The credit giant is adding advanced analytics to further assist lenders in managing their risk profiles while adding expanded credit models for small business loans and credit-card lines.

Our next guest on the Fintech One-on-One podcast is Steve Smith, the CEO, and co-founder of Finicity. Finicity has been a real pioneer in the open banking space, or as Steve likes to call it an open financial data network, which is probably more accurate.

This week, we look at:

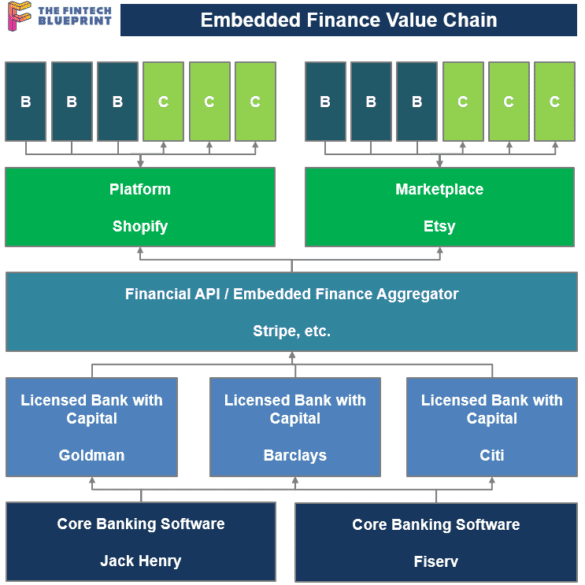

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe's launch of Treasury

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

WhatsApp launches payments in Brazil and is unceremoniously shut down by the central bank a week later, MasterCard buys Finicity to protect itself against Visa’s recent acquisition of Plaid, Checkout.com continues its largely silent meteoric rise in payments, Softbank-backed and DAX 30 index component Wirecard “loses" $2 billion from its balance sheet and files for insolvency, Upgrade raises $40 million at a $1 billion valuation to extend its personal credit offering.

With their recent acquisition of Credit Karma still fresh in everyone’s minds Intuit is rumored to be eyeing more fintechs;...

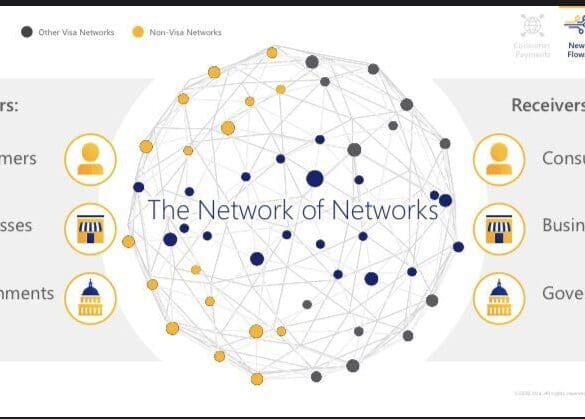

Mastercard launched a set of open banking tools through Finicity, enabling b2c transactors to check user accounts before requesting an ACH.

The principle behind Mastercard’s CipherTrace acquisition, L1 growth, and IRS getting your bank data

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.

In American Banker Penny Crosman considers Mastercard’s recent announcement of the acquisition of Finicity and Visa’s acquisition of Plaid; if...

Mastercard said today that is acquiring Finicity, a leader in real-time access to financial data, for $825 million; there is...

In TearSheet’s recent podcast they discussed the growth of data aggregation in the financial services; data aggregation has become one...