Today OnDeck, GreenSky and LendingClub all reported their Q3 2018 earnings. Like last quarter we review the highlights from the respective companies.

OnDeck

Separate from their earnings release, OnDeck announced significant news over the last couple of weeks. First was the announcement of their technology subsidiary called ODX, the platform that would house their lending-as-a-service offering previously called OnDeck-as-a-Service. Shortly thereafter, OnDeck announced their much anticipated second bank partner, PNC Bank which is the 9th largest bank in US.

Not surprisingly this was a hot topic on the Q&A portion of the earnings call. Here are a few takeaways from analyst questions:

- OnDeck is making $15 million of incremental investment in strategic growth initiatives including ODX. Two-thirds of this will be in ODX with the remaining one-third allocated to international investments in 2019.

- The revenue model for ODX generally speaking is technology licensing, professional services and customization with a volume based component.

- The pipeline for ODX has never been stronger. They have been working with PNC for over a year and are seeing interest both internationally and in the US. The ODX announcement has helped drive further interest in the offering.

- OnDeck is getting better at bringing banks on, making incremental improvements and aspects of on-boarding repeatable . Ultimately there is customization with every bank and OnDeck is also at the whim of banks’ decision making timeline.

- ODX and OnDeck’s on balance sheet loans are complimentary products. In the case of PNC they are serving the same customers, but providing a digital experience. OnDeck is focused on underserved small business finance which we haven’t seen traditional banks tackle.

- We will see more bank partnerships in 2019.

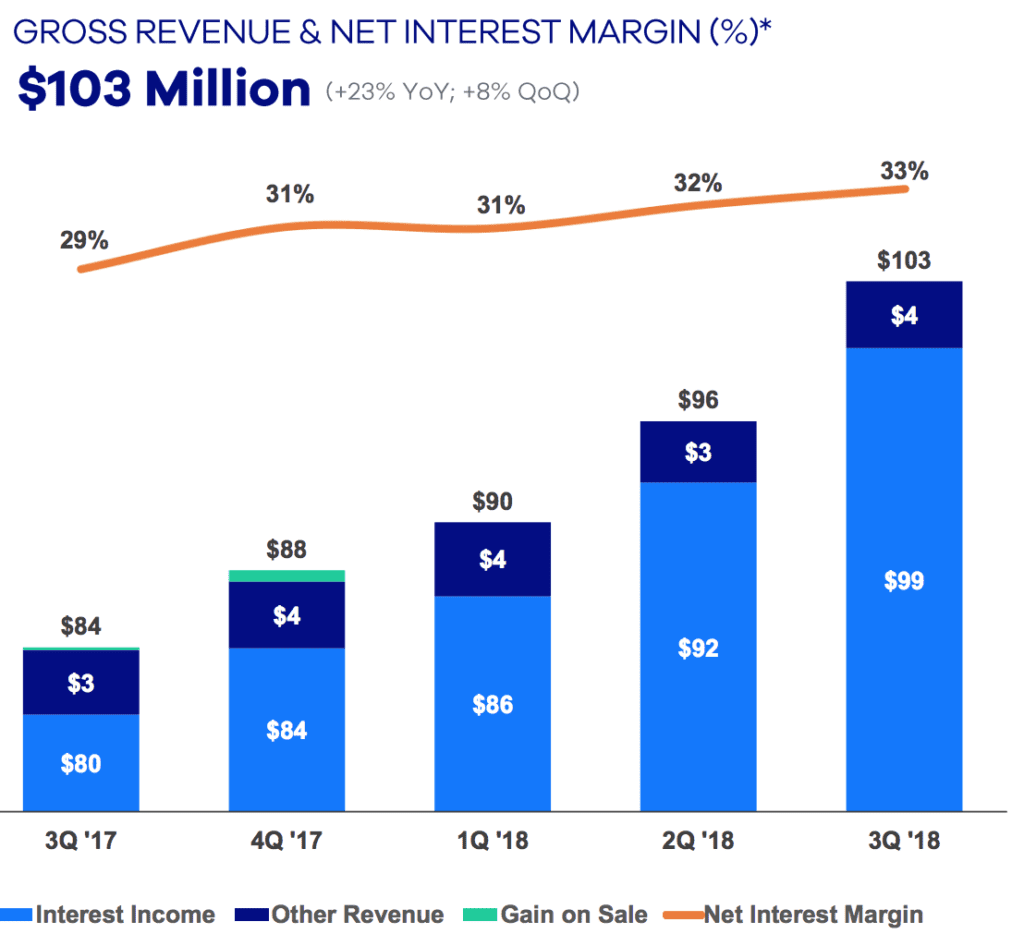

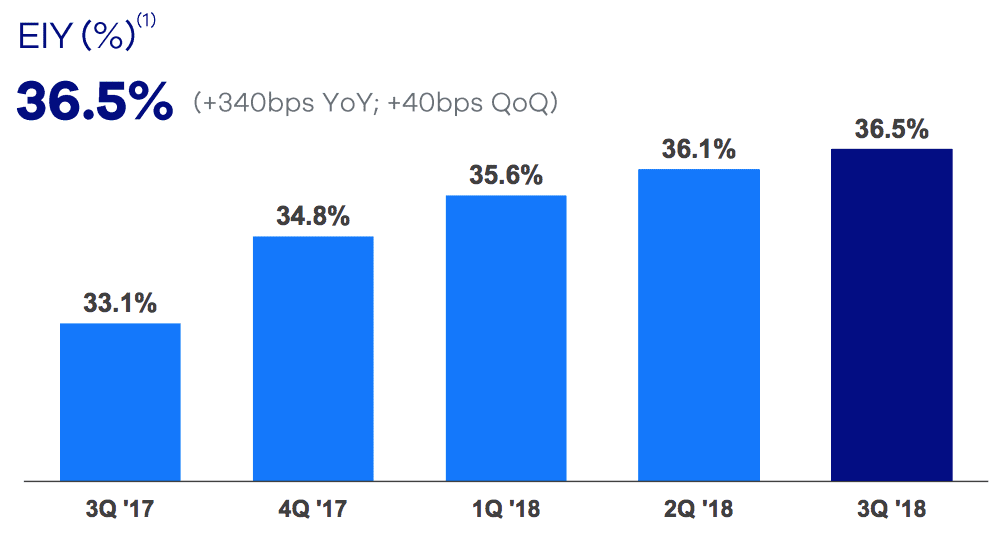

Moving on to Q3 2018 financials, OnDeck posted gross revenues of $103 million, up 8% from the previous quarter and 23% from the prior year period. OnDeck is benefiting from higher interest income due to rate increases as well as their origination growth while being able to decrease funding costs. Effective interest yield was 36.5%, up from 33.1% last year.

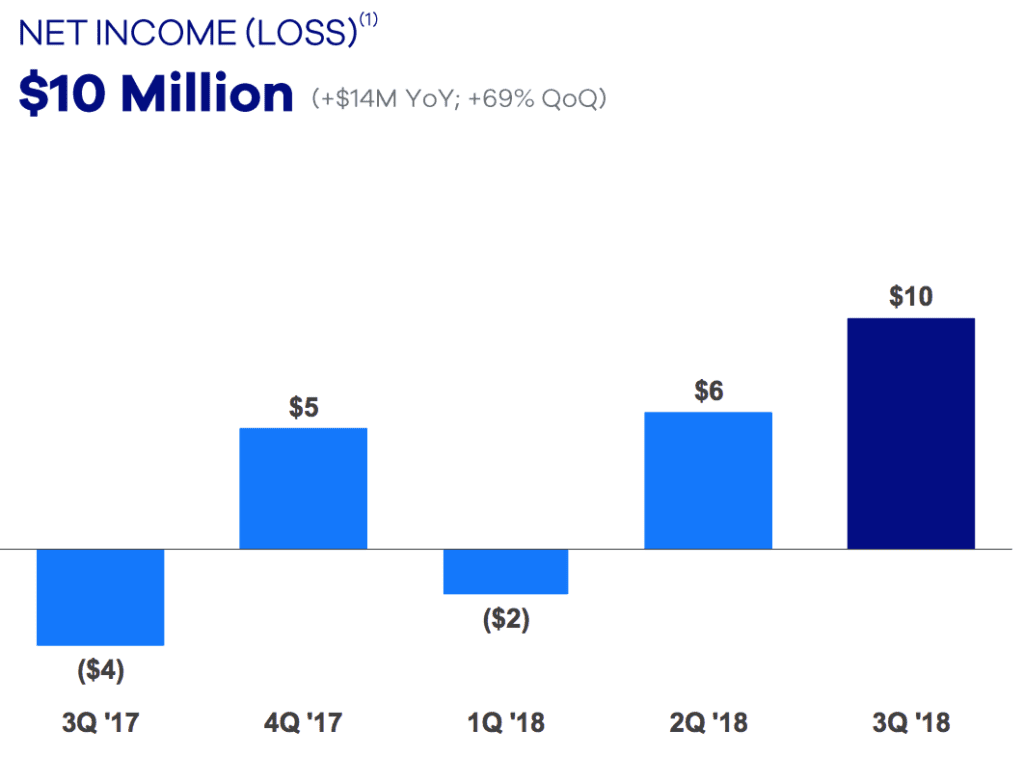

Net income came in at $9.8 million for the quarter, up from a loss of $4.1 million from the prior year period.

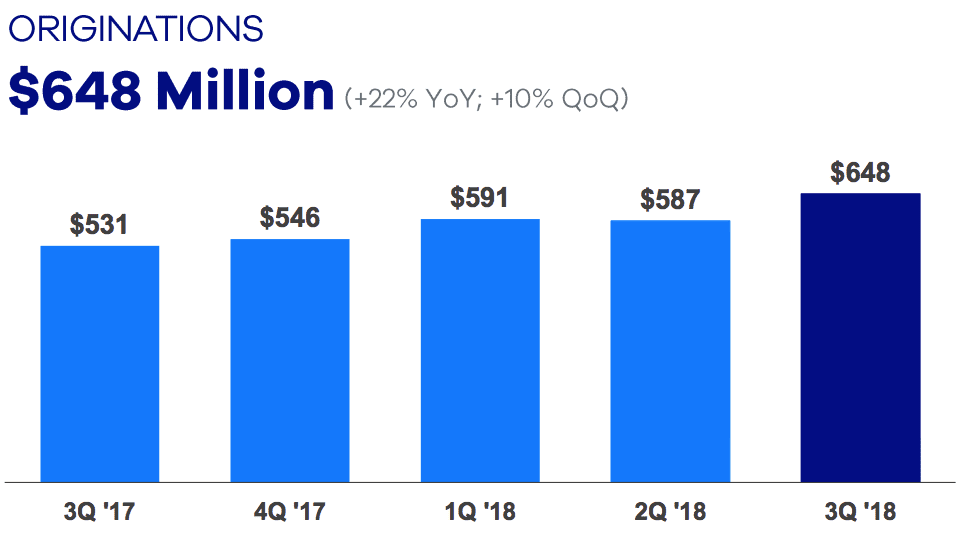

Origination volume reached an all time high of $648 million, representing a 10% increase from the prior quarter and 22% from the prior year period. The company officially crossed the $10 billion mark in originations and also shared that their next lending product would be announced before year-end. The company ended trading today up over 30%.

OnDeck also raised 2018 guidance:

- Gross revenue of $392 million to $396 million, up from $380 million to $386 million,

- Net income of $20 million to $24 million, up from $10 to $16 million, and

- Adjusted Net income of $40 million to $44 million, up from $30 million to $36 million.

OnDeck reported before the opening bell in New York this morning and the stock closed up 32% today.

GreenSky

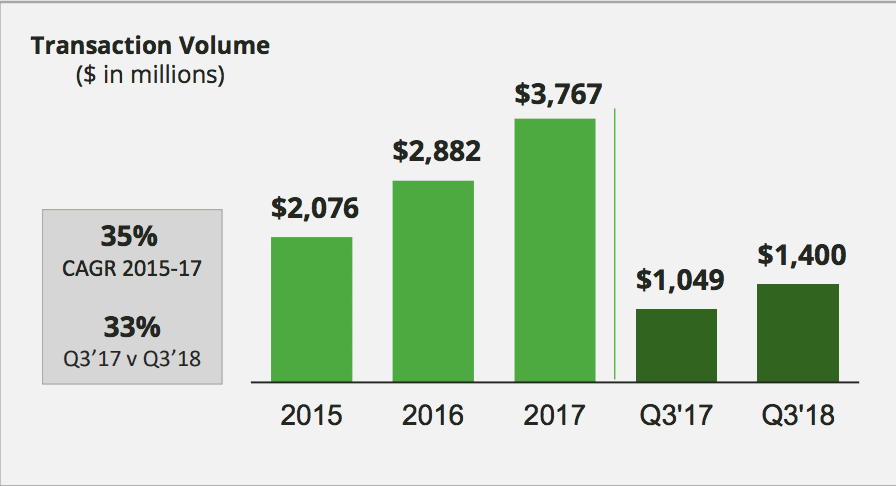

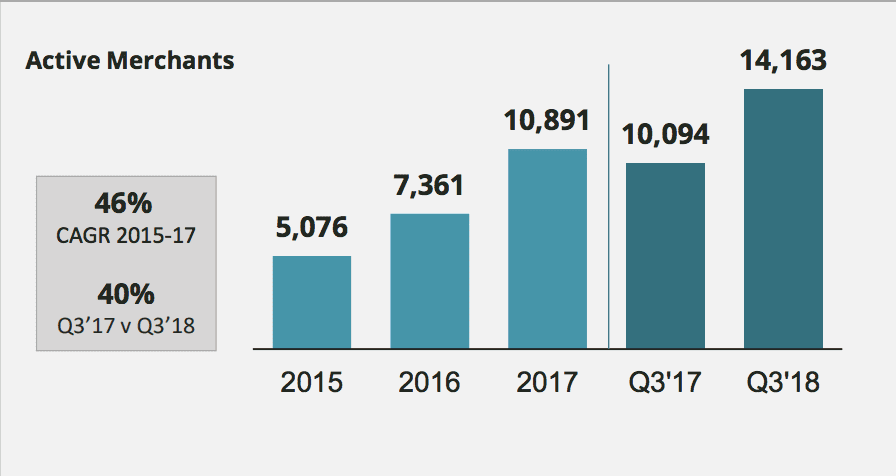

GreenSky reported record transaction volume in the third quarter of $1.4 billion, up 33% year over year. Revenue increased 29% to $113.9 million year over year. GAAP net income was $45.7 million.

CEO and Chairman David Zalik noted in the press release that they are still in the early stages of penetrating the total addressable market spanning home improvement, elective healthcare and e-commerce. However, the company adjusted guidance downwards due to anticipated seasonal headwinds in the fourth quarter along with a steeper yield curve than anticipated.

GreenSky added two new bank partnerships in the quarter with BMO Harris Bank and Flagstar Bank added to their lending consortium. Total commitments from bank partners now stand at $11.5 billion, up $3.5 billion from the prior quarter. The company relies on these commitments to fund their loan book. Last quarter we discussed GreenSky’s partnership with American Express. The cross-marketing campaign officially went live in early September and GreenSky reported over 1,000 Amex merchant referrals in 8 weeks. The Amex consumer direct installment loan pilot is slated to begin in the first quarter of 2019 in Atlanta, Chicago, Dallas, Los Angeles and Tampa. The product will be advertised as “powered by GreenSky” and will offer home improvement loans.

Along with today’s earnings the company announced a share repurchase program of up to $150 million of the company’s Class A common stock. Due to the adjustment of guidance downwards GreenSky’s stock price ended the day down significantly, almost 37%.

LendingClub

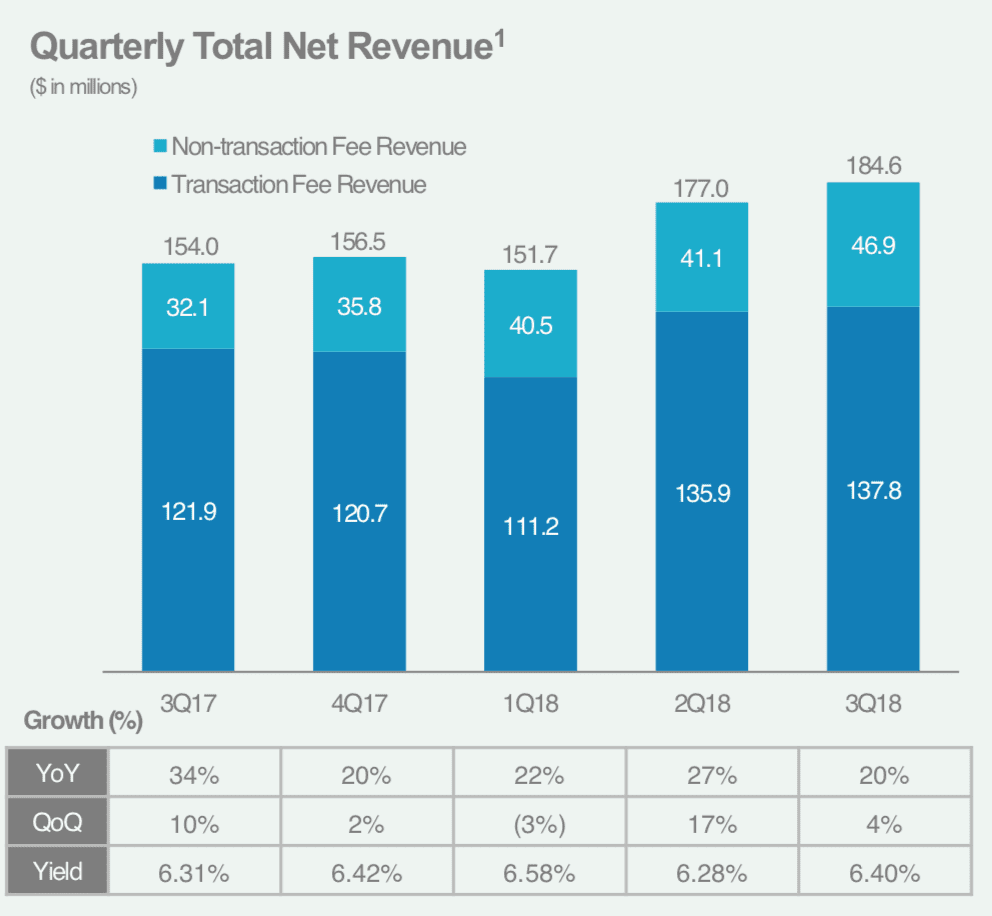

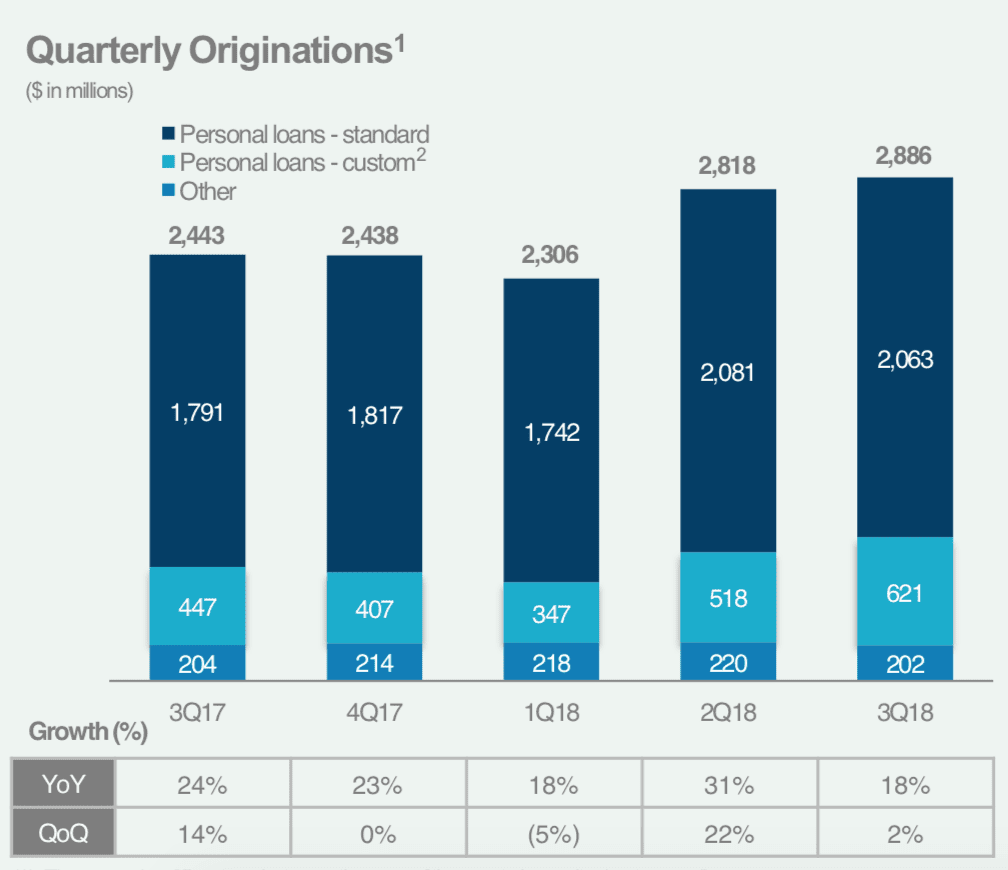

LendingClub had a quarter marked with a few records. Net revenues were $184.6 million, up 20% from the prior year period and originations were $2.9 billion, up 18% from last year. Applications also reached their highest levels, up 30% year over year. While originations grew slightly from the previous quarter it is important to note the steps LendingClub has taken to tighten underwriting this year which is why application growth doesn’t necessarily translate to significantly higher originations. It does however represent an opportunity for the company as they continue to improve features and better target their customers.

The company continues to drive to GAAP profitability. In Q3 2018 GAAP Consolidated Net Loss was $22.7 million, or $7.3 million if you exclude $15.5 million of expenses related to outstanding legacy issues.

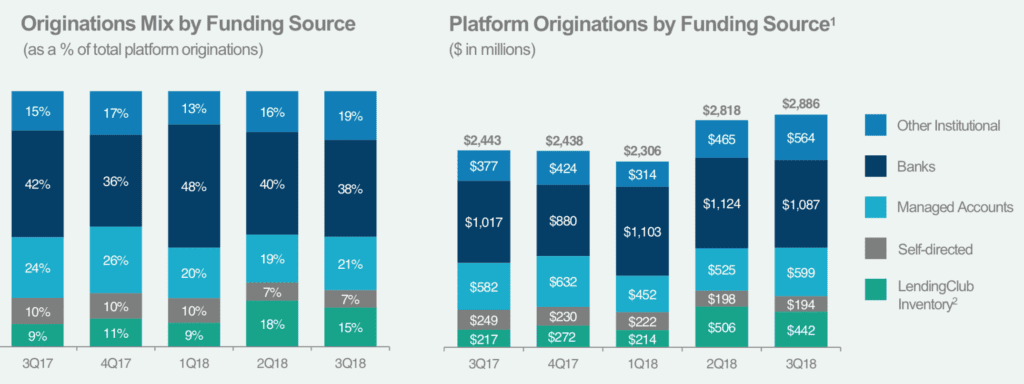

The mix of investors over the quarter are relatively stable from the previous quarter as shown below.

A few other milestones from LendingClub’s perspective include the near $1 billion in investments for their CLUB Certificate program which launched less than a year ago. LendingClub also settled legacy issues with the Department of Justice, SEC and lawsuits stemming from May 2016 which we wrote about at the beginning of October. According to LendingClub, they have “continued constructive engagement with the FTC regarding ongoing litigation”. LendingClub is also opening a new facility in the Salt Lake City area to further enhance operating efficiency and customer service.

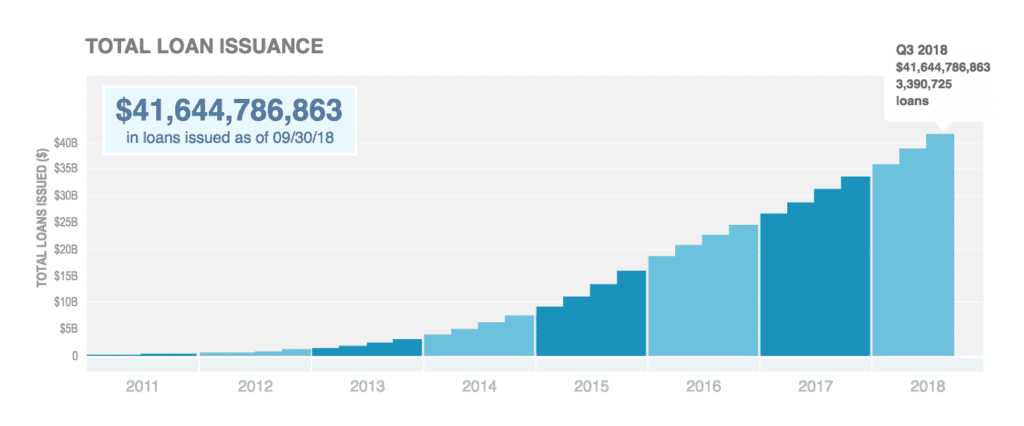

Total loans issued by the company now stands at over $40 billion.

LendingClub raised their full year guidance for Adjusted EBITDA*, adjusted net revenue projections slightly and increased the high end of projections for GAAP net losses:

- Net Revenue in the range of $688 million to $698 million.

- GAAP Consolidated Net Loss in the range of $129 million to $124 million, reflecting expenses related to outstanding legacy issues through the third quarter partly offset by higher Adjusted EBITDA guidance.

- Adjusted EBITDA in the range of $89 million to $94 million.

LendingClub reported after the closing bell but was up just over 1% as of this writing.

(Disclosure: Peter Renton, the founder of Lend Academy owns less than one thousand shares of both OnDeck and LendingClub)