Singapore based fintech company Trade Finance Market (TFM) recently launched their Invoice Check solution to cut down on trade finance fraud; the new blockchain based registry will help stop invoices from being paid more than once; they built the solution in the past year on the ethereum blockchain and it uses smart contracts; "Our system is in public beta and provides a manual method of entering invoices and having them checked against a blockchain-hosted database. This data is stored on the blockchain and funders are alerted if there is a potential risk of double financing," Raj Uttamchandani, the company's executive director, tells Global Trade Review. Source

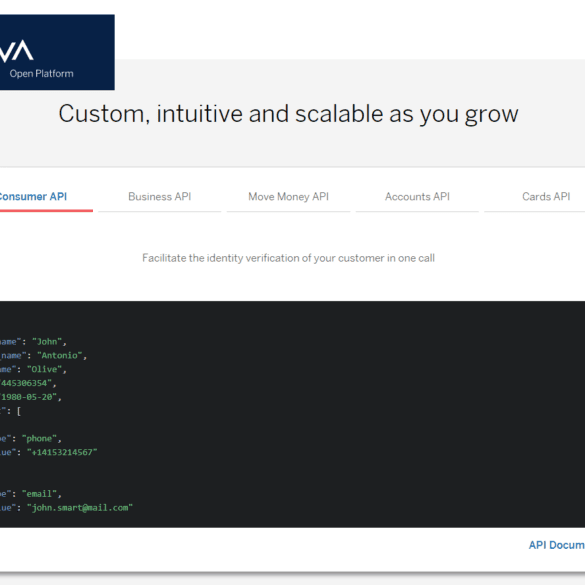

Anyone watching Fintech over the last decade has recognized an increasing shift of power from product manufacturers to the platforms where those products are sold. In the case of Amazon, Google, and Facebook -- finance is just a feature among thousands of others. I've made this point since 2017, when Amazon launched lending into its platform. Brett King has been a bit more generous in the categorization, calling the shift "embedded banking". This means that banking products are built into you life's journey, not accessed in a separate customer center location. The financial API trend is a tangible symptom of this vector.

The Singapore Exchange has closed a deal with online debt and equity crowdfunding platform Crowdo with terms of the deal including support for raising small and medium enterprise (SME) awareness or capital funding availability in Singapore, information sharing and cross-referral of clients; similar deal terms were included in the Singapore Exchange and PwC deal with promotion of the Singapore startup ecosystem a central component of the deal. Source

The CEO of DBS Group Holdings in Singapore believes that Singapore may follow Hong Kong in offering virtual banking licenses;...

Toast aims to make cross-border payments easier and cheaper for migrant workers living overseas; the Singapore-based startup closed the $2.5 million pre-Series A round with Aetius Capital, 1776 and Pepper Group; historically, migrant workers have relied on services like Moneygram or Western Union to send money back to their families; company works with existing local remittance stores and kiosks and originally set out to use blockchain and bitcoin to power the service; CEO Aaron Siwoku stated they aren't going to replace banks and traditional lenders, but want to be meaningful partners with people who have distribution. Source

Singapore's LATTICE80 fintech hub has announced it will expand to London; it has registered as an entity and is seeking a location with plans to open by 2018; the expansion builds on the "Fintech Bridge" agreement signed by the UK and Singapore in 2016 to promote cross border collaboration; LATTICE80 is owned and operated by Singapore-based private investment firm Marvelstone Group which is actively developing new fintech services and solutions for the Asian and UK markets. Source

Singapore-based Dymon Asia Ventures has received investment of $20 million and plans to meet its target fundraising of $50 million over the next 12 months; firm plans to invest in 12 to 15 companies and has already begun investing in five companies which include: blockchain startup Otonomos, financing firm Capital Match, forex-focused 4XLabs, trading platform Spark Systems and marketing service WeConvene; the firm's investment focus will be on business to business companies targeting the growing Southeast Asia internet market; it says it will invest in seed stage funding through Series B funding with investments ranging from $300,000 to $3 million and reserves available for continued investment in follow-on rounds. Source

Online lending platform Crowd Genie has obtained regulatory approval from the Monetary Authority of Singapore; launched in mid-2016 the platform seeks to match accredited investors with SMEs for a fast and efficient alternative loan financing solution; the firm has been focusing on back office processing to meet regulatory guidelines and is now planning to increase its lending with the new regulatory approval. Source

Funding Societies is the first P2P lender to join the International Association of Credit Portfolio Managers (IACPM); the IACPM was established in 2001 and is focused on supporting a community of members in the practice of credit portfolio management; the Association currently has approximately 100 financial institution members. Source

The regulator says, "digital tokens in Singapore will be regulated by the Monetary Authority of Singapore (MAS) if the digital tokens constitute products regulated under the Securities and Futures Act"; if digital tokens fall under the definition of securities in the Securities and Futures Act then issuers are required to register a prospectus with MAS and other requirements may also apply to associated parties; overall the statement from the MAS increases the level of compliance needed for an initial coin offering. Source