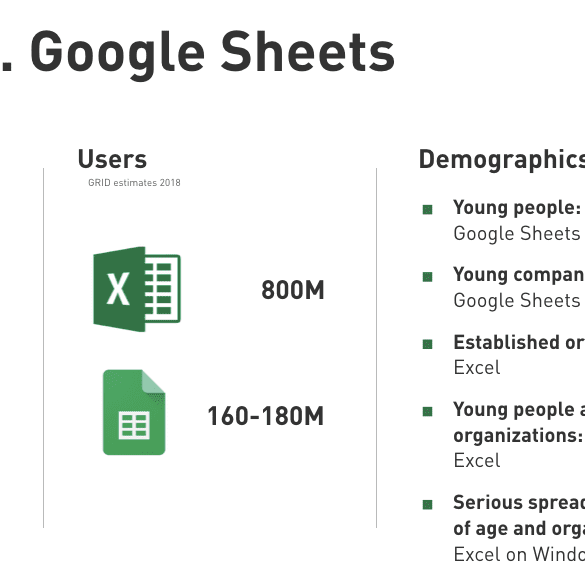

At $13 billion of revenue and 800 million users in 2016, Office 365 roughly generated $20 per user. That's like Monzo, but with the user foot print of Ant Financial.

You might think the comparison is daft. But let's dig a bit deeper. Excel, and spreadsheets more generally, are the default behavior for managing personal finances. Even for financial advisors, who are supposed to be the precise niche leveraging financial planning software, Excel is the default "do nothing" option. If you are not paying for digital wealth software as an advisor, you are doing it in Excel.