Cboe Proposes Plan That Could Curb Advantages of Fast Traders European banking needs a Big Bang Hong Kong-based EMQ raises...

JPMorgan Chase, HSBC and Deutsche Bank are amongst a group investing $20mn in online shareholder platform Proxymity; the company is...

Today's corporations and governments are in the business of defining the balance of these aspects of our participation in society and the economy. Beliefs about the immutability of different attributes about what makes a person (or an employee) and how economies are built (cutting the pie, vs. growing the pie) determine the policy decisions you make, top down. As the core example this week, let's take Deutsche Bank. Facing pricing pressure and headwinds in several of its businesses, Deutsche is responding with a plan to fire 18,000 employees by 2022 and an announced investment of €13 Billion in technology and innovation by 2022. They even spun up a hipster-colored neobank as a proof point. Wall Street ain't buying it.

OnDeck, the small business lender has extended existing credit facilities with Credit Suisse and Deutsche Bank; the amended facilities provide...

Deutsche Bank examined whether bitcoin is improving in a recent note they sent to clients last week; a few factors have played into fees staying low, less demand with people looking to transfer their bitcoin and the SegWit upgrade to the bitcoin network; while only 14 percent of transactions occur through the SegWit update the tech is helping to improve the network; transaction volumes moving lower are the bigger reason for the drop in fees according to Mosaic.io co-founder Garrick Hileman. Source.

Alibaba’s Ant Group Plans Hong Kong IPO At $200B+ The Startup Movement Is Globalizing: New Report Proves It Global Digital...

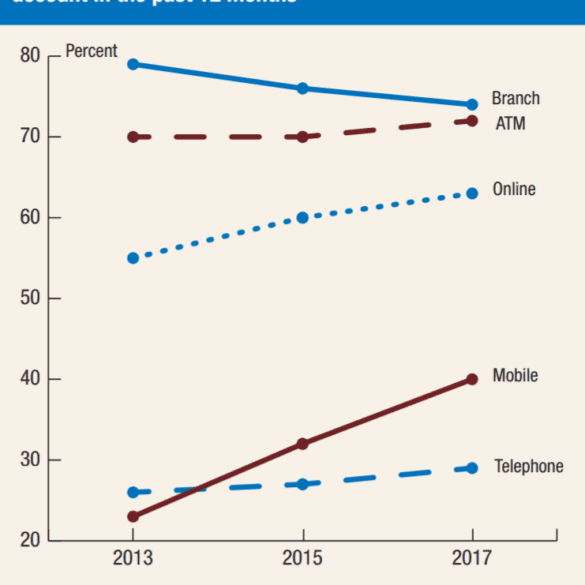

Let's make a collective decision to see the glass as half-full. While physical banking (7,000 US branches gone during 2012-2017) and employment in the sector (425,000 jobs lost since 2013) has been contracting, digital commerce, banking, and investment management have been growing. Even DFA is finally giving in and lowering fees on their $600 billion institutional mutual fund family. Of course, Fintech has been a slow and gradual transformation, not a rapid disruption. We can make a choice to bemoan the loss of the past, or a choice to express an excitement for the future and participate in its making. Which side are you on?

U.S. Fintech ConnexPay Secures $7 Million Through Series A Funding Round Deep Dive: Small and local banks drive some of...

Deutsche Bank has partnered with the International Air Transport Association to develop an industry wide payments solution; they hope to...

Ireland has become a hub of technological innovation as big tech, fintech and big financial services companies set up shop in country as an alternative to the UK; “Ireland has always been quite an innovative country; it has to be because it is such a small market, you can’t just lean on the Irish market to produce a decent fintech business.” says Sinead Fitzmaurice, co-founder of TransferMate, to the FT; talent from Google and Facebook have not only started their own companies but have also moved into finance giants like Deutsche Bank; low corporate tax rates combined with the tech talent has help the country become an emerging fintech market. Source.