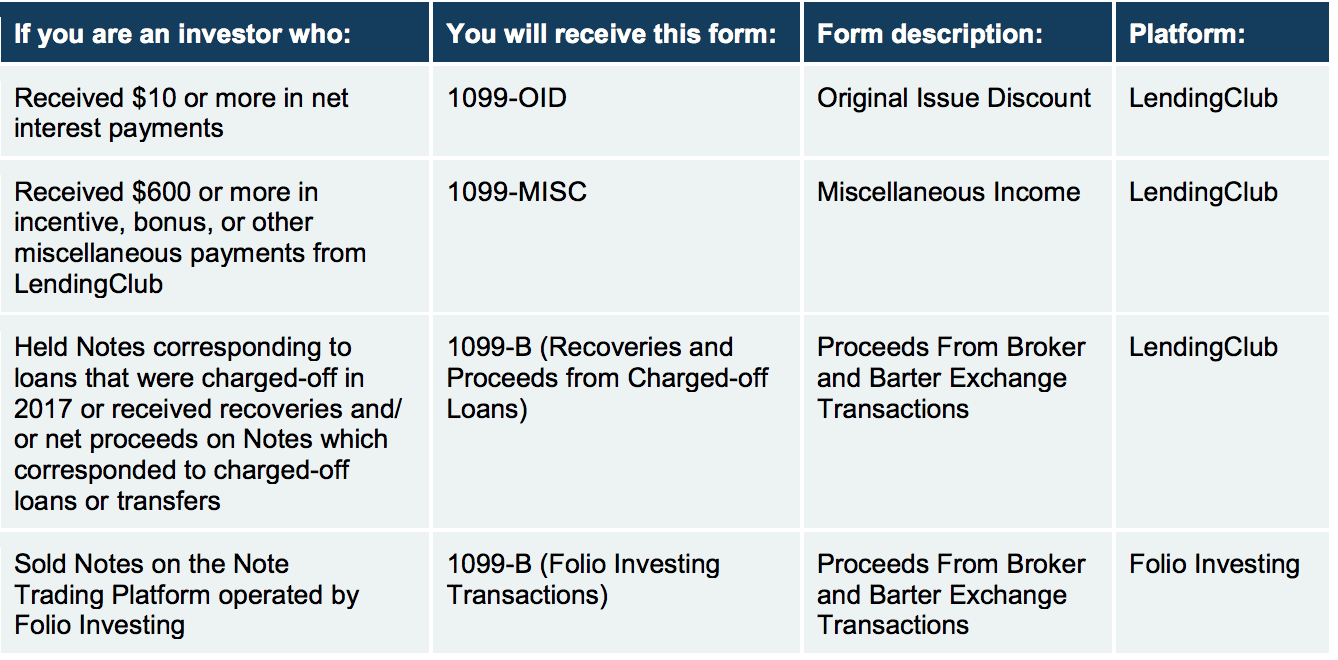

Every year we provide the information that retail investors who buy notes at LendingClub or Prosper need for filing their...

Lend Academy shares information related to filing taxes with LendingClub and Prosper for the 2017 tax year. Source

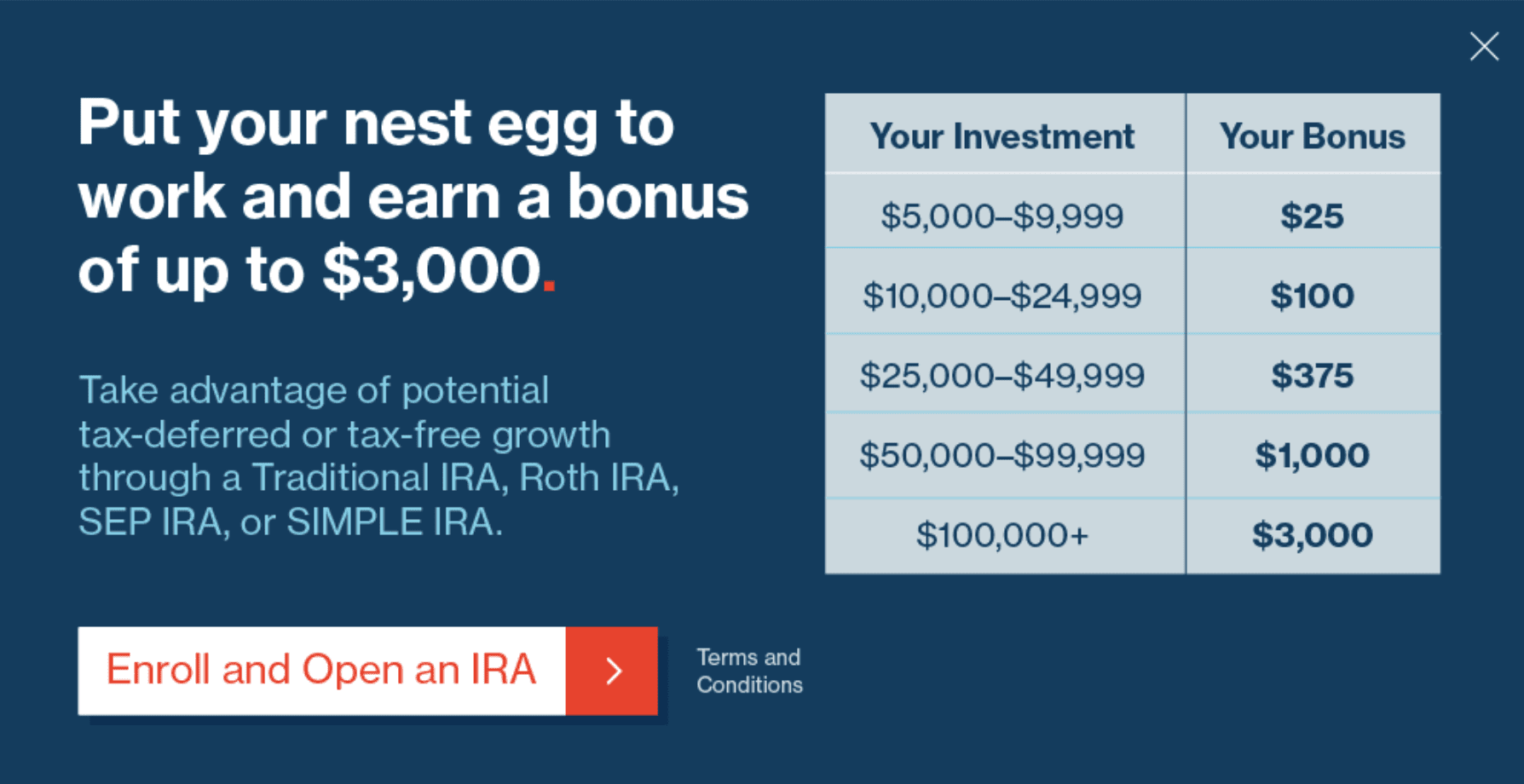

There are unique tax implications when it comes to investing in marketplace lending and investors should consider investing through an IRA; LendingClub is currently offering a bonus for IRA investments and is working with a new preferred custodian. Source

Most lenders like to request tax return information from a borrower during the loan application process. It is the most...

In episode sixteen of PitchIt: the fintech startups podcast we talk with Abound Co-Founder & CEO Trent Bigelow. Abound helps...

[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. You should seek professional advice before...

[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. You should seek professional advice before...

[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. You should seek professional advice before...

As tax day has arrived it is important for investors to understand that real estate crowdfunding has specific tax treatment; investments into syndications are considered passive and there are two types of passive activities, rental activities and business; understanding how your passive activities tally up into income or losses will determine how you will file and if you will need to carry over to future years; another benefit to crowdfunding syndications is favorable long term capital gains tax rates if a property is acquired and held for longer than a year. Source