Goldman Sachs has been offering more products to a wider range of consumers; this started with the acquisition of the online deposit platform of GE Capital; the firm is competing aggressively on their deposit rates to grow this base; in 2016 they launched Marcus, their online lending platform, and now have a new lending product called GS Select; product offers loans backed by investment portfolios for individuals that have a Fidelity financial adviser. Source

Another Profitable Year for Marlette Funding as Best Egg Surpasses $7B of Personal Loans Blockchain RegTech Startup TRM Secures $1.7...

There has been a lot of discussion in the last few years about blockchain technology and its potential impact on...

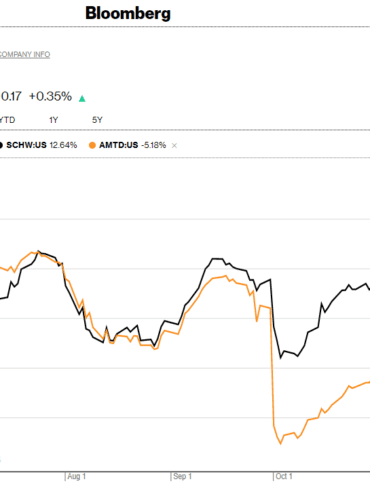

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

The wealth management industry has gone through a host of changes in recent years and now fractional share trading has...

Fidelity’s chief executive Abigail Johnson spoke about the company’s current projects involving cryptocurrency at the Consensus conference; they have made venture investments and are also looking at applications of blockchain technology; Fidelity has set up a mining operation which is making money for the company. Source

Fidelity Investments said that it will allow its institutional customers to buy and sell Bitcoin “within a few weeks” according...

Fidelity has launched a new data sharing hub called Akoya in a bid to end screen scraping and clarify data...

Ant Financial’s Yu’e Bao previously had the title for the largest money market fund; however, JPMorgan and Fidelity have now...

Akoya is currently Fidelity’s data-sharing arm but now will become its own company, owned by Fidelity, The Clearing House and...