We live in a society of increasing movement across borders.

In 2020, the UN estimated there were 281 million international migrants. Although the COVID-19 pandemic slowed migration, it still grew. Additional international events caused increasing numbers of civilians to be displaced.

The reality stands the future of the finance system could lie in breaking down borders. Cross-border payments have continued steady growth and are set to rise by over $100 trillion between 2017-2017. One primary advantage of using digital currencies is their borderless transaction capabilities.

The continued growth in migration is mainly affected by the financial exclusion. Consumers relocating all over the world can have difficulty gaining access to critical financial products. A lack of credit scores can limit access to essential elements for setting up a home.

“When you travel to another country, especially if you’re looking for a school or a job relocation, stuff like that, you will not have credit in the new country that you arrive at,” said Sarah Davies, Chief Data and Analytics Officer at Nova Credit. “So you can’t get a loan for a car or phone, you can’t rent an apartment, you have no way to demonstrate your financial identity.”

Partnering with HSBC to improve global access

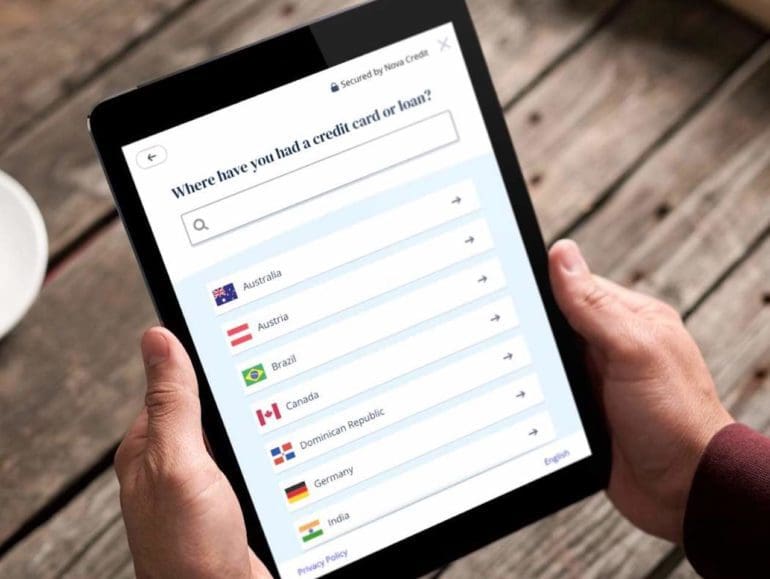

Nova Credit was formed to solve this issue, creating a network of pathways between jurisdictions that could share credit data.

“We enable you to become visible to the destination country and allow the previous management of your financial information to be used for underwriting purposes and access to credit,” she said.

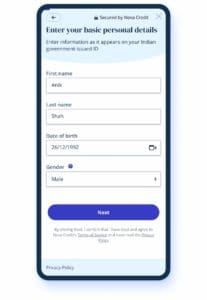

Their Credit Passport is much like a regular passport but used to create an international financial identity. With the passport, consumer credit data is transported across jurisdictions as they relocate. On September 28, 2022, Nova Credit partnered with HSBC to expand its network of international pathways from 20 in the US to over 400, interconnected between themselves.

This means instead of just targeting migrants in the US, they can now assist people all over the world. Starting with the connection between India and Singapore, they plan to expand their capabilities rapidly worldwide.

“We bring that data over, and we restructure that data into a US interpretable format,” Davies continued. “That restructuring essentially is a presentation of your credit file into what we call the Credit Passport. The Credit Passport is essentially the product that a US lender like American Express, or HSBC, in our newer markets, can review and then make a decision on it.”

Listen to the interview:

Impacts on migrants ‘ financial inclusion

The Credit Passport could have significant effects on financial inclusion.

“My role is all about how do we get this data or any data, so to speak, to accurately and fairly assess consumers when they don’t have that classic credit file,” said Davies. “Most credit scores worldwide need enough information on your credit file to score you.”

“When you bring your home country credit data over to the new country where you have nothing, (the Credit Passport) now supplements that. And so you’re very clearly, solving that credit data need.”

“The thing we’ve found with our analysis is that credit data in any country is accurate and representative of how a consumer will behave.”

She explained that in addition to the Passport, Nova launched their Cash Atlas product in May this year. This product aims to delve deeper into the financial inclusion potential of alternative data and looks at bank transaction data as another way to underwrite credit.

Using transaction data to enhance Nova’s effect

“Cash Atlas looks at bank transaction data and recognizes that some people just don’t like credit loans and aren’t simply going to use the credit system in a way that’s conventionally understood.”

“But 95% of US citizens, and almost everybody across the world, will have a bank account or checking account, so how do we use that data to underwrite consumers?”

“Our Cash Atlas product is intended to enable underwriting for consumers who may never have much credit data but have lots of bank data.”

In addition to helping consumers with little credit data access credit in new jurisdictions, Atlas helps create a recent picture of the consumer’s ability to take on credit. For those with bad credit scores, Davies explained that looking at bank transaction data could be much more indicative of a consumer’s financial health.

“The thing that really matters when you look at data and how it points to how you’re going to behave tomorrow, or the next couple of years, is what you did in the last few years,” she said.

By using these products in unison, Davies explained that there is an ability to tackle the length and breadth of the financial inclusion issue for migrants’ access to credit.

“My goal is that within five years, we should have sufficiently mature solutions using those two forms of data to eradicate even the idea of financial inclusion.”