The benefits of blockchain technology are yet to be realized in banking. While some large banks have commercial projects nothing has really taken off yet. Much of that is due to regulatory uncertainty but many banks are actively engaging and learning while we are in this something of a holding period.

Our next guest on the Fintech One-on-One podcast is Robert Morgan, the CEO of the USDF Consortium, a group of banks creating a blockchain-based system for tokenized deposits that will make banking safer, cheaper and more reliable for consumers (see their deck here). Rob used to be the head of innovation at the American Bankers Association (we had him on the show back in 2017) and so he has a deep understanding of banking and technology.

In this podcast you will learn:

- Why Rob decided to make the jump from the ABA to the USDF Consortium.

- How he describes what USDF is exactly.

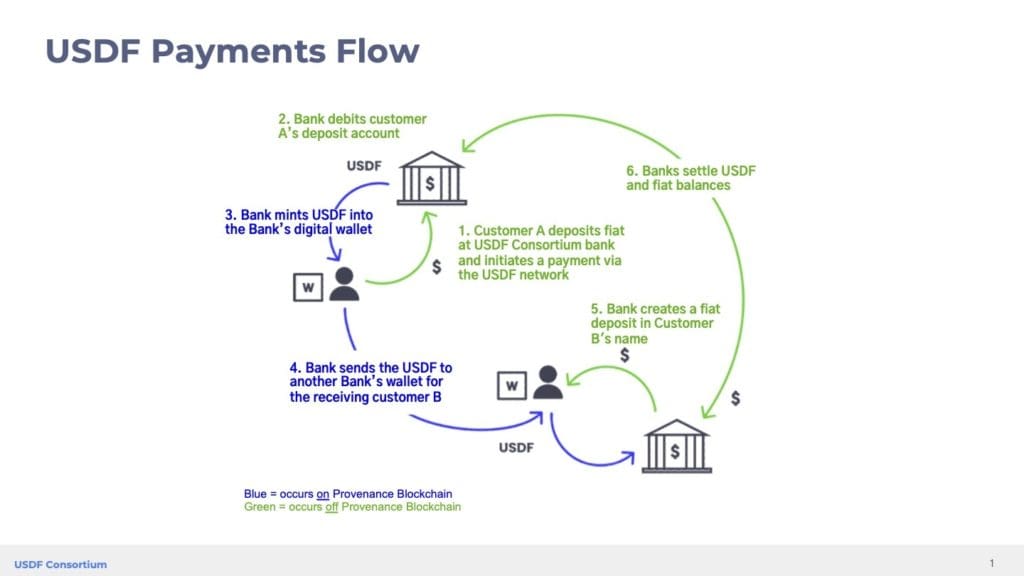

- How banks will use USDF and a description of the payments flow.

- The primary benefits of USDF and the most popular use cases.

- How the programmability of USDF can be leveraged.

- Why USDF will be complementary to Fedwire and FedNow (when it launches).

- How the USDF Consortium, the Provenance Blockchain and Figure are related.

- How they are working with the Federal regulatory agencies today.

- Details of their response to Treasury’s RFC on digital assets.

- How they view CBDCs and how it could be complementary to what they are building.

- The types of banks that are members of the consortium.

- Where they are at when it comes to USDF going live.

- The objections of banks who are not ready to join the consortium.

- What Rob thinks the next move from regulators will be when it comes to digital assets.

- What the banking system could look like in ten years time.

You can subscribe to the Fintech One-on-One Podcast via Apple Podcasts or Spotify. To listen to this podcast episode, there is an audio player directly above or you can download the MP3 file here.

Download a PDF of the Transcription or Read it Below

FINTECH ONE-ON-ONE PODCAST 385-ROBERT MORGAN

Welcome to the Fintech One-on-One podcast, Episode No. 385. This is your host, Peter Renton, Chairman and Co-Founder of Fintech Nexus.

(music)

Before we get started, I want to tell you about a new event we are hosting in London on October 17th and 18th called Merge, it is focused on the intersection of traditional finance and Web3. Regardless of the price of crypto tokens, the technology being developed by Web3 startups has the potential to completely transform the financial system. Our event will be bringing together leaders from Web3, fintech and traditional finance to discuss how this transformation will take place. Find out more and register at fintechnexus.com.

Peter Renton: Today on the show, I’m delighted to welcome back Robert Morgan, he is the CEO of the USDF Consortium. Last time on the show, a few years ago, when he was at the American Bankers Association – he was head of innovation there – and so he’s really got deep expertise in the banking space, dealing with Washington all around innovation in banking, So now, he’s moved to USDF, which is the USDF Consortium, a membership organization of banks so they’re really all about bringing banks the ability to mint tokenized deposits.

Now, we’ll explain what that means: it’s all blockchain-based, we go into the technology in some depth, we talk about the different use cases, how the payment flows work, how it’s going work with the Fed system, Fedwire and ACH. We talk about, you know, the programmability of USDF and the exciting pieces that can bring. We also talk about, you know, where the regulators stand, where they stand with regulators, what these conversations are like with lawmakers as well, we talk about CBDCs and much more. It was a fascinating episode, hope you enjoy the show.

Peter: Welcome back to the podcast, Rob!

Robert Morgan: Great to be back, good to see you.

Peter: Yes, indeed. So, last time we had you on, a few years back now, you were with the American Bankers Association, Head of Innovation there. So tell me, you obviously had a interesting job, you stayed there for quite a while, but what was the driving force in moving from the ABA to the USDF Consortium?

Rob: So, spent 11 years at the ABA and can’t say enough great things about that. The team in ABA, the work that they do, really enjoyed and proud of everything we built there and over the time I was at ABA we saw a lot of different trends, a lot of waves of disruption come through the industry and in that time we saw banking modernize a tremendous amount. But what I think ultimately has not really panned out are the warnings of banks being disrupted and disintermediated and in many ways that’s because a lot of the fintech innovation that we’ve seen, it is around how do you interact with what at the end of the day is a pretty traditional bank deposit and its new form factors, new ways to engage. What we’re starting to see now I think is something that really does raise that question of what will banks play in our economy and I think it’s really important to make sure that banks have the ability to continue playing the important role they do. So, what’s different today and one of the reasons why the opportunity with USDF is so great is we’re asking fundamental questions about what does it mean to digitize money and as we both know, the dollar really is already digital today, but what we’re talking about is how do we tokenize money, how do we leverage blockchain as the way to deliver financial services.

The reality is that as we think of money today, we often think of cash and as we think about digital dollar conversations we think about how are we transacting cash, but the reality is today, 73% of money is bank money. It’s the liability of a private institution like a bank or a credit union that is mature, so 73% of that money exists today and in a form where it can help power lending that drives the economy.

And so, as we look forward, today we see lots of options that would do away with that, whether it is non-bank Stablecoins or even in the conversations around should the Federal Reserve issue a CBDC and one of the things that USDF is doing is trying to ensure is that as we look at the future of money on blockchain, banks can play the same role in that market that they do in every other and act in that same intermediating role in having the ability to create credit. So, I think that’s a really critical question not just for the banking industry, but for the economy as we go forward and I think this is the best way to help influence that.

Peter: Right, right, that sounds fair enough. I want to dig into the CBDC thing in just a minute, but before we do that I want to just get your description of what USDF is. Particularly, I mean, you were in traditional banking for a long time, I imagine that you’ve had a lot of questions about your move here. How do you describe USDF say to someone who really doesn’t know it very well that is in traditional banking.

Rob: It’s a funny question because I think there’s so much buzz about crypto in general and there are so many banks trying to understand what their strategy is on crypto, what their strategy is on blockchain and where all of the pieces fit together. In many ways, we have very little to do with crypto itself and are more focused on blockchain so, you know, at the end of the day, we believe blockchain can be a more efficient ledger for traditional financial services transactions. And so, when we talk to banks about what this means for their business, we are often talking about what ledger are you using and how can we make it more efficient.

So, there was an era where banking was conducted on paper ledgers that we moved to on-premise servers, now we’ve since moved to cloud-based servers. We think blockchain can be a more efficient ledger as we look towards the future of financial services and USDF is an important piece in making that possible. USDF is a tokenized deposit so not a Stablecoin but a representation of an existing bank deposit on blockchain and what that does is allow banks to communicate together on blockchain and be able to bring some of the innovation that we’ve seen born out of a crypto ecosystem into traditional financial services.

Peter: Maybe let’s start off with that payment flow that you just touched on there. You have a really great slide that you shared with me before in our talk here that describes the payment flow. Maybe you can just give us an example of how does the payment flow…..you talked about this, it is not a Stablecoin, this is a tokenized deposit, describe what that means in the context of this flow.

Rob: In many ways, what we’re talking about here looks a lot more from a flow perspective like a messaging layer in traditional payments than it does a Stablecoin where consumers may buy it through an exchange transacted through their own wallets and use it to either buy or sell other goods. As opposed to that, USDF is that representation of a deposit on chain and what banks use it for is to communicate with each other to effect payments in real-time in a blockchain-native way between the institutions.

So, the consumer may never see USDF, they just see that the transaction happens faster, cheaper, more efficiently. What that means behind-the-scenes is that a bank will go on chain, they’ll take the money that the customer has instructed them to spend, whether it’s peer-to-peer, business-to-business, they’ll take the money that the customers has instructed to spend, move it into an omnibus account and they will then mint USDF under the Provenance blockchain and transfer that USDF to another institution who will then burn the USDF and credit their customer’s account all in real-time. When we talk about that ledger what blockchain then facilitates is tracking of those liabilities between those institutions throughout the day. Today, those banks will ultimately settle up with each other and that, at the end of the day, via Fedwire.

Peter: Right, okay, okay. So, give us examples of some of the use cases that you think will be most popular and what you think are the primary benefits for using USDF.

Rob: So, you know, as everyone who talks about blockchain will say, the applicability is really broad, there’s a lot. We think this is a new, more efficient ledger, there are a lot of app sets that can benefit from it, but ultimately, we will focus first on how do we affect traditional payments and then we think about this in two phases. The first phase is really proving out that banks within the four corners of the bank regulatory structure can move money faster, cheaper, more efficiently on chain so we’re in this first phase focused on those traditional bank-to-bank payments, things like peer-to-peer payments, things like commercial payments.

How do we make those more efficient and then leverage some of what blockchain brings to the table as some of the programmability so we can have smarter payments as we begin integrating those. Once we have proven out that those payments work, once regulators are comfortable with that, we think there’s an opportunity to bring other financial services assets on chain, traditional assets. So, let’s say a consumer loan, for example, in this case blockchain adds a few benefits. One is the transparency that comes along with that, so now if you want to buy or sell that loan, you have a series of blocks that has all of the information about that loan. It has the underwriting criteria, the documentation, provision of consumer disclosures, payments, amortization, all of that so instead of having to audit the bank that underwrote the loan, you’re able to provision access to that data.

And then the second piece which I think is really exciting is what happens when you use the same system of record for the payment and for the asset. So today, if I want to buy a loan from you, we have to send money into escrow and then ultimately that escrow agent will look to another system of record to see if the asset/the loan has moved from me to you and then ultimately will release funds to you after that’s occurred.

When you bring them on to the same system of record, you can have real-time transfer that is contingent on the other so the money doesn’t move unless the asset moves and the two happen at the same time with zero settlement risk between that. So, as we hit that segment base, we think there’s a lot of opportunity to lower funding costs and create efficiencies that will allow those assets to move faster and allow more customers to access them because they are cheaper.

Peter: Interesting, interesting. So then, you touched on programmability and I think this is something that few people have grasped yet in traditional finance and I think it’s just, you know, we might be talking of several years down the road before this really becomes mainstream, but I just tend to think this is going to be such a massive game changer with programmable money which……money has been non-programmable for, well, since it began so tell us a little bit about the programmability of USDF and how that can be leveraged.

Rob: Absolutely. And I think this is one of the real powers behind blockchain is it allows that real-time collaboration between institutions and allows for the automation of tasks that are today often take a lot of time and can implement human error at each step. So. for example, let’s look at that same mortgage closing process, right, and instead of sending money to escrow and then having an escrow agent deliver individual payments to all of the parties associated with that transaction, whether it’s the realtor, the title agent, that’s a whole other issue, but all of the individual pieces of that transaction today, you have to send one lump sum of money to the escrow agent who will then send the individual payments, call the banks, confirm wires.

With programmability at the very first level, which I think we can achieve sooner, you are able to create an automated waterfall of payments where under the right circumstances the correct amount is delivered to the correct party at the correct time. It takes a lot of that friction out of the transaction and as we get farther along and start digitizing some of those other assets, you can also tie the conditions of the assets to the payments themselves. So, let’s say it’s someone who buys a participation in a loan, you can have those payments automatically redirect to the owners in the right amounts and so really think back now to a lot of efficiency.

Peter: It’s amazing. I feel like the use cases are endless when you start sort of carrying that forward, but I want to touch on payments because payments, right now, we have everything settles through these Fed Master accounts. If you got two banks that are part of your consortium and they’re doing a transaction between the two, you did mention that it’s still conducted through Fedwire, settled through Fedwire, are we going to get to a place where we completely bypass the Fed system, whether it’s Fedwire or FedACH?

Rob: I don’t think so and ultimately, I think we view this as complementary to a lot of their systems. I know we got news this week about when FedNow will be available, it’s not now, but it’s coming. I think, ultimately, the banks still need to settle via some of those wholesale systems at the end of the day, but what we think this can do is be that messaging layer that allows for transactions in the real-world to happen at the same time, happen on chain and be certain at that time to leverage some of those efficiencies, to leverage some of that programmability and ultimately, through money will still need to settle through the Fed at the end of the day or in real-time, depending on the use cases.

Peter: Right, right. You know, I had Mike Cagney on the show, that was probably over a year ago now, talking about some of the things that you’re mentioning here and I just want to explain, like Mike Cagney, obviously the CEO & Co-Founder of Figure, they created the Provenance blockchain which I know is separate from Figure and USDF, maybe you can explain how those three entities are related. You’ve got the USDF Consortium, the Provenance blockchain and you’ve got a private company, Figure, which kind of, you know, created a lot of the technology.

Rob: So, I’ll start with USDF, we are a group of banks, we’re owned by our member banks, a group of banks that have come together to build what they think is those future modern blockchain-based payments rails and they have done it on Provenance. So, Provenance, to your point, is the public permissionless chain that Figure has built and we operate as a walled garden where only insured depository institutions can transact on that chain.

And so, what we’re doing is bringing bank level payments on to that chain so Provenance is separate, and then Figure obviously has played a key role and really forward looking in terms of how do we bring traditional financial services assets on-chain. So, they have built a lot of that infrastructure and the technology that the banks will leverage as they do that.

Peter: Right, okay. In your previous role, obviously, you were talking with regulators all the time and, you know, it feels like the regulatory piece is going to be key for the success of USDF. So, when you look at the key regulators like the OCC, the FDIC and the Fed, where are you at today, what are your conversations like with those entities?

Rob: Yeah. So, what I will say is that I think the public policy imperative is enough of a reason why I made this move and as we look towards that future of tokenized money, I think it’s across the policy of landscape across Washington. Policy makers are looking at a number of risks associated with the crypto ecosystem today and consistently what we’re starting to hear is the way to manage those risks is through the bank regulatory framework. It turns out we actually have a regulatory framework for digital money today and it is through banks, like bank deposits are regulated as digital money.

And so, in many ways we are answering the call that Treasury made in the President’s Working Group Report, Treasury and the other banking agencies, where they looked at the future regulatory framework for Stablecoins. Now, again, we’re not a Stablecoin, we are a tokenized deposit, but as they looked at how do you bring money on-chain, what is the appropriate regulatory structure and the answer is really consistently banking regulation. So, what we think we offer is a way to bring a lot of those benefits of blockchain-based payments, but do it while maintaining the same protections that the banking system offers and do it while maintaining some of the same benefits that the banking system brings to our economy in the role it creates creating credit.

So, from a big picture perspective we think there’s a lot of opportunity here to help bring this innovation from the trusted regulated parties that the customers are used to engaging with. Now, we will continue to work with the banking agencies, we’re talking to each of the agencies and as you know each of the banking agencies now require some form of approval or notice before any bank can engage in anything deemed to be a crypto activity So, we’re working really closely with the agencies today to help explain our model, help them understand that this is really a new ledger, we are building, traditional bank payments, not necessarily building bridges to some of the crypto ecosystem that exists outside of banking today.

Peter: You’re not a crypto activity, right, it’s blockchain-based, it’s not crypto.

Rob: I think anything that touches blockchain today probably falls under the OCC interpretive letter 1179 where some of the other guidance from the FDIC and the Fed we’ve seen more recently. I think anything that engages with blockchain probably falls under those, but not every one of those activities presents the same risks. What we’re trying to demonstrate is really this is a technology question and we think that there is a new ledger that can be more efficient for what banks have always done and how to make sure we have the appropriate controls around that to make sure regulators are comfortable before we move forward.

Peter: Right, right. Speaking of making regulators comfortable, I feel like, the Treasury put a request for comment out on digital assets, you put a detailed response together, can you just summarize the ten pages that you wrote in the request for comment to Treasury.

Rob: Absolutely. And I think the response is really what we’ve talked about already that if you think there is value to bringing money on-, we think that it’s important to 1) maintain the protections that exist within the bank regulatory framework and, 2) maintain the value the banks bring in the credit creation role that they play. So, as we look at that landscape today and see whether it’s towards Stablecoins that increasingly we have a regulatory, or a legislative discussion around how we should regulate Stablecoins and should they be fully reserved.

We also see discussions around whether the Federal Reserve should issue a CBDC to bring money on-chain. The case that we make is that we should leverage the two-tier banking system that exists today, that we should maintain those protections that bank regulation was designed to implement and we should create a clear path for banks to serve the same role on-chain that they do in others so that we can keep consumers protected while we bring blockchain innovation into the real word.

Peter: Right, right. So, I want to touch on the CBDCs now because that, in your comments and hearing others talk about this, that USDF really negates the need for CBDCs, is really what I think you’re saying, right? Maybe you could talk about how would USDF work with a CBDC or are you feeling like this is, really banks should be really in control, like when it comes to their…..they have the relationship which is direct to consumer, we don’t want the Fed having 300 million relationships obviously with consumers, but tell us a little bit about how USDF views CBDCs.

Rob: In many ways, I think that a CBDC correctly designed could be complementary to what we’re building. So, the conversation around CBDC is always a really hard one because much like fintech, it means something different to everyone that says it and where most of the policy dialogue has focused, so far, is on the concept of retail CBDCs and this is whether a CBDC is delivered directly from the Fed to consumers or done through the banking system in an intermediated model. All of those retail models ultimately are a Fed liability that consumers can hold direct so I think the concern that you’ve heard from the industry about that retail model is that every dollar that is held in CBDC will ultimately sit on the Fed’s balance sheet and not on individual bank’s balance sheet where it’s available to be back into the communities that they serve.

Now, what hasn’t received the same amount of airtime is the idea of a wholesale CBDC, one that acts in the same role, that you see a FedNowor an RTP does where consumers never see it, consumers still hold their money in bank accounts. So, where we can leverage modern backend infrastructure to create those same sort of real-time payments and leverage those efficiencies of blockchain and so what I’m hopeful we’ll see more of as this policy dialogue develops is a focus on the trade-offs between a retail and a wholesale CBDC.

So, our view is that a retail CBDC really has major costs, particularly how do we maintain the credit access of the communities that we’re trying to help serve if we’re taking deposits out of banks who are the entities today that create that credit. We think a wholesale CBDC might be much better positioned to help achieve the real goals and empower banks to offer the latest products and services to their customers while maintaining the same two-tier system that exists today.

Peter: Okay. So, let’s talk a little bit about the Consortium itself, you’ve got many banks on there. Maybe you could just tell us some of the banks that are actually part of it and who else is on the consortium.

Rob: So, as I mentioned, the Consortium is the group of banks that have come together. We are owned by our member banks, we have nine banks in the Consortium today, the banks are community and regional banks and I think they’re the banks that 1) have been forward leaning in terms of their own business model, how do they position themselves to make sure they are ready to take advantage of the efficiencies that this can bring. But 2) have also recognized the importance of the industry standing up this kind of a functionality and have opened the door for other banks who want to join and want to have that seat at the table as we develop a blockchain-based modern payment rail.

Peter: Okay. And then you’ve also got, I believe, Figure is a member, right and JAM FINTOP which is really an investor group, what’s the thinking there?

Rob: Yeah. And those are two other groups again, we talked a little bit about Figure, they built a lot of the technology, JAM is one of the networks they’ve brought together a number of the banks that were thinking through, really they were forward leaning thinking through how banks can engage thoughtfully in this space. And so, they’ve helped bring this group together, build some of the common infrastructure, but important to note that when we talk about tokenized deposits that really is limited to insured depository institutions so only the banks will be able to engage in the business of minting, transferring and burning USDF.

Peter: Right, right. So then, where are you at in that process, I mean, like is there a pilot happening today, when are we going to see banks actually minting USDF?

Rob: Yeah. So, we have banks who have built the infrastructure, have built the test protocols and are really ready to go live. As I mentioned, we are still working with regulators to get that formal approval, that’s something that’s a bit of a new dynamic in banking, having to ask permission rather than making sure regulators are comfortable. So, we’re working on getting that formal approval and then ready to begin moving transactions.

Peter: Right. And I imagine, you obviously want to expand this beyond nine banks and I also imagine you talked to lots of different banks before you took this job so what are the concerns that banks have that have said no to join the Consortium or at least said, I’m not ready yet.

Rob: Yeah, and it really is that second piece. So, I did talk to a number of banks as I made my transition over before and since, and I think there’s really a lot of interest, a lot of broad recognition of the importance for banks of having these modern blockchain-based payments options and I think enthusiasm about ensuring banks maintain the same role they do in the economy. The banks that aren’t signing on today are the ones who I think, to your point, aren’t quite ready yet and one of the things I often hear is I don’t necessarily have the staff expertise or my board may not be quite up to speed on exactly what this means and how it fits into the big picture.

And we’re actually starting to see some of those banks show real interest in the consortium as well as they work towards actually implementing USDF, but recognizing that we’re also bringing, as a sort of bank-owned organization, a bit of that trade association model. So, even for the banks that aren’t ready to go live tomorrow, that we think there’s a lot of value in engaging in the working groups, helping get your staff, whether it’s the legal team, whether it’s the compliance team up that really steep learning curve as well as helping your board understand that you have a holistic strategy on your bank’s role in a blockchain economy.

Peter: Right, right. So, I imagine when you get approval, when you actually launch because, I mean, right now, everything is still, you know, somewhat theoretical because there is no approved product, right. I imagine, that’s going to, in your projections, that’s where the momentum is going to come, is that right?

Rob: Yeah. We’ve had a lot of interest, I think we will see more banks engaging here in the near future and expect, especially as we see those proven out in real world transactions and from a competitive standpoint, we think there will be a lot more interest as well.

Peter: Okay. So then, let’s switch to the lawmakers, you know, you said you’ve been around Washington a long time, you’ve kind of got a pretty good idea about how Washington works. There’s been talk about, like Stablecoins as being the one thing that is going to get regulated first because it seems like it’s a lighter lift and obviously we have midterms coming up in two months so, you know, might not happen in the short term, but what do you expect the next move from regulators to be when it comes to digital assets?

Rob: Yes. There’s really two things we’re watching. At the regulators, we’re watching the reports that are due out of the executive order so those reports are due on September 5th, a number of them are. I think we will get really good clarity in terms of where the agencies are on all of these issues when we see those reports. I’m not sure when this will air, and this may be dated by then, but in the next few weeks, we expect to get more clarity on that. I know a lot of really hard work has gone in over the summer to craft those reports and so those I think will be a really thoughtful representation of where the banking agencies and other agencies around Washington are on these issues.

The second piece we’re watching that you mentioned is the Stablecoin legislation coming out of the House Financial Services Committee as well as other legislation that’s been developed by really thoughtful members of Congress. What I will say there is it’s certainly something we’re watching and engaging in and again, USDF is not a Stablecoin and I think, you know, what we’re seeing is a really thoughtful bipartisan effort to understand the benefits to help put in the appropriate regulatory environments that we have consistent protections.

What we’re trying to make sure as we look at this is that banks are able to play that same role on a blockchain-based system that they do in every other economy. So, again, ensuring that banks have the ability to take deposits, to make loans and facilitate payments, I think it’s really important that they’re able to serve that same role as we move into this sort of modern infrastructure.

Peter: I also heard, I heard a lot of people say that really banks should be the ones that issue Stablecoins, right. I mean, that’s become part of the conversation, you know, in a very real way, it seems.

Rob: Yeah, absolutely. That hasn’t been our focus, right, our members just want to be one of the options out there, but I think there is a broad recognition and we saw this in the President’s Working Group Report that these are exactly the risks of taking what is effectively a deposit facilitating payments, are exactly the risks of the banks’ regulatory structure is designed to control, right? There’s a reason that the complex set of regulations that banks are subject to, there’s a reason those are in place, they’ve been implemented really thoughtfully over a long period of time and so if you want to maintain those same protections, the banking regulatory structure is a really good place to start.

Peter: Right, right, okay. So, let’s close with a future-looking question and I’d love to kind of get your sense of what your vision is for USDF and for what the banking system will look like let’s just say in ten years time. I know it’s not easy to gaze into the crystal ball that far in the future, but you must have thought about this deeply, I’m guessing.

Rob: Yeah, absolutely. And so, there are a few things as I look forward that I’m really hopeful will materialize, whether it’s the next two, four, ten years. You know, the first is that I think we will see blockchain being used as common infrastructure for more and more real world assets. So, today what we see is that a lot of the crypto ecosystem has demonstrated the value of this technology, but we have yet to see it really interact with the real world in meaningful ways and so what I’m hopeful is that we will see more tokenized assets, whether it’s in financial services or other industries and leveraging the power of blockchain and I think that means a few things.

The first I think, that common infrastructure will allow smaller institutions to punch above their weight so my hope is that we see less consolidation in the banking industry as community banks are able to leverage this shared infrastructure and really be able to do what community banks do well which is know and engage in their communities. The second piece that I think is really important and one of the things that gets me excited about this is that the efficiencies that will bring will lower the barrier to entry for financial services, lower the cost of serving those communities and help create more inclusive access to financial services to help make sure our nation’s banking system works for the entire country.

Peter: Okay. That’s a great vision and we will all be following along to see how long, whether it becomes reality we certainly hope that there’s a lot of movement here in the short and medium term. So, Rob, thank you so much for coming on the show, it’s always great to chat with you, I really appreciate it.

Rob: Thank you, Peter, always a good time, really appreciate you having me.

Peter: You know, you often hear the crypto enthusiasts talk about bypassing the banks, moving beyond the banks as even the really popular community called “bankless” that we are actually involved with here with Fintech Nexus, but my position is that we are not going to go “bankless” any time soon as a culture, as a country, you know, really internationally. I mean, the banks in this country, especially, they are the core of our financial system, this is not crypto, it’s blockchain-based, but it gets thrown into that bucket as he said.

But banks are here to stay and banks should be taking part in bringing the fruits of the blockchain movement to bear on consumers, for consumers and small business and that’s exactly what USDF is designed to help facilitate. I see it as, you know, banks are going to change dramatically over the next decade, we are not going “bankless,” we are, well never say never, but we’re certainly not going to do it in the next multiple decades. We are going to have a more efficient financial system still centered around banks, but it’s a system that is going to be much more efficient, much cheaper and much better than what we’ve had in the past.

Anyway on that note, I will sign off. I very much appreciate you listening and I’ll catch you next time. Bye.

(music)