The pandemic has helped drive a surge in Canadians using digital identity authentication platforms to get access to government programs;...

Lenders are facing some extraordinary times right now as they try to prepare for the months ahead. Underwriting risk has...

Many customers want to improve their risk profile while offering decisions to their customers quickly; Join us for the webinar...

FinTech Sandbox is a non-profit which aims to further financial services by providing both data and infrastructure to fintech startups;...

Challenger bank Masthaven receives £60m investment Postal Banking Is Back — On Democratic Party Platforms — But Is It Viable?...

Lenders are facing some extraordinary times right now as they try to prepare for the months ahead; underwriting risk has...

Now more than ever it is important to bring the fintech community together. Many readers are already aware that we...

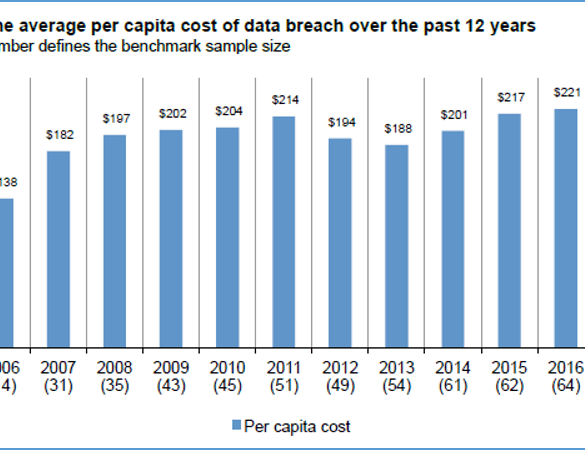

Capital One recently suffered a data breach resulting from poor security practices that exposed 100 million credit card applications and accounts. They expect the breach to cost the company $150 million. Two years back, Equifax lost 140 million identities, again from poor security practices. At the time, I said that according to GDPR this should cost them $150 million. They have since settled for about $600 million -- though some of that seems to be in-kind services coverage like free credit monitoring (lol!). Separately, Facebook has settled for a $5 billion fine associated with the Cambridge Analytica privacy "breach".

Equifax announced late yesterday that it has acquired the small business data analytics company Paynet; Paynet provides commercial credit risk...

Credit bureaus have had a tough past year with the Equifax breach of customer data and new legislation in the U.S. looking to increase competition by allowing lenders to use different sources; changing the credit bureau system is not as easy as it may sound as they have been intertwined in the financial services system for a long time; lenders still use the bureaus for a large majority of lending decisions, even though some alternative bureaus have seen traction; the breach at Equifax could have a lasting effect because people did have a lot of trust in the company to secure their sensitive information like social security numbers; as data sharing in financial services becomes commonplace a premium will need to be placed on how that data is secured. Source.