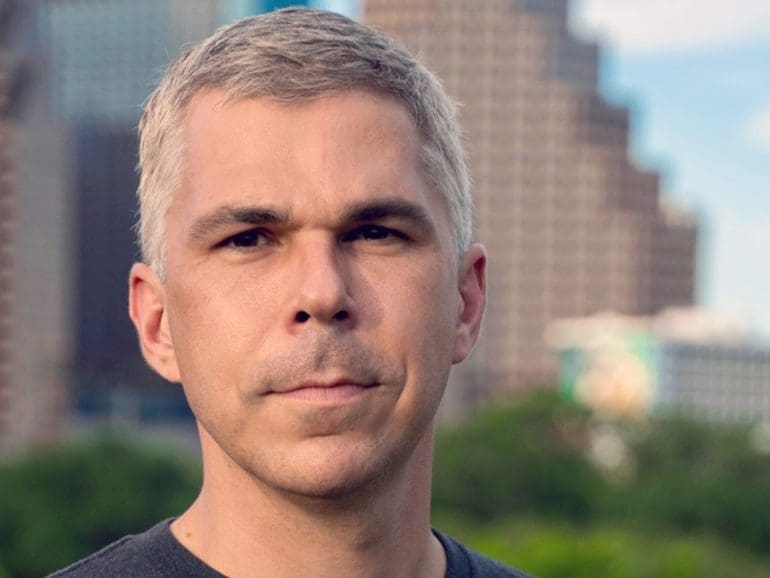

The second wave of neobanks is here, and it’s going to be community-focused, according to John Waupsh, the CEO and co-founder of Nerve, a neobank for musicians launching on Sept. 15.

“You saw like this first huge wave the early startup’s neobanking with like Moven and Simple,” Waupsh said. “Then, you started to see the mega wave of neobanks: Chime would be a great example. Now you’re seeing the next wave and is probably going to be the greatest wave of neobanks and its community-focused neobanks.”

But by “community,” Waupush doesn’t mean the small Community banks that dot the country, serving local river valleys and town squares. To Waupsh, a 15-year veteran in the music and fintech space, community in 2021 means something beyond geographic location. They built Nerve to bring mobile payments, digital credit, and audience tracking all in one place, Waupsh said, for the musician community.

Built by Musicians, for Musicians

Going to college in Chicago in the late ’90s, Waupsh “kind-of conned myself into thinking that if I spun records as a DJ, I could pay my bills.” Though he said he wasn’t good enough to get by, he has surrounded himself with a community of musicians since.

He realized the power of playing songs no one had heard before. Someone recorded an album lost to time, and died without ever knowing a packed club of 500 people would dance to it years later. Spinning a track that only existed in five copies, he said he became obsessed. So while pursuing post-grad work as a copywriter and coder in the financial tech community banking space, he also ran a gig to find, preserve, and produce lost music from the ’60s to ’80s.

“I started collecting acetates and reels, two reels of recorded music that that was essentially…think of it like demos from artists who never got record deals whichever actually made it,” Waupsh said. “And I did that all during the years of fintech escapades.”

By 2016, he was working at he had started The Preservation Project and was selling lost records to buyers across the world. Although, he quickly realized that mailing records out to Norway could be expensive. He wanted to build a streaming alternative that paid musicians well enough to earn a living to better support artists.

“You know, the whole attention of the preservation project is to find these artists and to give them the money that they would get from actual releases,” Waupsh said. “So to put their stuff on Spotify, effectively, I’ve earned them like three cents over 10 years, it wouldn’t do anything.”

That where Nerve.fm came in, Waupsh and co-founder Ben Morrison built a streaming service to pay artists recurring revenue for their music. He called it a “really awesome version of Patreon” that features an audiovisual streaming app that pays musicians “a hell of a lot more money.” But when artists were sold on the idea, they all still asked for more: where they loved a better revenue model, they needed a bank.

“As we were working on that product and trying to talk about it with musicians and get them excited about it, I can’t name one artist out of hundreds of musicians that we talked to over, where this didn’t happen,” Waupsh said. “They would say, ‘wow, that is a cool thing. I can get paid more. Did you say that you were in banking,’ and I’d say ‘yeah, and they go; ‘could you tell me where to bank?’”

Free Business Banking for the music Industry

Even with years in the banking space, Waupsh said at first he didn’t believe he had anything to offer. With the hundreds of banking options, how could Musicians still need help? But when reviewing the options out there, he realized there was a market for a banking product that addressed musicians’ nuanced problems.

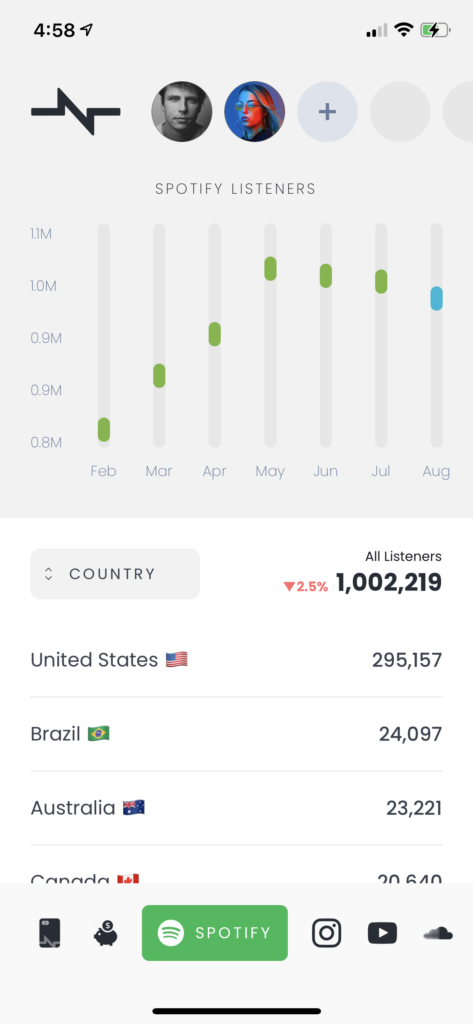

Launching Sept. 15, the new app features a business debit product, a social media account tracker, and payments options for a network of users. Waupsh said it was essential to making payments easy through the app; many musicians get paid in cash. Nerve makes it easy to set up a deposit. Nerve also makes a cheaper payment vehicle for firms that connect sites like SoundCloud to artists bringing the cost down from 2-3% to .4%.

“Business to business: all that stuff involves fees these days. Because we’re business accounts, I can now pay you for free from the business account to a business account, instantly, as long as you have a Nerve account.” Waupsh said. “And so that can be through, for instance, this QR code mechanism, or I can invite you right through my contact book.”

Without heavy paperwork, drug testing, or a Business LLC, artists can sign up in two minutes. Then, swiping through the app’s pages, musicians can track their followers on Spotify, Soundcloud, YouTube, Facebook, and across their virtual life. Waupsh said he hopes to set up these drawn social counts toward underwriting personal credit options in the future.

“So that’s really important not just for them, but also ultimately to help us,” Waupsh said. “Today, we’re not offering lending products, but soon we will, and that sort of data is really important.”

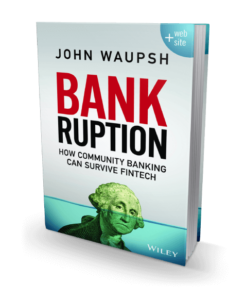

How community banks can Survive Fintech

With more still to come, all of the features relate to Waupsh’s vision of the future of banking. Back in 2016, he wrote a book Bankruption: how community banks can survive fintech, examining the game plan community banks had to follow to make it in a time of PayPal and Visa. The world of banking limited by geographic location, by “rivers and streams,” was over. If community banks had relied on a local community to survive, they would have to grow to adopt an online digital community to survive.

“What I was effectively talking about was, you know the next wave of neobanks would be very centered on affiliate groups or new versions of communities,” Waupsh said. “Putting a flag in the sand and saying this is where we’re heading we’re building solutions to solve the problems of these communities, not unlike actually the original community banks, and the original credit unions.”

The original community banks serviced workers or farmers that had the same needs. Waupsh said that there are dozens of very focused niche banking products servicing the needs of race, gender, social or ideological communities today.

“There’s the green climate banks like Good Money. Small business, freelance, and gig payments banks like Current, Lili, and Brex. There’s Mercury for startup investor networks, Anytime for gig workers. Each one is going after a different niche, like Nerve for musicians’” Waupsh said. There are Black, Latino, Asian, immigrant, and Muslim-focused banks like Cheese, Greenwood, and First Boulevard. Banks for kids and teens like Greenlight and GoHenry, LGBT+ with Pride bank, Superbia, Daylight.”

There are different passions around climate, religiosity, and members ask, ‘where is this bank putting my money? Are they investing in certain subsidiaries that violate the terms of my religion?’ In the information age, connection over personal values bridge vast distances, and fintechs are helping.

“This new wave, the time has come,” Waupsh said.