Credit Karma is seen as one of the hottest fintech startups in the world and a potential 2020 IPO candidate;...

Lend Academy profiles a real borrower who recently went through Credit Karma to apply for a debt consolidation loan; the...

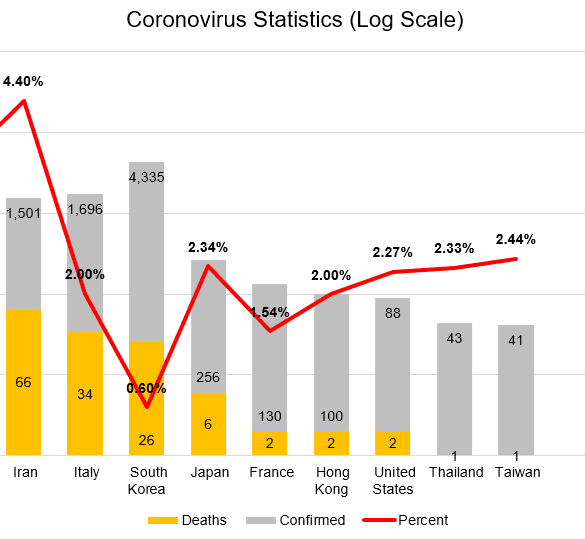

I look at how the news about the spread of the coronovirus are cracking the global economic machine. Some may argue that the number of people effected is still low -- but that misses the entire point. The shock of a global pandemic has revealed weakness in the financial machine, sending the stock markets falling 10% year-to-date. Gross domestic product growth is expected to slow by billions of dollars, governments and central banks are unable to implement policy to compensate with rates at historic lows and borrowing at historic highs, public market valuations will tumble arithmetically, and private Fintech companies will lose a path to exit. At least that's what the conspiracy theorists want you to think!

Following the Equifax hack, Credit Karma is offering a free service that will alert customers if their information has been compromised; the service is currently being tested and will be available sometime in October; the company accelerated the launch due to the large breach at Equifax and has seen a 50% increase in signups following the hack. Source

While most of the fintech world has been focused on small businesses since the onset of the crisis there is...

Competition in the personal loan market has become quite heated since the financial crisis; banks of all sizes, and credit unions now have to compete with the likes of emerging fintech companies who have originated billions in loans; at LendIt USA 2017 Ken Lin of Credit Karma did a keynote presentation on some of the keys to success in this highly competitive market; helping to understand the trends of the last few years (higher defaults and increased APRs) can first give you a better understanding of current market conditions; the keys to success to overcome and reverse those trends are to continuously refine your underwriting models, solve real customer pain points and find a way to win on mobile; keeping ahead of the curve is not easy with so many players but making improvements to certain areas could go a long way. Source

Credit Karma is looking to make managing your car related routines a lot easier by launching their auto information center; the new product will allow customers to manage their auto finances, insurance and other car related items like recall notices; the biggest benefit will allow users to shop for better auto insurance and loan refinance rates that will help make sure they are getting the best deal. Source.

With Credit Karma in the news this week, we thought we would revisit a keynote given by CEO Ken Lin...

According to the WSJ, Credit Karma isn’t receiving any proceeds or issuing new shares as part of the deal; Silver Lake will instead be purchasing shares from early investors and employees in a secondary sale; the investment values the company around $4 billion; Credit Karma generated $500 million in revenue in 2016 and according to CEO Kenneth Lin they have been growing at a double-digit pace since; Credit Karma last raised money in 2015. Source

As the sparkling firecracker news of acquisitions, plans, and partnerships in the BNPL space fizzle, oversight reporting has sprung up. A Credit Karma survey found that of those who used BNPL, more than half of the younger crowd missed at least one payment.