Revolut is on a roll, and its sights have been set on supporting businesses this month.

In a global economy that seems to be on the brink of recession, Revolut’s development comes at a critical time.

With just under 84 million people employed by SMEs and an average value of around 56% added to the economy (with many nations gaining significantly more, 84% of Germany’s economy is made up of SME activity), accessible and affordable options for operations may be essential to businesses’ survival.

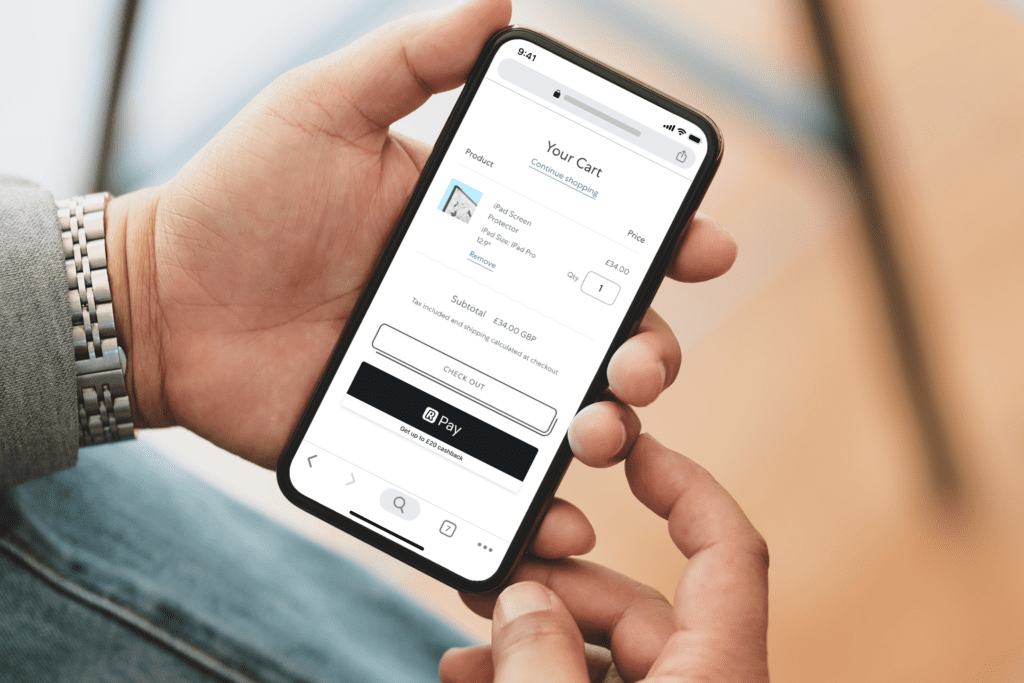

Revolut Pay supports growing e-commerce sector

First up this month was Revolut Pay, Revolut’s answer to Apple Pay and Google pay, which launched Sept. 9.

The new feature adds to the 19 other products launched by the company as part of Revolut Business, launched in 2017, and provides a secure, online checkout feature to UK and EEA merchants.

It’s aimed at making the online shopping process more manageable and frictionless, allowing customers to pay in one click, directly from their Revolut account or any of their saved cards. The payments can be validated using biometrics or other security methods without inputting card numbers and account data to minimize the risk of fraud.

“With its speed, convenience, security, and low pricing, Revolut Pay gives merchants a competitive advantage in a rapidly growing e-commerce market,” said Nikolay Storonsky, Founder & CEO of Revolut.

“At Revolut, we constantly strive to make it faster, easier and cheaper for merchants of all sizes to accept payments, wherever they are, and to make it more convenient and secure for customers to pay.”

Although not that dissimilar from the existing offerings from Apple and Google, Revolut’s consistent expansion and increased popularity as a neobank may give them the upper hand. The development also gives them another firm footing in their quest to become a super app.

Supporting the expanding E-Commerce sector

Large retailers, such as WHSmith, are currently using the feature. Still, it offers plugins to major e-commerce platforms such as Shopify and WooCommerce, allowing small merchants to integrate the feature.

“Revolut Pay is powered entirely by Revolut’s payment technology,” said Thibaut Genevrier, Head of Merchant Acquiring at Revolut. “This means Revolut can offer the product to merchants at lower blended fees. That’s important for businesses of all sizes but is particularly valuable to those operating at a smaller scale.”

“It offers low fees and security, as well as enabling businesses to easily and seamlessly accept payments with just one click from customers, boosting conversion rates and offering a competitive advantage in a rapidly expanding e-commerce marketplace.”

E-commerce has been on a steady growth trajectory, boosted by increased digital adoption. In 2021 total online sales reached €718 billion, and 87% of internet users bought something online. Easier, quicker, and more seamless payment options are suspected of boosting this growth further.

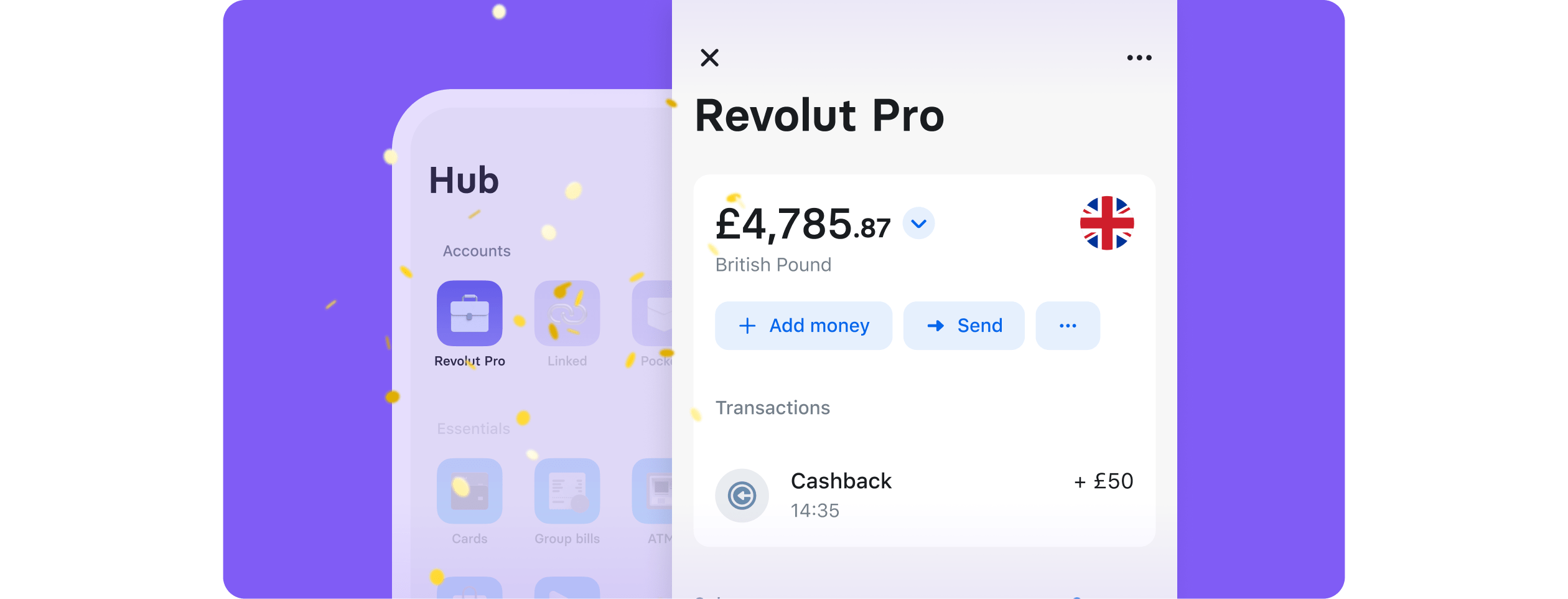

Making it easier for freelancers and sole traders to manage expenses

Deepening their commitment to sole traders and freelancers, on Wednesday, September 21, the company also announced the launch of Revolut Pro.

In the UK, nearly one in six adults work in the gig economy at least once a week. However, traditional banks and financial institutions have been slow to respond. Many business accounts lack the flexibility and simplicity needed for gig work, and the sector is significantly underserved.

The new product is a free account connected to a customer’s primary account, allowing easy business expenses and income tracking. Clients also receive a separate debit card offering 1% cash back on purchases.

With the increase of the gig economy, the new offering targets an evolving sector, making it easier for freelancers and sole traders to keep on top of accounts. Payments are available for multiple currencies, and clients can pay for add-ons according to their needs.

“The explosive increase in gig workers, artists, bloggers, and the like alongside more traditional individual professions including private teachers, home service providers, and fair vendors has driven demand for better ways for those working on their projects, be it full-time or part-time, to manage income and expenses,” said Maria Marti Garcia, Product Owner of Revolut Pro.