The credit system has faltered in today’s global society, where international relocations are part of daily life. Millions of international migrants have been excluded from access to financial products, a hardship not impacting many nationals.

This is particularly pressing in post-Brexit Britain, which, buffeted by economic headwinds and a critical talent shortage, may need to implement additional measures to maintain its seat as a global epicenter of trade and innovation.

In addition, many in the UK’s existing immigrant population, making up over 16% of the total number of residents, have been stuck without access to credit products- a critical disadvantage as the cost of living crisis takes hold.

However, developments in fintech have risen to address the issue.

On Thursday, Jan. 19, Nova Credit received authorization from the FCA to become the UK’s first cross-border credit reference provider.

Crossing the Atlantic

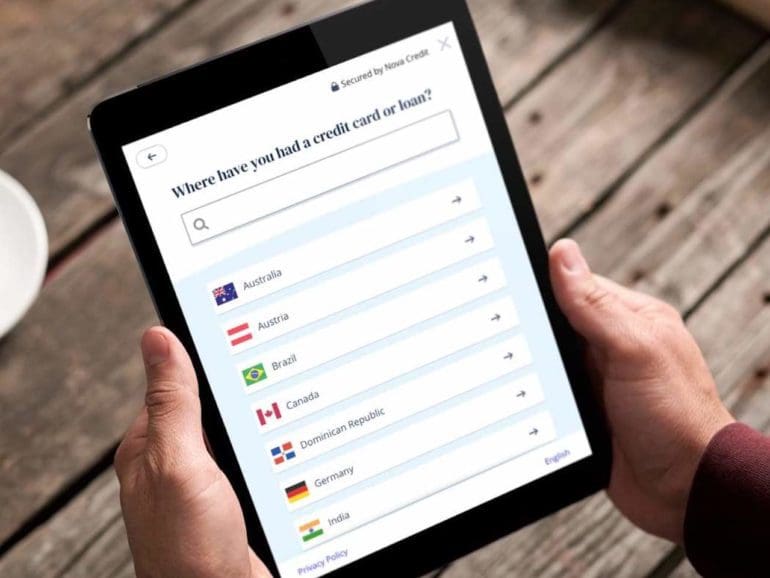

The company, founded in the U.S. in 2016, has partnered with credit bureaus in more than 20 countries. Using its technology, Nova converts the data from the bureaus into credit scores and reports compiled in a “Nova Passport” that local lenders can use.

“Using the Nova Passport, UK lenders will be able to understand the financial history of consumers from over 20 countries and instantly use this information to make more fair and inclusive decisions,” said Collin Galster, Non-Executive Director of Nova Credit UK.

“We’ve been thrilled by the reception we’ve received from the UK’s leading banks, fintechs, auto lenders, and telecom providers, and we look forward to announcing our first wave of partners in the coming months.”

After announcing its intention in April 2022 to expand into the European market, the new subsidiary will operate in the UK under the FCA’s oversight.

Nova Credit’s technology unlocks consumer-permissioned access to over 2 billion credit profiles worldwide. By working with Nova Credit UK, financial services providers in the UK can now incorporate credit information from foreign bureaus as part of their creditworthiness assessment.

“The UK is home to one of the world’s largest and most diverse immigrant communities; one in seven people in the UK was born overseas,” said Misha Esipov, Co-founder & CEO of Nova Credit.

Improving access to credit products

The Office of National Statistics showed in 2022 an overall reduction in net immigration of 540,000.

While this has been an objective of the post-Brexit government (framed by controversial rhetoric), this has led to concerns that drops in immigration have left the British workforce lacking. Experts have warned that this reduction could limit the growth of the economy.

Despite this, 277,069 work-related visas we granted in the year ending March 2022, demonstrating a continued need to provide immigrants with access to financial services.

Many are left without access to lending products due to an inability to leverage their existing credit files in their previous country of residence.

“This critical consumer segment is the largest driver of the country’s population growth and is mission-critical to any business looking to maintain and grow market share,” said Esipov.

Matt Davies, Head of UK Market Development for Nova Credit, said, “There is a widespread appreciation among UK financial institutions of the need to be more inclusive. This trend will be accelerated substantially this year when the FCA’s Consumer Duty rules are enacted to help more financial services deliver good customer outcomes.”

The Customer Duty rules come into effect in July of this year, requiring businesses to implement additional measures to “act in good faith, avoid causing foreseeable harm, and enable and support customers to pursue their financial objectives.”