PeerIQ covers marketplace lending securitization in great detail through their weekly newsletters as well as their in depth reports. Today, the company released their Marketplace Lending Securitization Tracker for Q1 2017 which is a 15 page report that provides information on every securitization in the industry. Below we provide an overview of key takeaways from the report.

Total Marketplace Lending Issuance $2.9 Billion in Q1

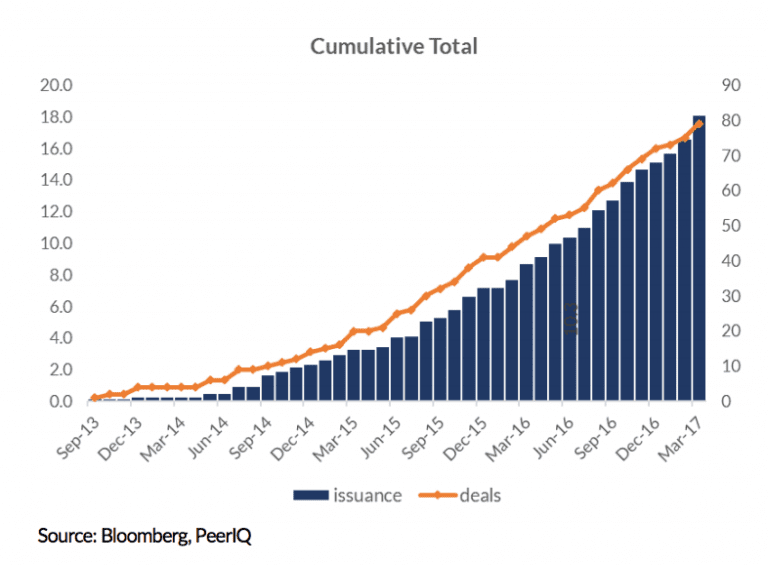

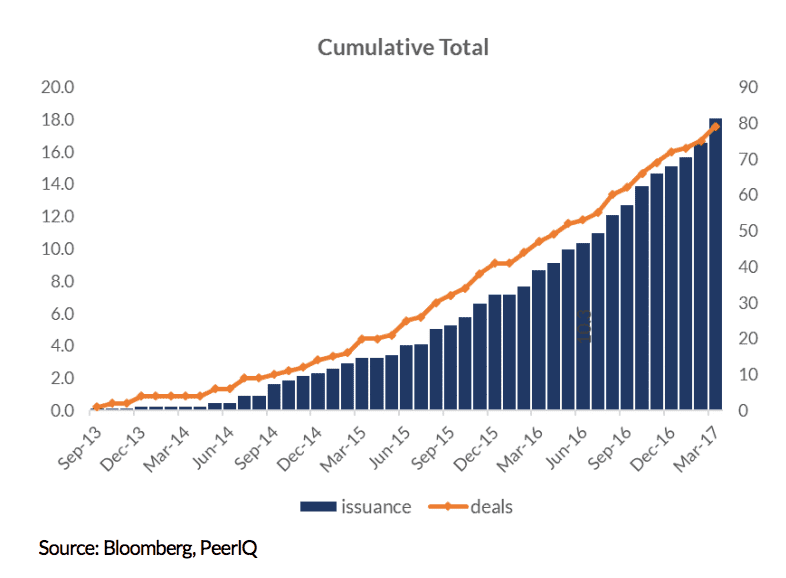

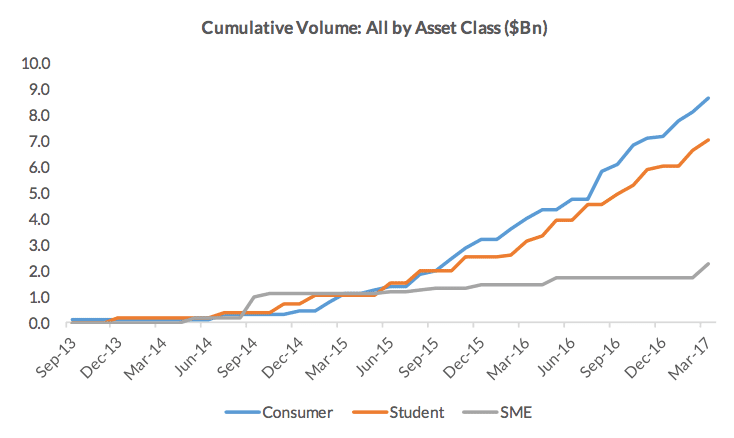

When we look at loan funding over the last few years both the total deals done and total issuance have steadily increased. Issuance totaled $2.9 billion in Q1 2017, bringing total issuance to $18 billion across 80 deals.

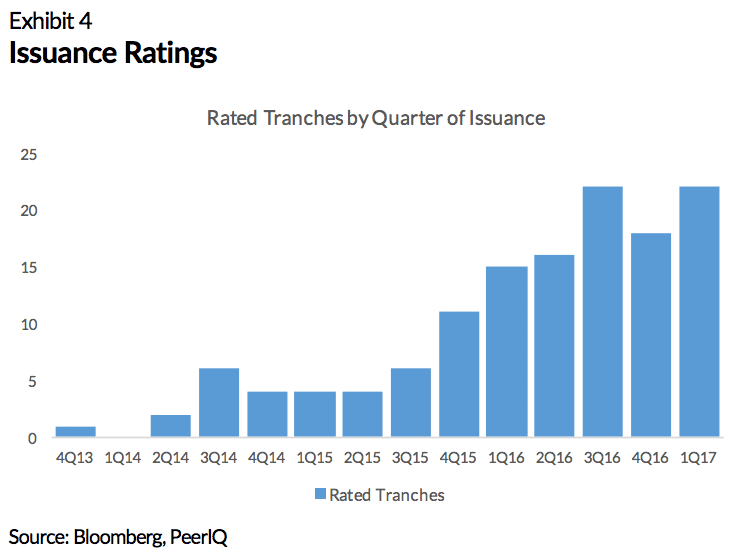

There has been a trend towards rated deals with all deals during the first quarter of 2017 being rated securitizations.

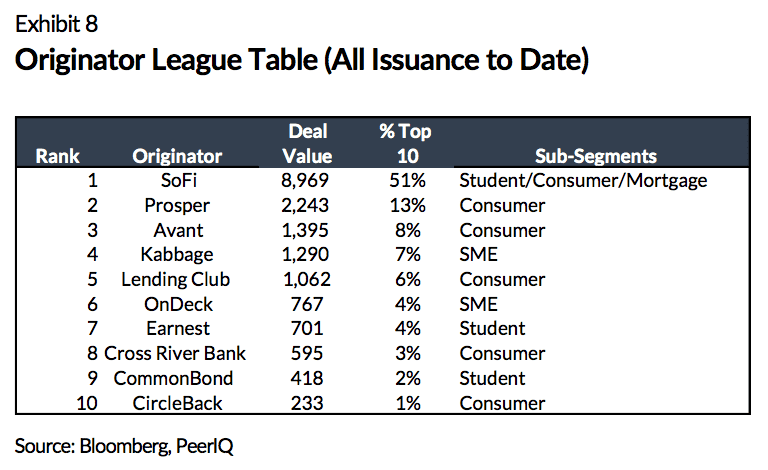

Not surprisingly SoFi continues to lead the way with record-sized consumer deals. SoFi alone represents 51% of deal value of the top 10 originators with just under $9 billion of issuance. The first quarter also brought the first prime deal from Lending Club.

Consumer volume still outpaces student with SME volume remaining relatively flat since September, 2014.

Other topics covered in the securitization tracker include loan stacking and the many bank partnerships in the industry. They also discuss how spreads continue to tighten which continues to make it a good environment for securitizations. Now, they do not cover only the good news, they also have a section devoted to deal trigger breaches including a table detailing every deal that has breached triggers (there are 10).

PeerIQ estimates new issuance of $11.2 billion for 2017 while also providing other thoughts on the current market conditions:

We expect higher volatility from rising rates, regulatory uncertainty, and an exit from a period of unusually benign credit conditions. Platforms that can sustain low-cost stable capital access, build investor confidence via 3rd party tools, and embrace strong risk management frameworks will grow and acquire market share.

You can download the full report from PeerIQ.