The ability of small businesses to remain financially healthy within the current economic landscape has become challenging.

Despite forecasts for rate rises being less than previously expected, the higher cost environment is just one in a long line of challenges that have wreaked havoc on the SMB sector over the past few years.

In 2020, amid COVID chaos, 43% of businesses applied for loans only 48% of these had their needs met. The introduction of PPP loans was critical to many companies being kept afloat. However, ongoing restrictions and worsening inflation continued to afflict SMB owners, and CNBC reported in Q3 2022 that confidence had reached an all-time low.

On average, alternative lenders have played a significant role, approving many more than their traditional counterparts. Developments in technology applied quickly by fintechs have facilitated quicker lending with accurate underwriting.

Nav has supported the small business lending space, streamlining the process for owners to find suitable financing options. Using business data and proprietary scoring, the company gives small business owners transparency in finding the right loan, credit card, banking, and other business service options.

Since launching in 2012, Nav has grown to obtain over 1.7 million users in 2022, assisting almost 200,000 small businesses to find financial solutions.

Today, January 26, 2023, the company has announced its acquisition of Nuula to increase its impact on small business financial health.

“This acquisition means we will continue to deliver a financial health experience that eliminates subjective and irrelevant information that small business owners are bombarded with daily,” said Nav CEO Greg Ott.

“I’ve been impressed by the caliber of Nuula’s talent and am excited to integrate our team. Together, we will continue to bring simplified financial insights and streamlined access to the best financing and credit options to small business owners.”

Gaining real-time transparency

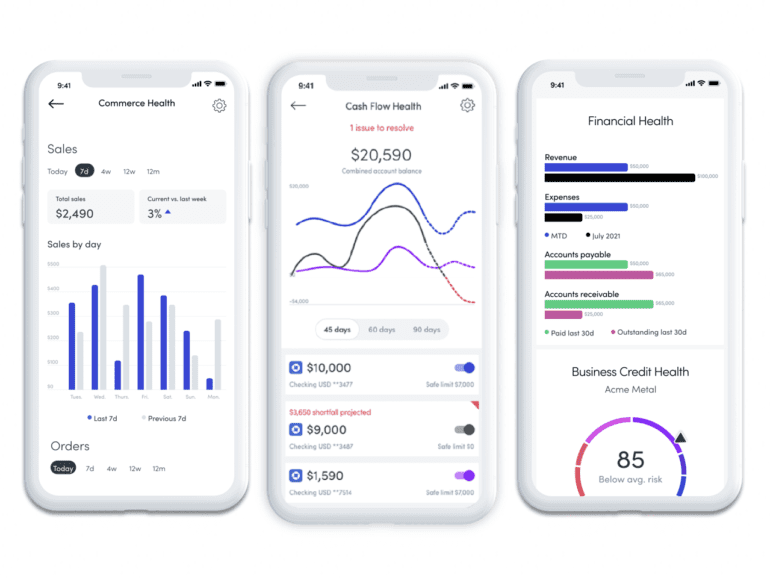

Nuula was formed in 2021 to deliver business insights and financial products to small businesses. The company’s app allowed users to track their finances and performance, gaining real-time transparency into their financial health. It was aimed at individual freelancers, gig workers as well as the owners of small businesses.

In addition to financial insights, the app monitored customer sentiment and notified users of changes to their social media channels and online ratings.

This ability to see real-time data on a business’s finances has become ever more critical in the current climate. The higher risk and complex environment of small business lending has caused many traditional lenders to reduce approval rates, leaving owners to fend for themselves.

Already put under pressure by increased costs, the inability to gain capital if needed has made owners’ accurate understanding of their businesses critical to steer them through narrowing profit margins.

Nav’s acquisition of Nuula will bring more transparency into its suite of products. The company states that it will make them the “only app combining cash flow tools, access to credit report information, and financing options to help business owners understand what they may qualify for before they apply.”

“Nuula and Nav both share a passion for helping small businesses succeed,” says Mark Ruddock, former CEO of Nuula. “I look forward to seeing how Nav leverages Nuula’s technology to extend Nav’s already compelling product offering in exciting new ways.”