Today we're joined by Brett King, founder and executive chairman of Moven, one of the world's original digital banks, and Lex Sokolin, global head of fintech at ConsenSys. Lex and I discussed Moven's recent announcement to shutter its B2C business on episode 170 of Rebank. And we're happy to have the opportunity to connect with Brett directly to discuss the decision in more detail.

Moven announced last week they would shutter their challenger bank offering and all accounts would be closed by April 30th;...

Two fintech firms from opposite ends of the world are joining forces to create a digital banking solution for young...

In his most recent book, Bank 4.0, Moven founder Brett King explains how U.S. banks and regulators are still significantly...

American Banker takes a look at some of the better know digital banks and how they are trying to build...

This week, we look at Betterment launching a bank account and payments feature. They are not the first, but they could be the best! Still, it feels like the world has moved on. Barriers to entry around digital finance have collapsed, and shifted industry goal posts. Hundreds of companies are integrating API-based solutions that connect to banking and investment entities. Amazon, Google, and Apple are there already. And let's not forget the incredible pressure from the COVID recession: 20MM+ unemployed, $100 billion decrease in global remittances, 1 in 8 banks being unprofitable. Is it time for incremental improvement, or a sea change?

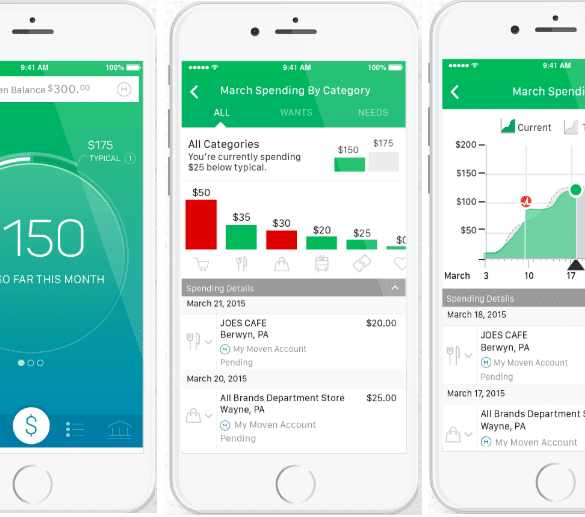

Moven is winding down their personal financial management offering due to the current market; going forward Moven will now focus...

An article in Forbes earlier this month about the traction of digital banks caught my attention. A survey of U.S....

The discussion at American Banker’s annual Digital Banking Conference in Austin last week revolved around new technologies like AI and...

Budgeting app Moven is planning to buy a small bank so they can become a more direct competitor in the banking space; the company’s new partner, SBI Holdings, is investing in Moven to create two entities MovenBank and Moven Enterprise; “We’ll do a digital direct challenger bank without having to run branches,” Moven CEO Brett King said to TearSheet. “That was really the thing we were waiting to see if we could solve because we’re just not interested in doing branch banking.”; the company will look continue allowing banks to leverage their technology with Moven Enterprise then use MovenBank to be a true digital bank alternative. Source.