Every quarter I share my marketplace lending investment returns with the world. I started doing this back in 2011 with just my LendingClub and Prosper accounts. Today, I share my returns from 16 different accounts across a variety of investment vehicles and platforms.

I had at least some slightly good news this past quarter. After 13 consecutive quarters of declining returns I have finally had an uptick, albeit a small one. Of course, I am still not happy with these returns and I want to see a continued increase particularly when interest rates are rising. Given that you can now earn over 3% in an FDIC-insured CD for a three or five year duration I think these unsecured investments need to earn at least 7% to justify the risk we are taking.

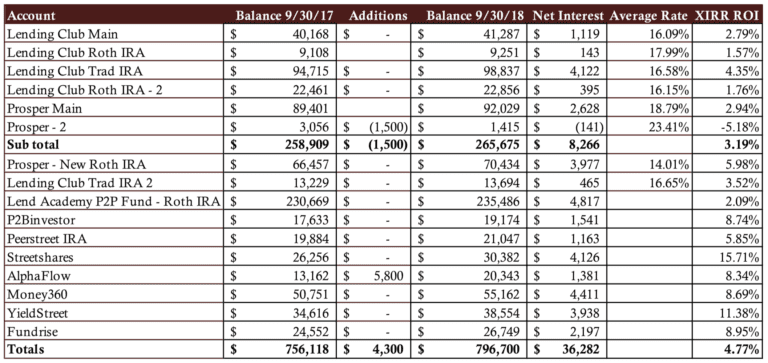

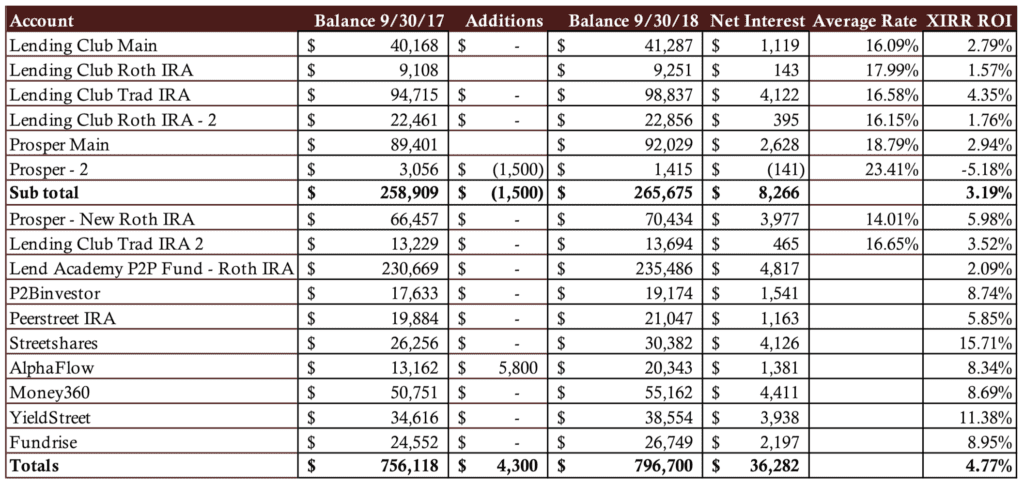

Overall Marketplace Lending Return at 4.77%

My trailing 12 month returns for the year ended September 30, 2018 across all my accounts was 4.77% up from 4.46% in my last update. My original six accounts, all with Lending Club and Prosper, also improved over last quarter but are still at a paltry 3.19%.

My newer investments are all performing well with Streetshares still my standout account and the only investment today with returns consistently in the teens. But I am also very happy with AlphaFlow, Money360, Yieldstreet and Fundrise as they are all returning more than 8%.

Now on to the details. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way for individual investors to determine their actual return.

- The six older accounts have been separated out to provide a level of continuity with my earlier updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

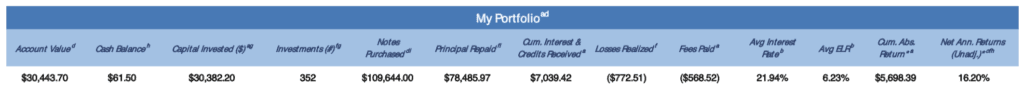

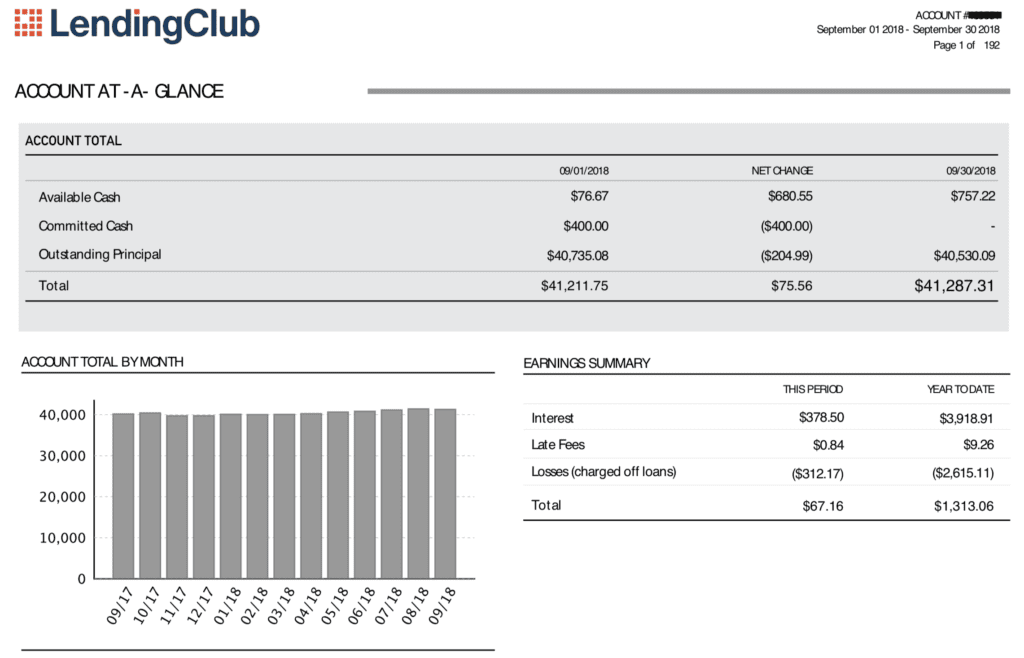

LendingClub

While admittedly coming off a very low base the TTM return for all five of my LendingClub accounts improved this past quarter. This gives me hope that the credit model changes implemented at LendingClub in 2017 have indeed led to better returns. I have a diversified strategy at LendingClub investing across all loan grades but until 2016 I had focused almost exclusively on the highest risk loans. While this worked well for many years starting in late 2015 the highest risk loans started producing the lowest returns. Above is a screenshot of my September statement for my oldest LendingClub account.

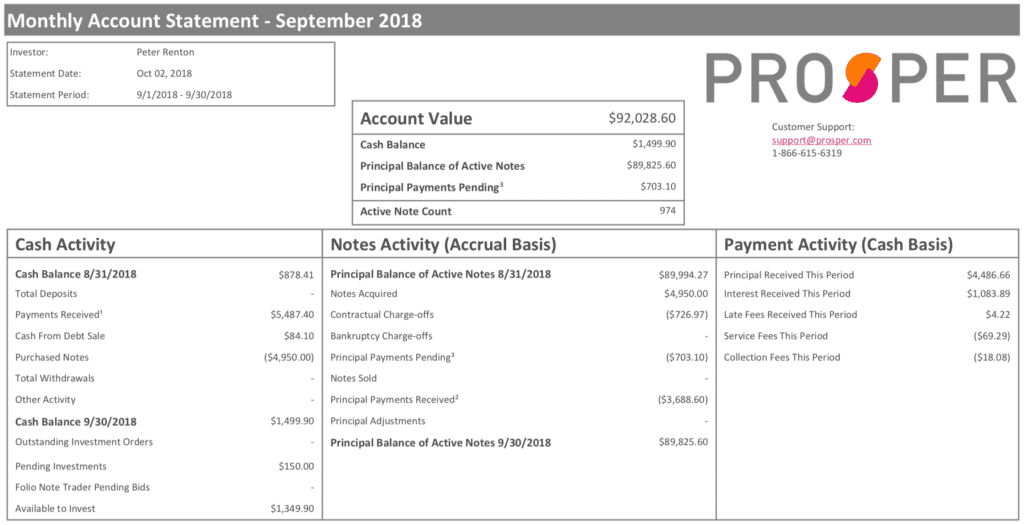

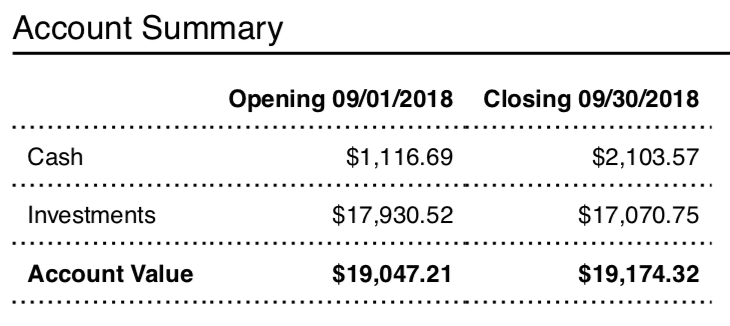

Prosper

Unlike LendingClub my three Prosper accounts are all down. Although, to be fair they are only fractionally down except for my small account which I am in the process of liquidating. This actually is worth noting. I stopped reinvesting in this account in August 2017. In just over a year I have already been able to withdraw $2,500 (I had invested a total of $2,000 back in 2011), more than half the account total in a little over a year. What is important to note about this account is that as it ages the returns get lower and in fact have turned negative. I continue to get charge offs but I am not investing in new loans which always perform well initially and helps boost returns. The above screenshot is of my main Prosper account that was opened in June 2010. A total of $50,000 has been invested into this account over a number of years so as you can see I am not far away from doubling the original investment account.

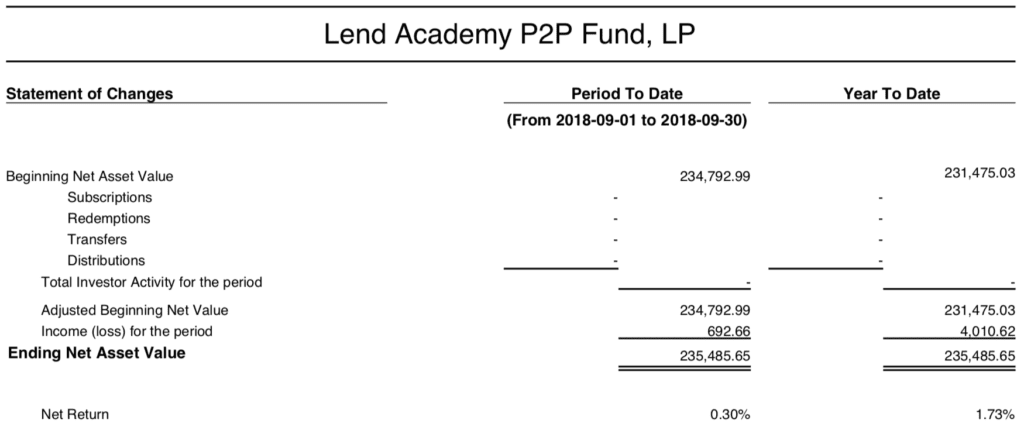

Lend Academy P2P Fund

The Lend Academy P2P fund, managed by the team at our sister company NSR Invest, invests in Lending Club, Prosper and Funding Circle loans and has a small position in Upstart as well. This has not been a good year for the fund. As I mentioned in my last update the fund uses a Fair Value valuation methodology, so changes in interest rates affect the NAV immediately and has actually caused some negative months this year. Several other funds in the space have also suffered from poor returns. I am hoping that interest rates stabilize so the fund can produce the kind of returns it has historically enjoyed. Obviously, increased defaults also hurt and we need the platforms to right the ship on that front as well.

P2Binvestor

P2Binvestor is an asset-backed working capital platform for small businesses based in Denver, Colorado. Full disclosure, I am on the advisory board of this company and have known the founders since before they began operations. What I like most about this investment is that it provides 30-60 day liquidity and consistently returns more than 8%. I would deploy more capital here if there was more new deal flow.

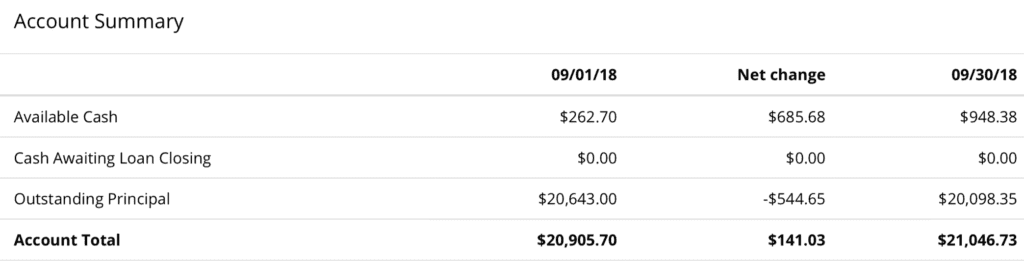

PeerStreet

PeerStreet is a real estate platform focused on fix and flip properties. These are short term loans, typically between 6 and 24 months, and they are backed by the property. I use their automated investment tool to invest in only those loans that are paying 8% or more, up to a 75% LTV and a duration up to 24 months. I invest in $1,000 per loan and currently have 21 different loans in my portfolio right now. There are currently three properties that are in some stage of foreclosure which explains why my returns have dipped a little.

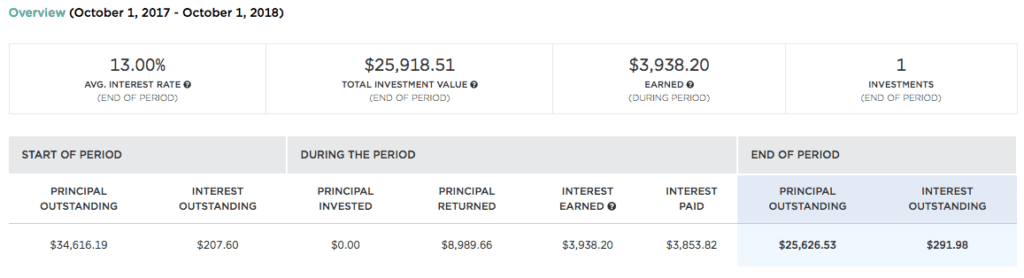

Streetshares

Small business lender Streetshares continues to be my best performing investment. Their returns have been surprisingly consistent given these are relatively high interest business loans. I have been investing for many years now and have had over $70,000 of loans paid back in full with only $1,200 charged off. That is an impressive record particularly when you consider the average interest rate of these loans is over 20%. One of the key differentiators for Streetshares is their affinity with military veterans. They are a veteran-owned company and have a large percentage of borrowers who are also veterans.

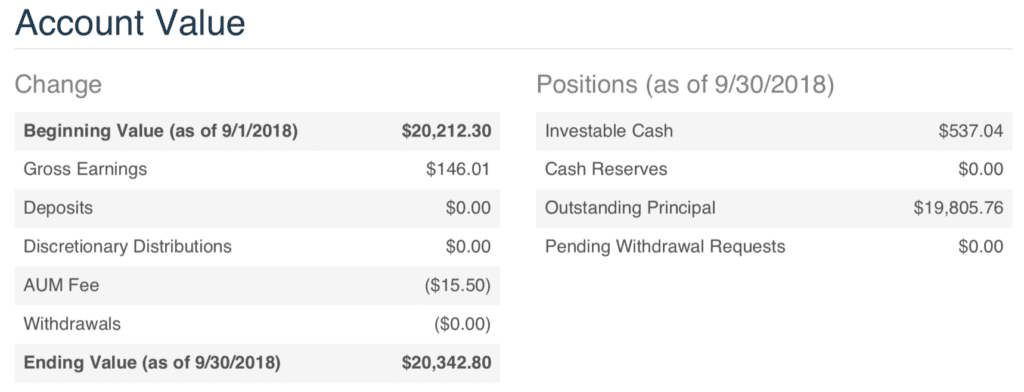

AlphaFlow

AlphaFlow is a real estate platform that allows investors to build a diversified portfolio of short term real estate loan quickly and easily. They have a unique structure that gives investors exposure to 75-100 loans right off the bat. My own portfolio currently has 111 investments in 16 states with an average LTV of 65%. They work with a number of different online platforms and screen the best properties for you.

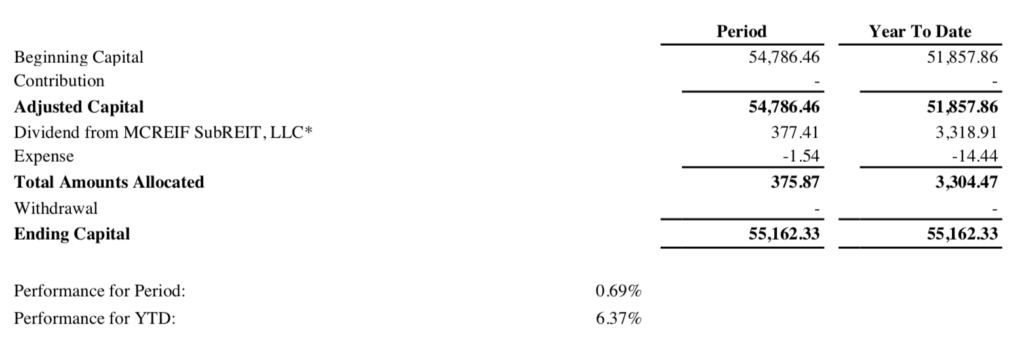

Money360

Money360 is another real estate platform but they are focused on a completely different segment of the market: commercial property. These are primarily bridge loans in the $1 million to $20 million range. I have invested in their M360 CRE Income Fund LP which is managed by M360 Advisors, LLC, their wholly owned investment management company. I like the diversification this gives me and so far the returns have been very consistent.

YieldStreet

What I like most about YieldStreet is the unique investment offerings they provide such as litigation finance. In the summer of 2017 I invested in their “Diversified Pre-Settlement Portfolio XXIII”, which is a portfolio of plaintiff advances related to 365 different personal injury cases. These advances are intended to help individuals pay for essential life expenses while they await the resolution of their personal injury lawsuits. YieldStreet also is one of the only platforms that offers interest on the cash sitting in your account, right now I am earning 2% on my uninvested cash there.

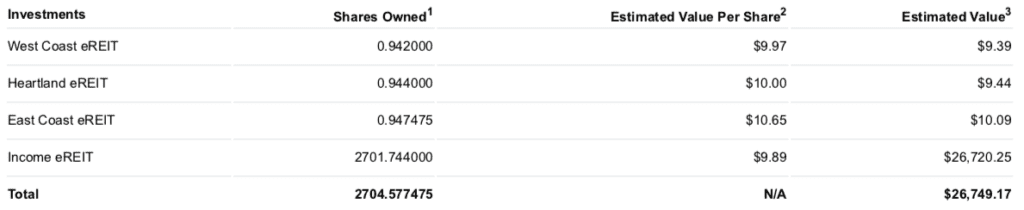

Fundrise

Fundrise is a real estate platform created with the individual non-accredited investor in mind. They have made it really easy to get started with a minimum investment of just $500 in their starter plan. They have “advanced plans” with three flavors: Supplemental Income, Balanced Investing and Long Term growth. These are all backed by their eREIT technology and I am invested in a legacy product called their Income eREIT.

Final Thoughts

While I am somewhat encouraged by the positive movement in my LendingClub account I have decided to make some changes. I am going to be liquidating my taxable LendingClub and Prosper accounts. These are my original p2p lending account that I opened in 2009 and 2010 respectively. I will be moving some of this money into my IRA accounts but the majority will be invested in other opportunities.

As I said in my last update I still believe in consumer credit as an asset class but I have come to realize I have had too much exposure there. And I have decided what exposure I have is best done through a tax advantaged account. All my other accounts at LC and Prosper are in IRA accounts. I will share the process of liquidating my accounts here and will be adding to other positions as well as looking at new investments.

Finally, I will highlight my Net Interest number. This is the money that my portfolio actually earned in the past year: $36,282. This is up significantly from my low point last quarter ($31,957) so I am hoping we can continue in that direction.

As always feel free to share your thoughts in the comments below.