The principle behind Mastercard’s CipherTrace acquisition, L1 growth, and IRS getting your bank data

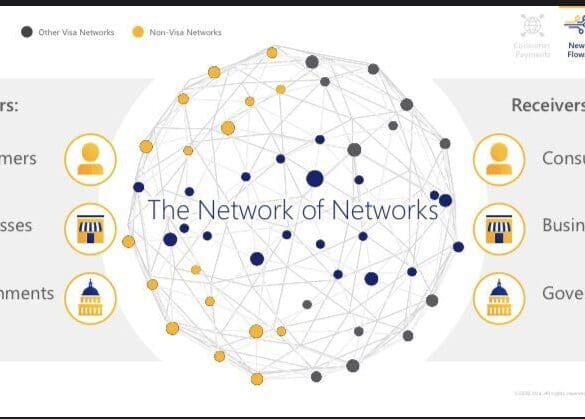

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.