In our increasingly connected global society, migration has become commonplace. All around the world, families, and individuals are deciding to move to their home country for varying reasons. Many governments show concern, especially in economies that have seen an increasing migration of younger, highly skilled generations.

“When you look closely, there are massive waves of migration away from the African continent,” said Damisi Busari, CEO and Founder of SendSprint. “This is a topic of conversation for many governments, where they perceive it as brain drain. But the reality is that the world is incredibly connected on a digital level, people are very skilled, and the population on the African continent is still incredibly young.”

“These young people are gaining globally relevant skills. So it makes sense for them to migrate to other regions of the world, where they can get better remuneration for their skills and grow themselves in multiple ways.”

Busari explained that although people are migrating, they maintain connections with their families and friends back home, many making a move with the sole purpose of economically improving the lives of their loved ones and sending money back home.

“What we see every time there is a massive wave of migration or immigration from any region, a remittance pattern follows backward as well,” she continued. “There’s a lot of countries on the African continent today where remittance influence continues to contribute a significant amount of their GDP.”

Remittance: a high cost and complicated reality for many

The world of remittances is an essential reality for many people worldwide. However, complex charges, high rates, and uncertainty about the money’s end use make it an uncomfortable and stressful business.

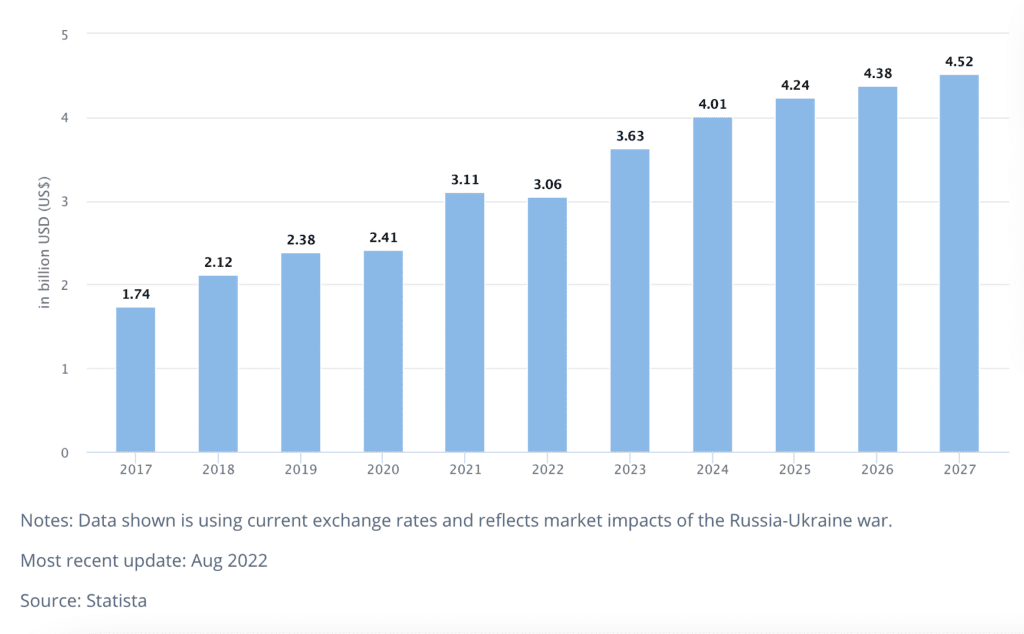

According to Statista, the transaction value for digital remittances in the UK is set to reach $3.06 billion in 2022, showing annual growth of 8.15% to reach $4.52 billion by 2027. YouGov found that 20% of UK citizens send remittance of some form every month.

However, in many cases, separated families can face an increasing undertone of “How much? What for? And When?”

“Today, when you think about the diasporic experience, it is incredibly transactional,” said Busari. “So far, the only language and tools available for any immigrant in the diaspora to maintain their connections with their friends, family, and business relationships back at home have always revolved around money.”

She explained that for the majority of cases, the money that is sent home is spent on day-to-day needs such as healthcare and groceries. About 75% of remittances are used this way, while the remaining 25% is sent for savings and investment in home countries.

Solving the high cost and complicated fees associated with remittance

Remittance customers often face high fees and scaling percentages when transferring back to their loved ones.

“Sending money is expensive in two ways,” said Busari. “It’s expensive from a service fee perspective and expensive from an exchange rate perspective.”

According to the World Bank, the global average cost of sending a $200 remittance is 6.4% of the value. Fees can vary wildly, and a market of comparison websites tracking the cheapest options has flourished.

“If you look at the cost of sending $200 to the African continent, it costs more than $12. Unfortunately, many players in the space operate a percentage-based approach to the fee itself. So the more you send, the more expensive it is.”

“Not only is that happening, but they are also providing very unfriendly exchange rates to the recipient. So it’s expensive for the sender to send, and it’s expensive for the recipient to receive money.”

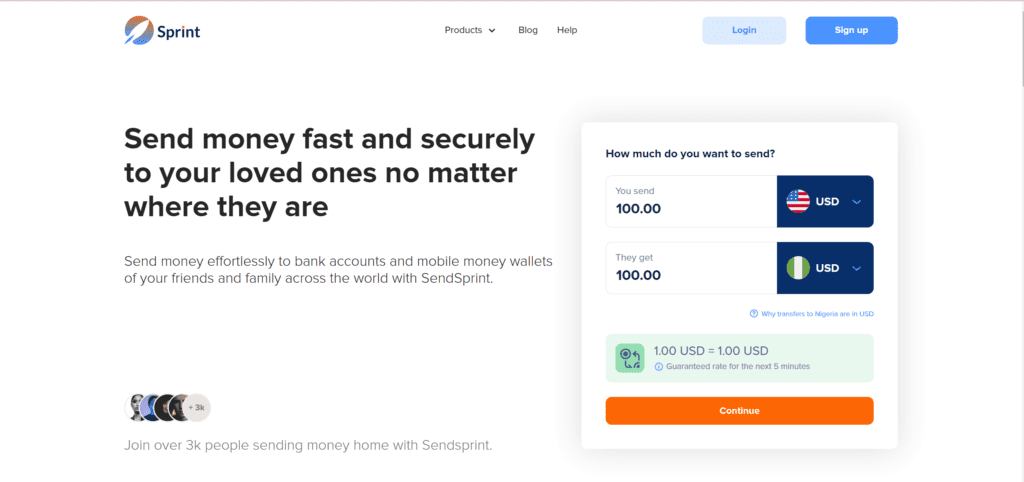

In response, one of Sendsprint’s initial focuses was introducing a flat fee of $5 for each transaction.

“The pricing model that we have defined for ourselves is a reflection of the cost of the service. We are providing the service at a discounted rate to the sender. That $5 fee is really to help the user have a fee at the back of their mind when they’re trying to send any amount, so they don’t have to do that percentage calculation.”

A resilient market, but senders need assurances

In the face of the pandemic and challenging living conditions, such as the rising cost of living crisis in the UK, many expected the remittance market to fall. However, studies have shown resilience.

“The money people earn from their jobs is not increasing, but their bills are increasing. So from a ticket value perspective, we see an impact,” commented Busari. “But from the frequency of that money transfer perspective, we’re not seeing an ultimate impact.”

“The sentiment behind the money transfer is what we are noticing. People are looking for guarantees. The importance of ensuring that the money they’re sending is being used for its intended purpose is becoming a much stronger need. This is a need that the African immigrant in the diaspora is beginning to speak about a lot more openly because the cost of living is now impacting their take-home amount.”

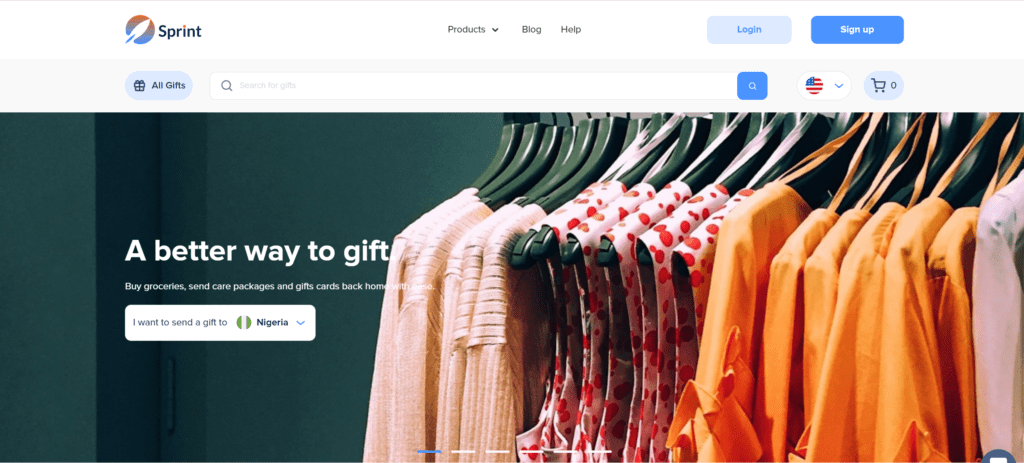

To facilitate this concern and nurture customers’ desire to be more involved with their families at home, SendSprint offers two options for remittance. Aside from the standard money transfer, the company has introduced gift cards, which customers can send to their families for specific use. This may range from healthcare to building work.

“We are helping people to use those remittance funds for the purpose it’s sent for. As a sender, not only can I send money, I can send a gift card to go to a hospital, I can send a gift card to go to a pharmacy, send a gift card to go to a grocery store, that kind of thing.”

“It allows the senders to be a lot more involved in the day-to-day lives of their friends and families back home. It also provides options for the friends and families when they receive these gift cards to spend them at the places they already intend to.”

The company has partnered with over 3,000 businesses on the African continent, spread over multiple markets and providing options for where gift cards can be spent.

“Our objective for every market is to support the send money use case, but we also want to provide a value offering. Value offerings in certain markets are incredibly skewed towards grocery stores and restaurants. In other markets, it is skewed towards more healthcare services and things like that. That reflects where we’re seeing the remittance flows being useful.”

First a UK focus, then beyond

SendSprint currently focuses on the African diaspora in the UK and beyond, following their needs in the coming years.

“From a top-of-mind perspective, as we roll each of the initiatives we have in the pipeline, the SendSprint products will be a strong remittance partner for the African migrants in the diaspora, regardless of where they are.”

“We want to ultimately be able to help them with the nuances around their relationship with the friends and families and businesses that you want to maintain their connections with.”