Today, Monday, March 13, 2023, is the day many have been waiting for, following a long weekend of uncertainty over whether deposits in the ill-fated Silicon Valley Bank (SVB) could be fully recovered.

In what has been described as the second-largest bank failure in US history, SVB went down in flames last week. Its fate was sealed when, on Friday, regulators decided to close the bank, handing control of deposits over to the FDIC.

RELATED: Silicon Valley Bank: Closed by regulators to protect deposits

On announcing the closure, they stated access to deposits would be made available at the start of business hours on Monday. However, it remained unclear how much would be protected.

An estimated $150 billion has been locked up since the bank’s closure, and many depositors were more than the FDIC-insured $250,000.

The weekend has been a long one for the customers of the bank. SVB’s position as one of the leading banks for tech start-ups left many concerned about how many it would take down with it.

All eyes have been turned toward the government for a way out that causes minimal disruption to the rest of the banking system. The threat of subsequent bank runs hung in the air.

Sunday evening, the industry had its answer.

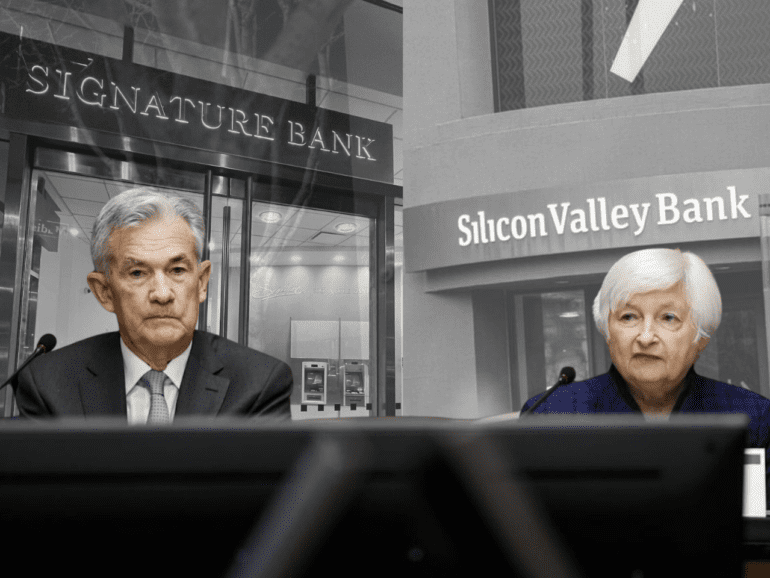

Secretary of the Treasury Janet Yellen, Federal Reserve Board Chair Jerome Powell, and FDIC Chairman Martin Gruenberg released a joint statement outlining the course of action.

“After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors,” read the statement.

“Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

Shareholders and certain unsecured bank debtholders will not be protected, and the bank’s senior management has been removed. The FDIC has also set up a lending facility for further assistance.

Regulators have said the intervention should not be considered a bailout as the move constitutes a “wipe out” of equity and bondholders taken to stabilize the financial system.

President Biden addressed the crisis this morning, assuring that due to the actions taken by the administration, the banking system “is safe.”

“I’m going to ask Congress and the banking regulators to strengthen the rules for banks, to make it less likely this kind of bank failure would happen again,” he said.

“Your deposits will be there when you need them. Small businesses across the country that have deposit accounts at these banks can breathe easier knowing they’ll be able to pay their workers and pay their bills.”

RELATED:

- BREAKING: Federal Reserve creating new lender to cover SVB deposits

- Government to backstop SVB deposits; Signature Bank shuttered

Signature Bank crumbles

Caught in the fold, Signature Bank was also shuttered on Sunday by regulators citing systematic risk to threaten the financial system’s stability.

“The actions that we took today were designed to limit the consequences of the depositor outflows from Silicon Valley and from Signature and to reduce any spillover effects,” a Senior member of the US Treasury reportedly told the press.

Signature was one of the biggest crypto-facing banks in the US, rivaling Silvergate bank, which succumbed to voluntary liquidation last week. At the end of 2022, it held $110 billion in assets and $88.6 billion in deposits. Digital asset-related client deposits stood at $16.5 billion. According to FactSet, it had a market value of $4.4 billion as of Friday after a 40% sell-off this year.

RELATED: Silvergate: Another fall from the CeFi house of cards

In an SVB fuelled panic, Signature saw its own bank run on Friday, hemorrhaging billions. However, The New York Times reported that the flow had been stemmed by Sunday morning, leaving many shocked at the announcement of its closure that day.

Like SVB, many of Signature’s customers held uninsured deposits or more than the insured $250,000. Yellen, Powell, and the FDIC’s statement said bank customers would be “made whole” like SVB.

The closure of Signature Bank marked the third in a week of banks facing the tech and crypto industries.

HSBC acquires SVB UK

Meanwhile, across the Atlantic, the UK had some of its own fires to put out following SVB’s demise.

Chancellor of the Exchequer, Jeremy Hunt was poised for the government’s own rescue plan, entering into conversations with the Prime Minister and Bank of England over the weekend.

While SVB has a limited presence in the UK, the bank provided major infrastructure for many of the nation’s key tech startups, posing a “serious risk” to the technology sector. Leaders quickly affirmed that no systematic risk to the broader financial system was imminent.

However, for a country that has made its position in tech and fintech a critical area for its future growth post-Brexit, the implications on the sector could have been dire, with more than 200 firms exposed.

“We’re working to recognize the anxiety and the concerns customers of the bank have and making sure we can work to find a solution that secures people’s operational liquidity and cash-flow needs. And that’s what the Treasury is working on,” said Prime Minister Rishi Sunak.

While many options were considered with an emphasis on avoiding an effect on taxpayers, like in the US, a bank sale was the preferred option. Unlike the fate of the US entity, a buyer was found.

Over the weekend, many bids were put forth for the bank, OakNorth Bank, and The Bank of London, amongst those who showed interest. On Monday, it was announced that HSBC had made the acquisition, buying SVB for a “symbolic” £1.

The sigh of relief rippling across the web is almost audible.

“HSBC is Europe’s largest bank, and SVB UK customers should feel reassured by the strength, safety, and security that brings them,” said Hunt in a statement.

“This ensures customer deposits are protected and can bank normally, without taxpayer support. I am pleased we have resolved this in such short order.”