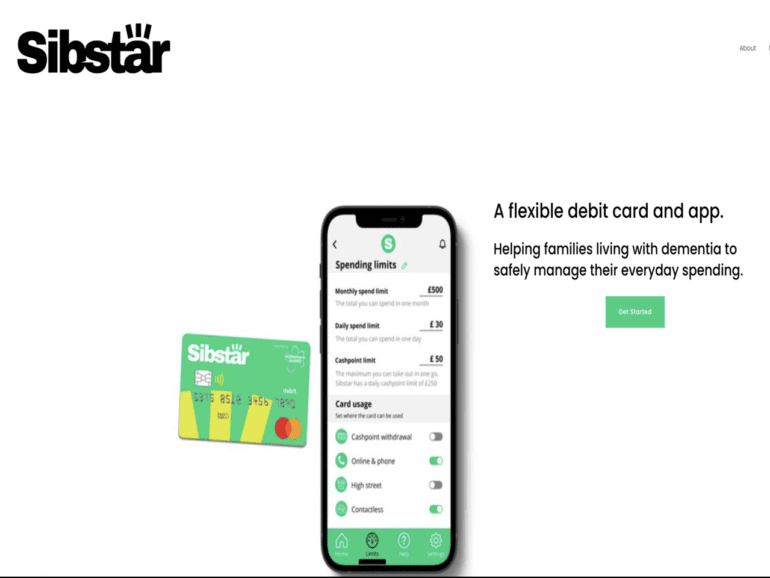

Sibstar is a British fintech positioning itself as a new, highly secure card and app designed to help families living with dementia safely manage their daily spending.

Sibstar adapts to meet the changing needs of people with dementia as carers choose the amount of money within the app and manage how and where they can use it. All of this functionality can be changed at any time to maintain a sense of independence based on the changing needs of those living with dementia.

Founded in 2020 by husband and wife Jayne Sibley and Martin David Orton, Sibstar supports carers in managing day-to-day money safely, giving them peace of mind as they continue to enjoy everyday activities.

The founders do not have a banking and finance background but, through lived experience, came up with a solution to meet an issue they were facing. “There wasn’t a solution to my mom’s financial independence. It is about enabling people to have a choice over how they live their life. Because we all want that, don’t we? And just because of dementia does not mean you don’t deserve that. So it’s not about taking away. It’s about giving back,” Sibley explains.

Jayne Sibley’s story

The idea for Sibstar came from Sibley’s lived experience of caring for her parents, who both have dementia. It was especially challenging for her mother to understand her use of everyday money.

“She was a falling victim to scams, overspending on food, you know, a fridge full of rotting food. She would have her nails done twice a week and pay for everybody in the salon to have theirs done as well, and also, she was taking out lots of money from the cash point. So the money she and my dad had worked hard for their lives disappeared in ways they would not have spent if she did not have dementia.”

The family tried many different solutions, such as scratching out the CVV on the back of her card to prevent scams, taking away her checkbook, or giving her cash instead. However, a lot of the solutions increased her mother’s stress and anxiety levels., She would lose the money or spend it all in one day. “I’ll be driving back down the motorway to give her more, so this administration around it was just too complex. And there wasn’t a fit-for-purpose solution out there,” Sibley adds.

Sibley had to remove her mother’s access to the money to prevent her from spending. Which indirectly meant taking away her independence. Her mother couldn’t leave the house without cash in her pocket; there was no trip to buy the daily newspaper or money to buy her grandkid’s Christmas presents. But equally, there was a recognition that this solution was not good enough. “Just because she has dementia didn’t mean to say that she couldn’t access other areas of her life and having the financial tools to do that is essential,” explains Sibley.

In addition, Sibley shared that she gave up work to care for her dad at one point, which consequently impacted her financial status, mental well-being, and ability to socialize. “It’s difficult. It’s stressful. And so what we’re aiming to do is prolong the independence of people with dementia; you are freeing up the carers to live their life too.”

“And then if you start expanding out, no, I believe that by keeping people active and including members of their communities and society, we will, over time, slowly change attitudes towards dementia, improve understanding, improve tolerance, and strip away the stigmas and fears because there’s a lot of that around this condition. And that’s something I experienced personally, myself.”

The solution

After some thought, the founders decided to create Sibstar to solve the very issue they had. “We thought why don’t we develop a debit card for the person living with dementia, and then an app which sits on their carers phones. By caregiving family carers and daughter, son, spouse, sibling, and within that app. you can essentially only ever lose the amount of money held on that card.”

Within that app, users can set monthly and daily spending limits and how much can be taken out of a cash point at any time. And then importantly, they can switch off cash point withdrawals online and phone transactions Chip and PIN contactless.

Living well with dementia

The flexibility is the crucial difference; it adapts to the changing needs of someone living with dementia as their condition changes.

“So what we are doing is prolonging independent living for longer so living well with dementia, it is important that people remain financially included in the world, access their own money, access their communities. And be you remain living their life the way they choose to for longer, and that’s important.”

Sibstar is not a carer card. “We are not about giving the money to a carer to spend on the vulnerable adult’s behalf. We’re about saying, Okay, you’re a vulnerable adult. Here is the way to continue living your life the way you choose. And then there’s the ripple effect of our products,” Sibley emphasizes.

The journey

The journey started a couple of years ago. They applied to the Alzheimer society accelerator program and gained much positive feedback. They then partnered with the charity alongside MasterCard and raised money from friends, family, corporates, grants, our their professional network.

“I just had this crazy idea and started Googling; how do you set up a prepaid debit card, but I’m not kidding. And I’m not ashamed to say that, and I’ve said it publicly.” Sibley acknowledges that this is still a challenge, as the team had to learn about the sector, particularly the payments, quickly, but that equally, Sibstar has a supportive network that helps. “So a lot of our team have personal experience of dementia and believe in this.”

They went on to conduct some research with the Alzheimer’s society to deepen their knowledge and evidence base. They found that two-thirds of the people they spoke to said that managing money was a great source of stress and worry for these people.

Launch

While Sibstar had a soft launch two months ago, they have yet to do any publicity or marketing, primarily because they think it’s crucial that they correctly onboard our early adopters. Given that they work with vulnerable adults, the onboarding can be challenging. They want to ensure every element, including the UX design, is as simple for the customer as possible.

“We’ve got a direct relationship with users. They’ve been incredibly supportive. And that’s what we want to do to ensure we are in the right place before we go out publicly with it with a bigger marketing launch.”

Sibley reports that early adopters have been providing positive feedback and how they can improve; she hears similar stories to her own and knows it is making a difference.

Although most of the input comes from carers, they want to engage cardholders long-term.”Talking to people living with dementia and their care sits at the heart of our business. We can’t create this, develop it, and make it even better without talking directly to the people using it.”

Long term

According to Alzheimer’s Disease International, someone develops dementia every 3 seconds, and over 55 million people worldwide live with dementia. This number will almost double every 20 years, reaching 78 million in 2030 and 139 million in 2050. Much of the increase will be in the emerging markets. Already 60% of people with dementia live in low and middle-income countries, but by 2050 this will rise to 71%. The fastest growth in the elderly population is taking place in China, India, and their south Asian and western Pacific neighbors.

Sibstar recognizes dementia is a global issue and would long term aims to scale internationally. “I’m sure there are parallels between what a UK family faces and what someone in France, Australia, wherever has. Dementia is a universal issue. And there’s a universal solution. So I hope we will be able to do that in the relatively short term,” Sibley explains.

The second way Sibley can scale is by expanding its services to other vulnerable adult groups. Many calls are already asking about different conditions, so this could be an opportunity for the company. ” You know, that is what drives me is about having a positive social impact on as many people as possible,” explains Sibley.

“You have to believe in your idea with every pore of your body because it is difficult, you know, it’s tough. But it’s on us when the chips are down, and launching a product like this is difficult. It is complex. You’re dealing with a vulnerable audience. You’re dealing with a sector in which we had no experience. But I believe this could make a difference to many people, which is what the drive was for me.”

As of now, they are pursuing a $700 000 funding round. The goal for Sibstar is to achieve this through a network of angels, and their investors and partners must share the same values as they do.

Fintech for Good

This is an example of Fintech for Good. Sibstar provides reassurance, security, and safety without overwhelming carers and vulnerable adults. Watching the company’s growth and expansion will be interesting.

“When you’re living with a condition like this, you, and when you’re caring for someone, your absolute motivation is to enable them to live as independently as possible, as long as possible, as fully as possible. And you will bring in any tool in your armory that can enable that,” Sibley concludes.