Structured changes to handling consumer data rights are making their way across the pond.

Following the successful adoption of open banking standards in the UK and Europe, the rest of the world is catching on. Development of countries’ standards to match the innovation in Europe is underway, and the U.S. is no exception.

There has been a shift in the mindset of the masses. Consumers, tired and outraged by companies’ mistreatment of their data, are demanding autonomy and control.

Open Banking and follow-on open finance are said to create a fairer and more competitive financial environment. Consumers have more control over their financial data, allowing them to choose alternative products and how they engage in their finances.

While the North American path to open finance has been seen in various forms over the past two decades, a solidified signal of this changing mindset was seen late last year. On Oct. 27, 2022, the Consumer Financial Protection Bureau (CFPB) announced its intention to strengthen consumers’ access and control over their financial data.

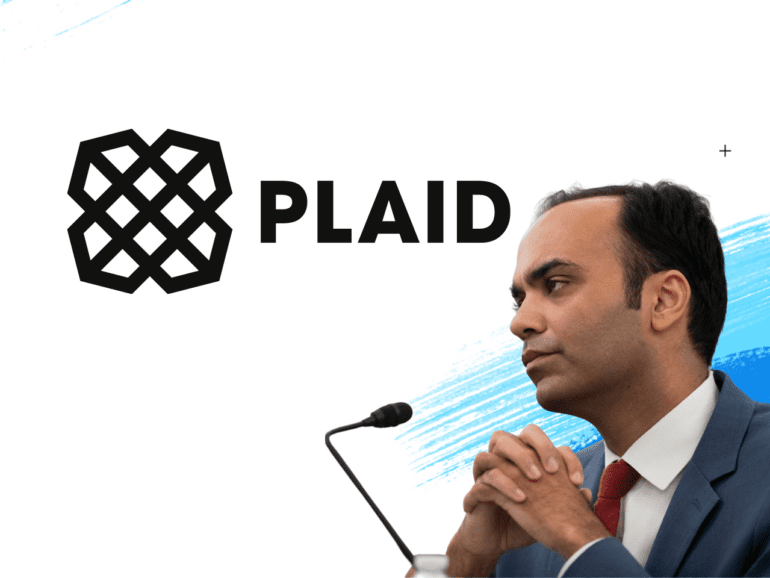

“Dominant firms shouldn’t be able to hoard our data and appropriate the value to themselves,” said CFPB Director Rohit Chopra in a statement. “The CFPB’s personal financial data rights rulemaking has the potential to jumpstart competition, giving Americans new options for financial products.”

The announcement spread hope among the financial industry that had long been waiting for formalized rules.

Plaid is supportive…

In response to the CFPB’s announcement, Plaid, a forerunner in the U.S. progression to open finance, submitted its letter in response to the organization’s request for stakeholder feedback.

Consisting of 112 pages, the document is a firm advocate for the CFPB’s oversight to support open banking, stating, “The rulemaking is critical to consumers fully realizing the consumer empowerment goal that underpins Section 1033, and to achieving a fair, transparent, and competitive financial services marketplace.”

“It will propel the financial services industry to better serve consumers by bolstering the consumer right to access and share their financial data and mitigate privacy, security, and anticompetitive risks.”

The Dodd-Frank Act, the most far-reaching Wall Street reform to date, was passed 12 years ago. Created as a result of the financial crisis, it has been put in place to avoid the excessive risk-taking that led to the crisis. Section 1033, which directly relates to consumer ownership of financial records, has been on hold until the CFPB’s most recent announcement.

RELATED: CFPB announces open banking rule

…But offers advice to the CFPB

Plaid’s vision for CFPB involvement is in the creation of a “consumer-centric” financial industry.

Policy and technical standards lead at Plaid, Ben White, said, “We believe that this framework would enable the CFPB to ensure that consumers have consistent access to their data, along with the protections they need, and that innovation can continue to flourish in the financial services ecosystem.”

Their recommendations for the CFPB’s future steps can be distilled into five main points:

- Establish a comprehensive financial data access right – Plaid voiced their support for the new rules to create consumer rights over their financial data. They believe that customers deserve holistic access to their data, allowing them to manage finances, regardless of the sector.

- Require companies to give consumers transparency and control over their data – In giving customers access to their data, Plaid also insists on transparency over what types of data are being collected, how it is used, and how to disconnect their data if required.

- Ensure consumers have consistent data access, no matter where they manage their money – Following a similar line to that of the first point, the company stressed the importance of a level playing field and reliability on access to data, regardless of the size of fintech institution.

- Protect consumers’ data access while supporting the industry shift to APIs – Plaid has championed efforts to reduce screen scraping, opting instead for API usage. Following this industry shift to APIs, they recommended that the CFPB remain aware of the effect it may have on smaller fintech players and support the transition by setting realistic timelines for the change.

- Set clear standards and supervise data aggregators – Plaid highlighted the important role of data aggregators in the CFPB’S proposals and recommended establishing clear standards for these entities.

Following these points, they also offered advice on the potential challenges of implementing the wide-reaching rules.

The company urged for the CFPB’s assistance in the compliance of entities that remained outside of the Bureau’s supervisory authority, as well as micro-entities and entities operating in sectors such as student loans.