Fraud has long been an issue in the finance industry, and it can be devastating for lenders.

In 2021, CoreLogic released its annual mortgage fraud report, which showed every 1 in 120 mortgage applications contained fraud. A 37.2% increase in 2020. Small and midsized business (SMB) fraud has increased by 7%, an area many fintechs consider significantly more complex than consumer lending.

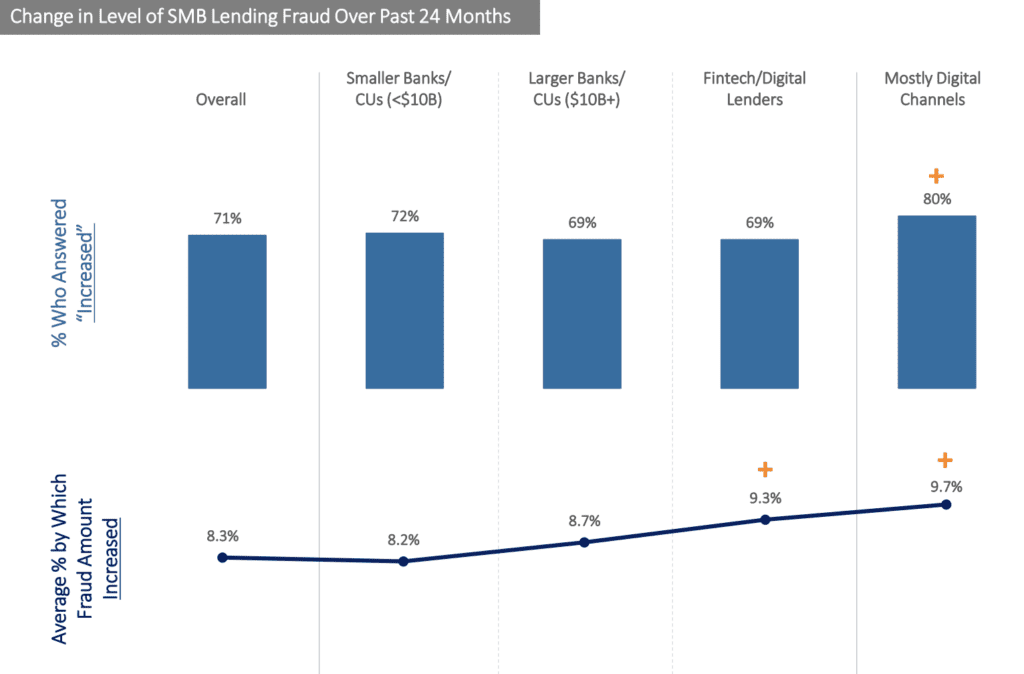

Although large banks saw the sharpest rise in fraud cost, for fintechs, the cost as a percentage of revenues is at its highest. According to LexisNexis (LN), many expect current levels to rise over the year ahead.

Traditionally, fraud prevention is time-consuming, using manual processes to check documents for manipulation, inconsistencies, and suspicious activity.

The LN study noted that the shift to online and mobile loan application platforms poses even more risk to lenders, creating a need for heightened security. It was found that fintechs and organizations which operated primarily through digital channels saw a 9.7% increase in fraud over the past year, the greatest for all sectors.

However, there could be an opportunity to improve with developments in automation and machine learning.

Ocrolus Detect with automation at its core

Today, Ocrolus has released its Ocrolus Detect product, an automated fraud detection solution for lenders.

Unlike the traditional detection process, which relies heavily on the human eye and can result in significant mistakes and massive losses, the Ocrolus Detect solution automates fraud workflows. The software can provide clear signals and visualizations of fraudulent activity undetectable to the human eye.

No strangers to document automation, Ocrolus has spent over 8 years developing software solutions to aid the loan application process. Already processing millions of documents a week, Ocrolus could be in an advantageous position to implement the added fraud protection elements to their machine learning software.

“Detecting fraud is mission critical to our business, and Ocrolus is uniquely qualified to provide a comprehensive fraud solution with its focus on lending,” said Zack Whitaker, Risk Operations at AtoB, a fintech company modernizing payments infrastructure for trucking and logistics.

“Fraudulent behavior needs to be caught in our underwriting process, and Detect has proven to be a highly effective insight tool for our team.”

Initial results promising

Their beta tests showed promising results. Ocrolus claims that Detect accurately uncovered four times more potential fraud than a leading competitor.

The software indicates where file tampering has occurred on a document, what fields were modified, and how they were changed to provide the necessary level of context for more informed lending decisions.

Detect also visualizes file tampering on documents received and often can recover the original document for fraud analysts to spot the modified fields easily.

“As the lending industry shifts to digital loan application processes, fraud is rapidly increasing and becoming more difficult for humans to catch,” said John Forrester, SVP of Product at Ocrolus.

“Detect enables lenders to quickly and confidently process more loans by proactively providing them with clear and reliable fraud signals.”