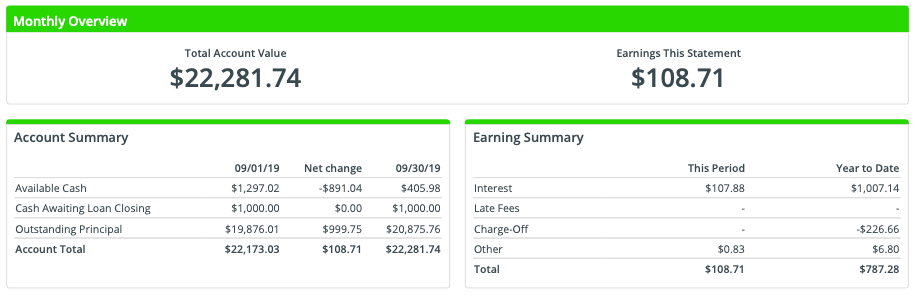

I am certainly late with this but I have finally found the time to bring you my quarterly returns report for Q3 2019. Every quarter I share my marketplace lending investment returns with the world. I started doing this back in 2011 with my LendingClub and Prosper accounts and since then I have added many investment positions across a variety of investment vehicles and platforms.

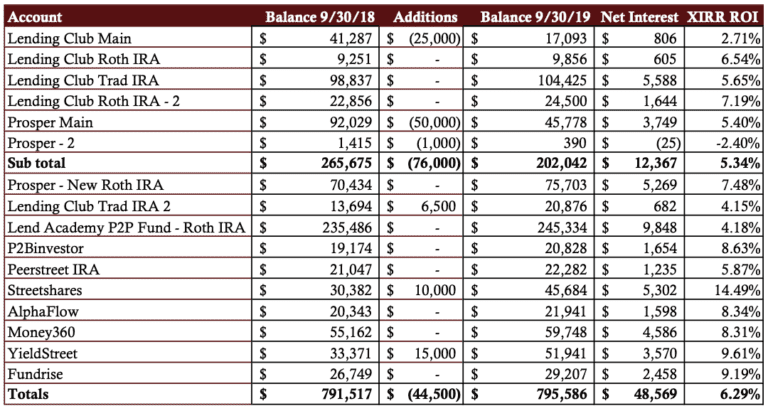

Overall Marketplace Lending Return at 6.29%

After a consistent upwards trajectory for the past year my returns appear to have stabilized at least for now. My trailing 12 month returns for the year ended September 30, 2019 across all my accounts was 6.29% which is almost exactly the same as my last update (6.30%). My original six accounts, all with Lending Club and Prosper, were also relatively stable at 5.34% versus 5.48% last quarter.

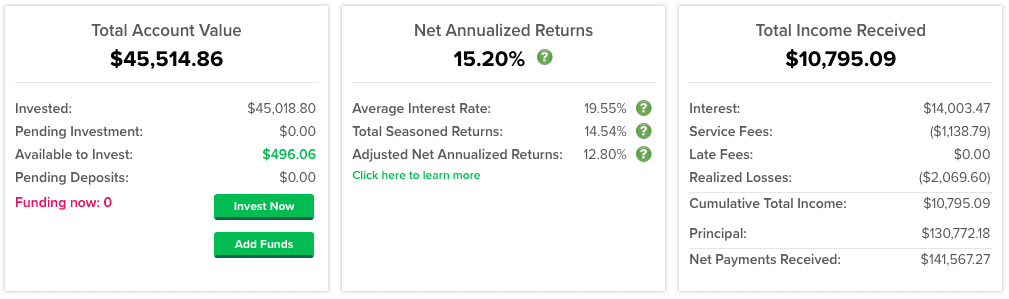

I continue to move money out of my taxable LendingClub and Prosper accounts, focusing my investments here on my retirement accounts. My standout account continues to be Streetshares, the only one of my investments solidly in double figures. But I am also very happy with AlphaFlow, Money360, Yieldstreet and Fundrise as they are all returning more than 8%.

Now on to the details. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way for individual investors to determine their actual return.

- The six older accounts have been separated out to provide a level of continuity with my earlier updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

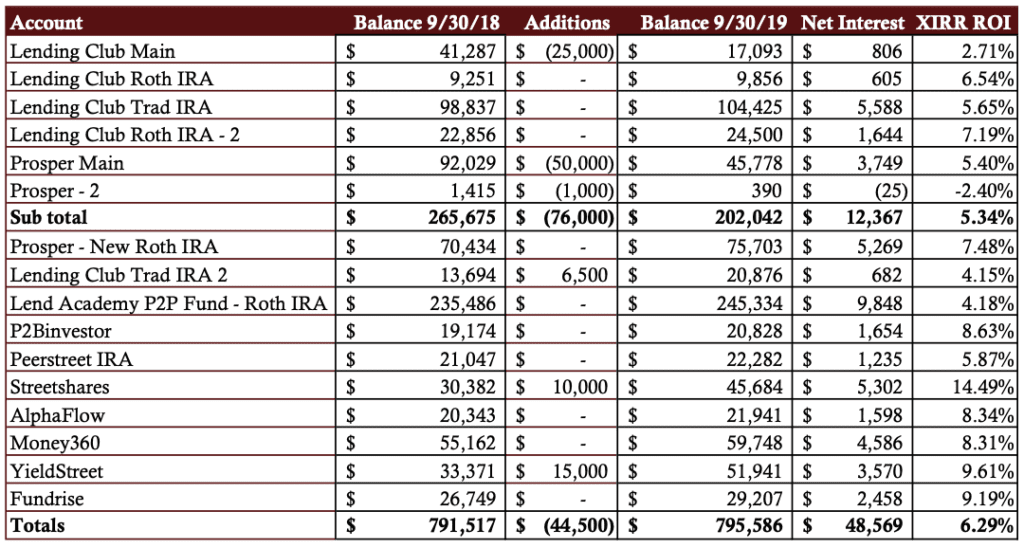

LendingClub

The above screenshot if for my wife’s Traditional IRA that was opened in 2010. It has now almost doubled in value over this time period. My original LendingClub account (Lending Club Main) is taxable so I made the decision in late 2018 to liquidate that account to focus my investments there on retirement accounts. I have been selling some loans on the secondary market to speed up the liquidation process but for the most part I am letting the loans mature and taking the cash out as it builds up.

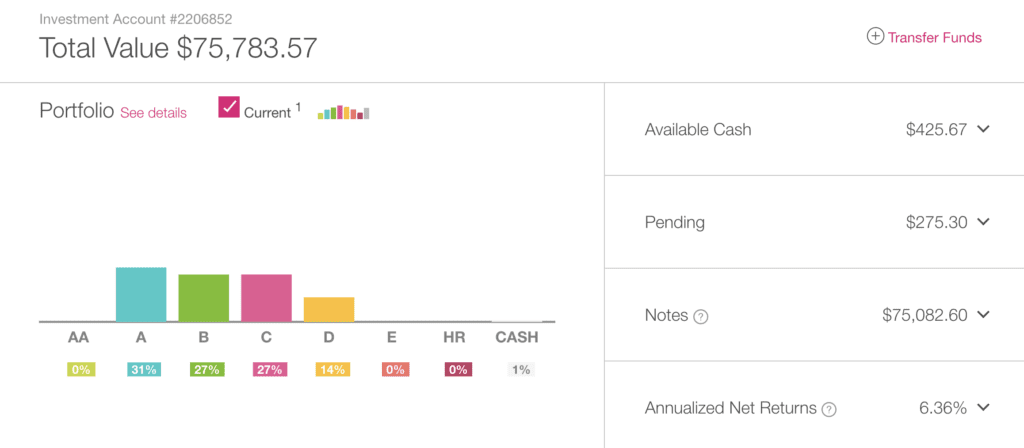

Prosper

The above screenshot is for my Prosper Roth IRA account which continues to be my best performing of all my Prosper and LendingClub accounts with a TTM return of 7.48%. It was opened in 2014 and is managed by our sister company, NSR Invest. From the outset this account was built to be a balanced account, with investments across grades A-D. Whereas my other P2P lending accounts tended towards higher risk this account never tried to swing for the fences and I have been rewarded for this more conservative approach. One interesting point to note on my taxable Prosper account (Prosper Main). I stopped reinvesting at the end of Q3 2018, so within one year I have managed to withdraw more than half the money in the account. There is no secondary market on Prosper so this is all done through loan repayments. I have found it a little surprising how quickly the cash has built up in this account.

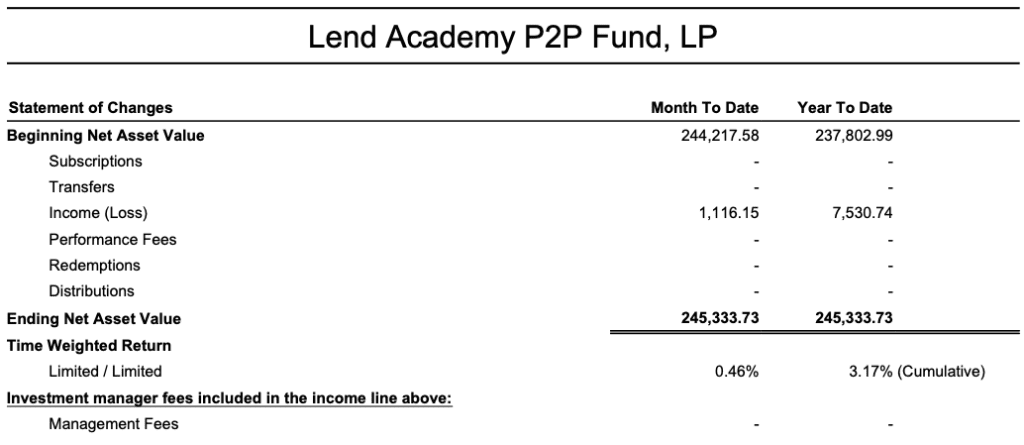

Lend Academy P2P Fund

The Lend Academy P2P fund, managed by NSR Invest, invests in Lending Club, Prosper and Funding Circle loans and has a small position in Upstart as well. The fund has not been performing as well as I hoped as it has been hurt by underperformance across all the holdings. But as LendingClub and Prosper have turned things around the fund is also beginning to perform better.

P2Binvestor

P2Binvestor is an asset-backed working capital platform for small businesses based in Denver, Colorado. Full disclosure, I am on the advisory board of this company and have known the founders since before they began operations. While the company has had some challenges in recent months in bringing new deals to the platform I continue to appreciate the consistent returns of more than 8% that I have received there for many years.

PeerStreet

PeerStreet is my longest running real estate platform investment with this IRA account now being open for more than three years. PeerStreet is focused on fix and flip properties with loan durations typically between 6 and 24 months. Because these are real estate loans they are backed by the property with up to a 75% LTV. I invest in $1,000 per loan and currently have 21 different loans in my portfolio right now.

Streetshares

Small business lender Streetshares continues to be my best performing investment. Their returns have been surprisingly consistent given these are relatively high interest business loans. I invest in every loan they make available to platform investors which is barely enough to keep me fully invested. I believe they are no longer open to new platform investors because have a Veterans Business Bonds program that pays 5% and they are channeling new investors to that program. They are a veteran-owned company and have a large percentage of borrowers who are also veterans.

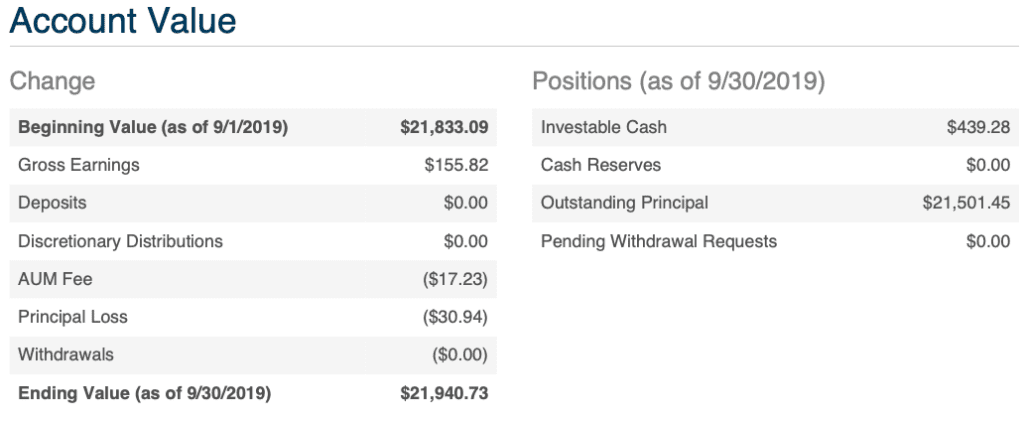

AlphaFlow

AlphaFlow is a real estate platform that allows investors to build a diversified portfolio of short term real estate loans quickly and easily. They have a unique structure that gives investors exposure to 75-100 loans right off the bat. Unfortunately, the company recently announced they are closing down their retail platform to focus on institutional investors so this account will slowly be liquidated.

Money360

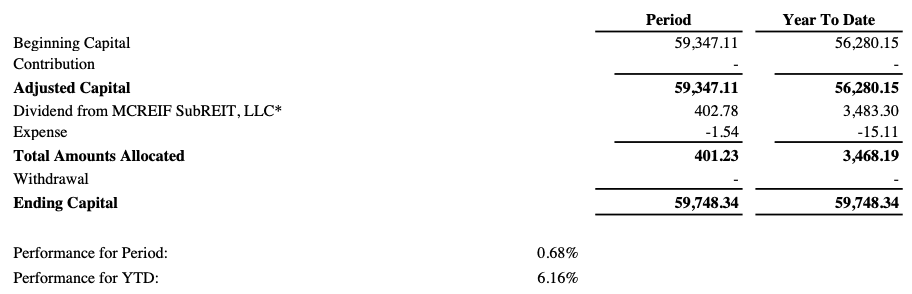

Money360 is another real estate platform but they are focused on large commercial properties. These are primarily bridge loans in the $3 million to $25 million range. I have invested in their M360 CRE Income Fund LP which is managed by M360 Advisors, LLC, their wholly owned investment management company. These are 12-month to 36-month loans with an LTV of less than 75% and broad geographic diversification.

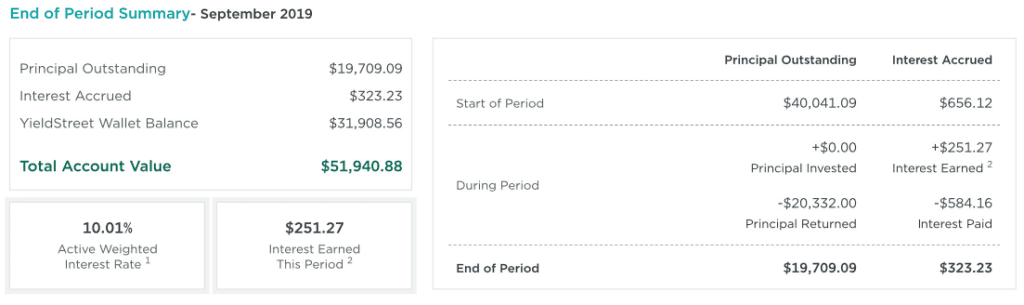

YieldStreet

YieldStreet has become a real fintech success story. This unique platform has funded over $1 billion of investments to date in unique offerings such as litigation finance, marine finance, art portfolios and commercial real estate. In the summer of 2017 I invested in their “Diversified Pre-Settlement Portfolio XXIII”, which is a portfolio of plaintiff advances related to 365 different personal injury cases. This investment has now been repaid in full and I am investing in new opportunities. The minimum investment is usually $10,000 so it takes a while for the cash to build up to reinvest but YieldStreet makes that a non-issue as they pay interest on the cash in the YieldStreet Wallet.

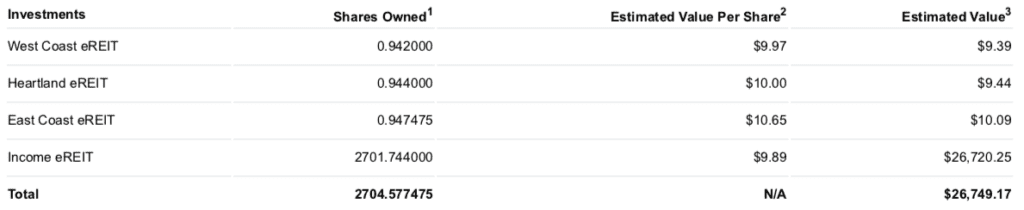

Fundrise

Fundrise is a real estate platform created with the individual non-accredited investor in mind. They have made it really easy to get started with a minimum investment of just $500 in their starter plan. They invest primarily in commercial properties such as apartment buildings and office buildings often as part of a large renovation project. They also have some single family home fix and flips. They have core plans with three flavors: Supplemental Income, Balanced Investing and Long Term growth. These are all backed by their eREIT technology and I am invested in a legacy product called their Income eREIT.

Final Thoughts

I feel like the dark days of 2018 are behind me now where returns dropped below 5% as the consumer lending platforms struggled. While my goal is definitely to be above 7% I am not unhappy with where I am today at 6.29%. I continue to divest from my taxable LendingClub and Prosper accounts while deploying some cash into other platforms and taking the remainder off the table to maintain a steady level of principal.

All lending-type investments should be held in IRA accounts if possible given that interest earned is taxed as ordinary income. LendingClub and Prosper have the additional problem of defaults that may not be tax deductible if they total more than $3,000 a year. This has been the case for me which is the reason I am liquidating my two largest taxable accounts there.

Finally, I will highlight my Net Interest number. This is the money that my portfolio actually earned in the past year: $48,569. This is the highest number I have had in over two years.

As always feel free to share your thoughts in the comments below.