SuperFi believes they are needed now as the UK faces a consumer debt crisis on an unprecedented scale.

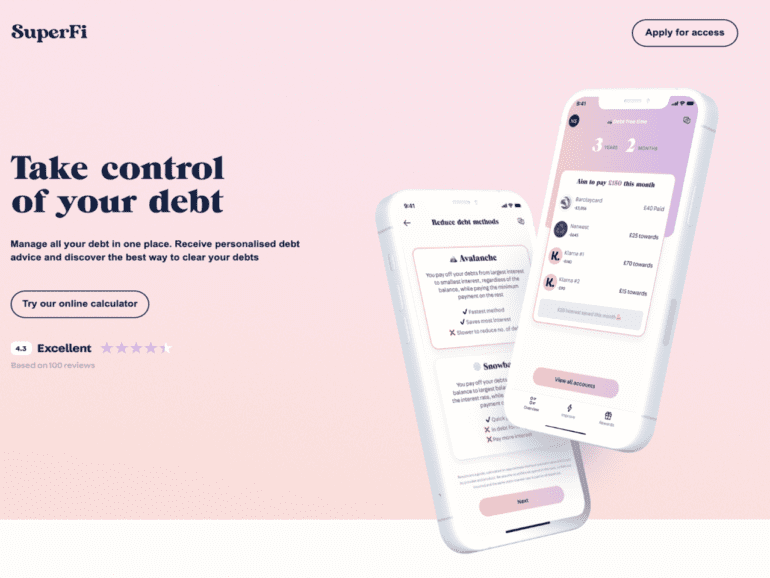

The company is a fintech in the United Kingdom that provides personalized debt support sooner to help people achieve debt freedom faster.

It uses open banking technology and proprietary algorithms to analyze the customer’s financial situation and needs to deliver highly personalized debt advice and access to integrated debt reduction tools/services.

The long-term goal would be for SuperFi to become the best debt management app in the world.

Co-Founder & CEO Tom Barltrop said SuperFi’s name choice was very intentional.

“We wanted a positive and empowering name that would reflect our service’s supportive and proactive nature,” Barltrop said. “We felt it was important to select a name and brand that would be in contrast to the words and feelings usually associated with debt.”

Related:

The current debt system

“The current system cannot provide early, pro-active support to the 23 million people who say they are struggling with bills and credit commitments – leaving many at risk of falling further into debt,” he added.

Barltrop said debt charities and organizations can support ‘problem debt.’ Still, for those in an earlier stage of their debt journey (of which we estimate there are over 17 million), their solutions (such as IVAs and Debt Management Plans) often need to be more suitable. This is why some debt organizations SuperFi has spoken with admit to turning away 30-50% of people that approach them for help because they do not have “enough debt” for their solutions to be relevant.

On the other hand, many of those not yet seeking debt advice but are trying to increase their borrowing are facing similar challenges, with some lenders admitting to rejecting over 90% of all loan applicants.

As a result, millions of people are struggling with their debts and need help knowing where to turn to for help. They need to understand the most suitable solutions available to them to reduce their debts.

How SuperFi was created

The SuperFi concept has been a long time in the making. Nick Spiller, the company’s chief product officer and co-founder, spent the past 10 years in roles where he has been responsible for researching the habits and developing a deep understanding of the needs of financially vulnerable people.

He then met Barltrop, who had spent 13 years scaling high-growth startups (including the previous three years in health tech), on an accelerator program last summer, where they bonded over the opportunity to build a company that could have a massive social impact.

Consequently, the creation of SuperFi was a combination of the founder’s expertise and the fact that millions of people were forced to increase their borrowing during the pandemic.

“We knew those managing debts needed to be our focus. To get initial validation, we created an (admittedly quite basic) debt management tool on an Excel spreadsheet. The feedback we received was surprisingly positive for such a crude and manual solution – so we knew we were on the right track. We continued to make improvements to and released a more interactive version via our website”, Barltrop adds.

“As part of our research, we also spoke with a number of the UK’s largest debt charities and organizations, with Deborah Ware (one of the most experienced consumer debt specialists in the industry) deciding to join our team once she learned about our ambitious mission. This was a key development as it allowed us to ‘digitize’ her 25 years of experience in debt advice – meaning SuperFi would be able to help a much broader range of needs through offering a range of personalized debt reduction tools and services.”

However, Barltrop notes some challenges operating, particularly concerning open banking.

“The space must capture the data level to provide personalized, accurate, and adequate debt support. This has meant we have had to invest in building our tools to collect and analyze additional financial data and personal information to ensure that we can support all of our users no matter where they are in their debt journey.”

UK’s consumer debt crisis

SuperFi believes they are needed because the UK is facing a consumer debt crisis on an unprecedented scale.

The Big Issue, the UK’s leading homeless charity, reports that because of the Cost of Living crisis, the average family is projected to be £1100 ($1299) worse off this year because 80% of their customers have less than £500 ($590) in their accounts. An unfortunate but inevitable consequence is the fastest increase in credit card borrowing in 17 years.

Additionally, inews reports 23 million people (45% of adults) in the UK are already struggling to repay their bills and credit commitments. With the UK facing its longest-ever recession, the outlook is bleak.

Women are more likely to be debt ‘strugglers’

SuperFi has looked at the UK’s debt crisis and taken this further by speaking and surveying hundreds of customers for their market research and created different personas to reflect people’s diverse habits towards spending and saving money.

They found the most interesting persona to be the one they described internally as “strugglers.” They are typically 20-44-year-olds on lower incomes, about 60% female, and have fallen into debt, despite their proactive management of finances, most often due to factors largely beyond their control, such as a change in employment, living circumstances, caregiving duties, or an unexpected/unaffordable bill (all of which are unfortunately much more common due to the ongoing Cost of Living crisis).

This demographic needed help understanding how to prioritize debt repayments or knowing which debt management tools or services were the most suitable for their specific situation.

While there is a wealth of helpful information online, many were simply overwhelmed, not knowing which advice was relevant to them or how to apply it to their financial situation.

Onboarding users

SuperFi is focused on two categories to access users:

- Companies with employees struggling with debts.

- Companies with customers who are struggling with debts.

They believe both categories are in desperate need of solutions.

According to the Money Charity, 73% of employees say that the Cost of Living crisis is affecting their work, while lenders and utility companies are owed billions in missed payments. Through the SuperFi launch partners, they hope to have access to several hundred thousand users ahead of the release of the SuperFi app in early 2023.

The feedback from their initial user tests has been overwhelmingly positive.

“To give people not only an overview of their debts but also personalized advice alongside access to innovative tools is an incredibly empowering offering — that people have not seen before. The feedback from our partners is similarly positive, as they recognize that SuperFi is providing proactive support for people in debt that other financial well-being products are unable to do,” Barltop said.

The broader impact on the society of SuperFi

“We are creating SuperFi to address that problem. By providing debt advice to people earlier in their debt struggles – we can help provide access to personalized debt support sooner to reduce the number of people getting into more serious difficulties,” Barltrop said.

SuperFi was accepted into the FCA’s sandbox program for innovative companies and the NatWest accelerator program.