![]()

Every quarter we delve into the securitizations happening in the marketplace lending space with the help of PeerIQ. They have a free download of their second quarter report on marketplace lending which is full of valuable information about all of the securitizations including commentary on the current state of interest rates and borrowing in the United States.

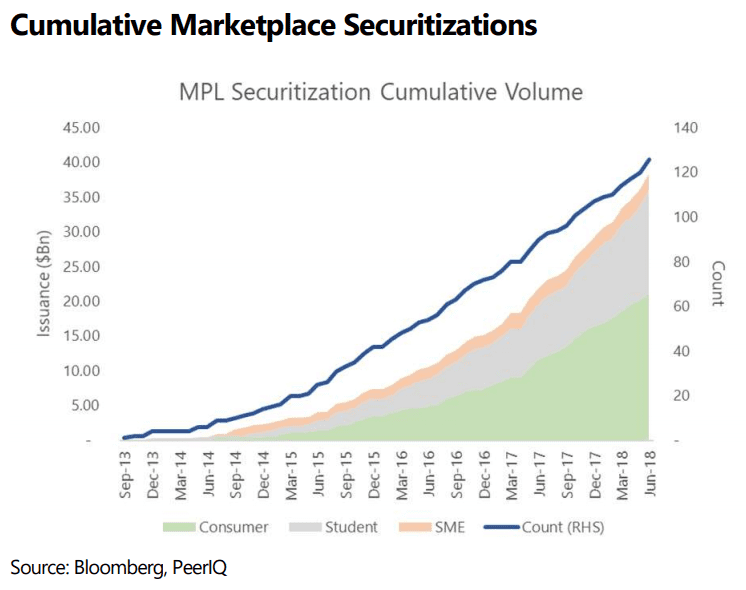

The upward trend continues with total Q2 securitization issuance reaching $5 billion, a high water mark for the industry. Securitizations grew 36% year over year and cumulative issuance now totals $38.4 billion across 126 deals.

With rising interest rates, PeerIQ noted that spreads are widening across consumer and student loans:

This is the first quarter where we observe higher all-in costs for issuers driven by rising front-end interest rates and ever-increasing ABS supply, breaking the trend of non-stop spread tightening. Weighted average all-in yields on consumer deals increased from 2.9% to 4.2% QoQ, and on student deals from 3.0% to 4.5% QoQ.

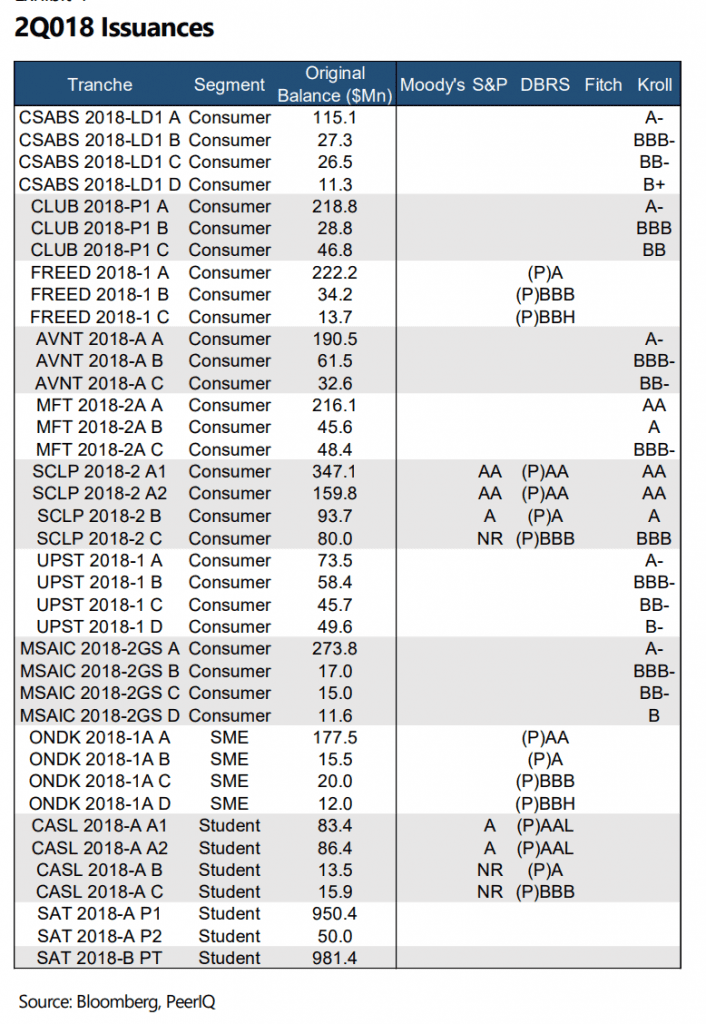

In the past we have commented on the participation of ratings agencies and that continued in the second quarter with all except SoFi’s student loan passthrough securitizations being rated. Another positive data point is the amount of deals getting upgraded. In total, 51 consumer tranches and 67 student tranches have been upgraded. DBRS currently leads in rated deals with $21.1 billion, followed by Kroll ($19.9 billion) and Moody’s ($12.6 billion).

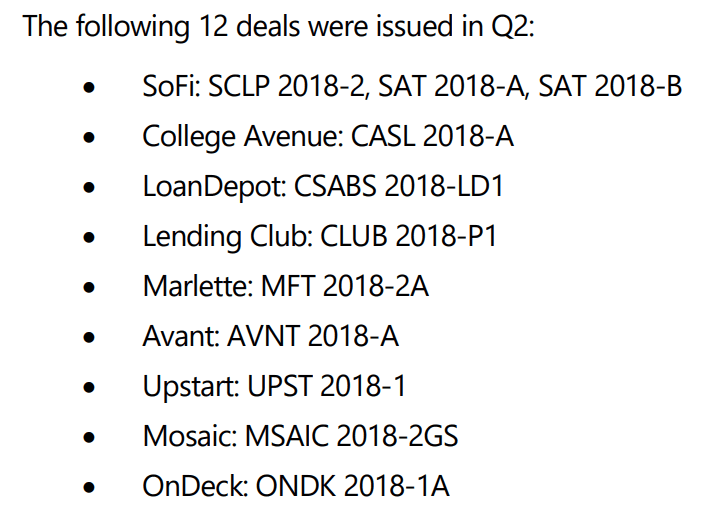

Other notable happenings for the quarter include Freedom Financial issuing their first deal and OnDeck returning to the securitization market. SoFi led issuance with $2.7 billion across a $681 million consumer deal and over $2 billion in student. The SoFi student deals were unrated passthrough structures.

Below is a roundup of the deals that took place during the quarter:

If you’re interested in digging further into the deals and getting additional color on what is happening in the securitization space you can download the report for free on PeerIQ’s website.