It is that time again when I share my quarterly investment returns. This is something I have been doing for many years now and I know it is one of the most popular features on Lend Academy. I started out investing in marketplace lending many years ago with just Lending Club and Prosper but slowly have added new investments over the years. I share all the details in this post.

Before I get started I do need to provide one caveat with this quarter’s returns. I do not have final numbers for our own Lend Academy P2P fund yet. We are reviewing valuation methodologies and we have several service providers working with us on that possible change. This process is taking quite a bit longer than we expected. I know my quarterly returns are keenly anticipated by many of you and I like to publish them around this time. So rather than wait until the valuation is final I decided to publish my quarterly report now and I will adjust when we get final numbers. In the meantime I have used the December 31 numbers, assuming a flat Q1, to provide a returns estimate.

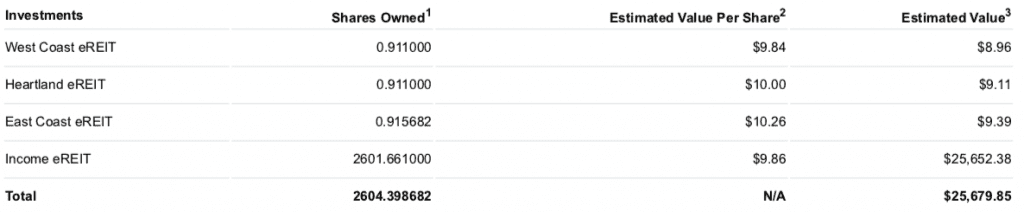

I have one new addition this quarter, Fundrise, they are a real estate platform that is open to non-accredited investors. While I had invested a very small amount with them several years ago I added to it substantially last year and so I am including it in my returns update now. You can find out more by listening to my podcast with the CEO, Ben Miller, from last year.

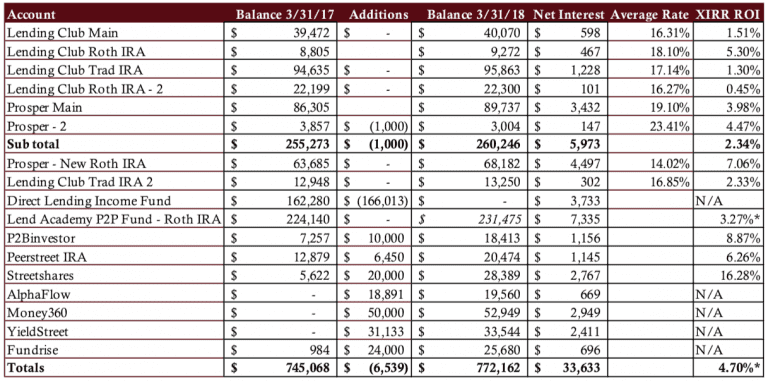

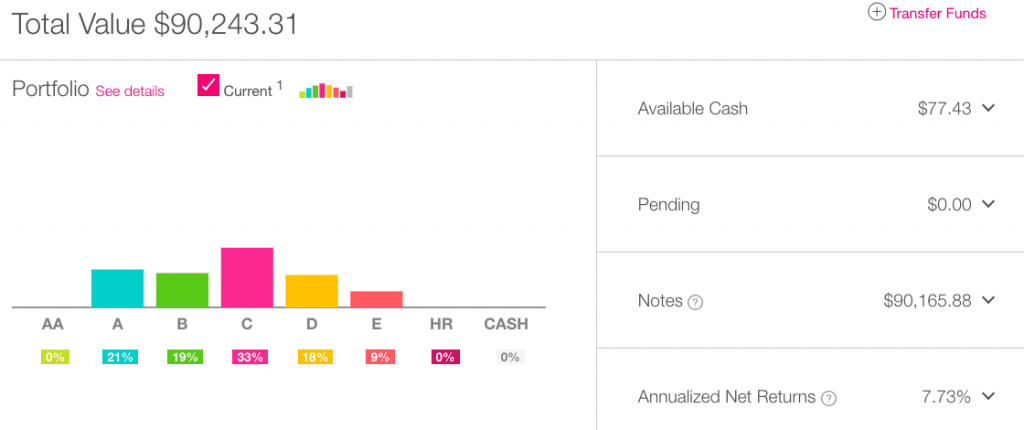

Overall Marketplace Lending Return at 4.90%

After a downward trend that has continued for many years I am wondering when I will reach a bottom. My preliminary return of 4.70% is close to where it was last quarter but still down. I don’t expect my final Lend Academy P2P Fund return to increase this number so I am still stuck in the downward trend of returns.

My six original accounts at Lending Club and Prosper have all been open for at least six years so they are very mature accounts that have experienced several turns of capital as I have kept reinvesting over the years. I separate these out because these were the accounts I had when I first started doing these reports so readers can go back and see how they have trended over time. The returns for the past year are still bad at 2.34% as I continue to pay for poor underwriting performance in 2015 and 2016 at both companies. When you see today that you can get 3% on a 10-year Treasury Note a sub 3% return is just not acceptable for an unsecured consumer loan.

While I continue to reinvest the principal and interest earned in my LendingClub and Prosper accounts in the hope and expectation of a rebound I am committing new capital elsewhere. I like real estate where you can still get mid to high single digit returns with the added security of an asset backing the loan. That is why I have added new money in the last 12 months to companies like Peerstreet, Alphaflow, Money360 and Fundrise. All are detailed here.

Now on to the numbers. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way for individual investors to determine their actual return.

- The six older accounts have been separated out to provide a level of continuity with my earlier updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

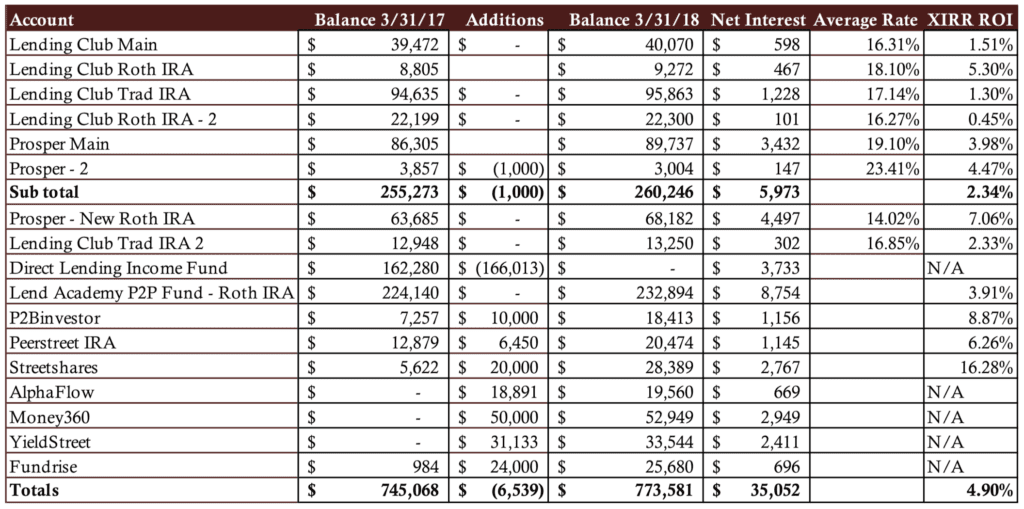

Lending Club

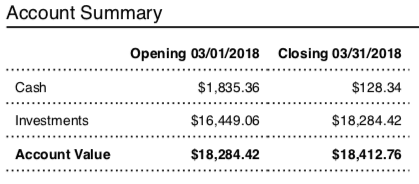

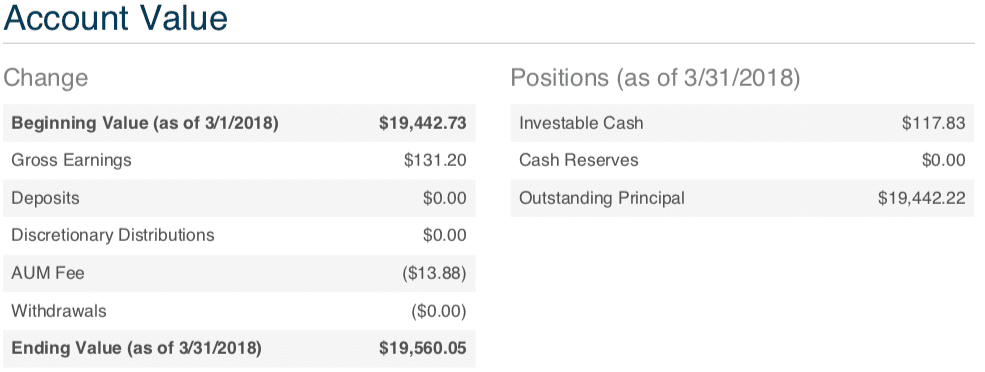

Above is a screenshot of what I call Lending Club Main – it was my very first Lending Club account that I opened in June 2009. The first thing I want to point out here is that I took this screen shot three weeks after the end of the quarter which is why the account value does not match the amount in the above table. The second thing is the Net Annualized Return number that Lending Club provides. My TTM return according to my own calculations on this account is 1.51% and Lending Club says my return is 7.03%. This is a very large delta and it comes from the fact that NAR looks at the total return over the life of each loan. Lending Club has a detailed explanation of how they calculate Net Annualized Return here. All my Lending Club accounts have struggled for some time with high defaults which has resulted in all but one (my smallest account) having returns under 2.5%.

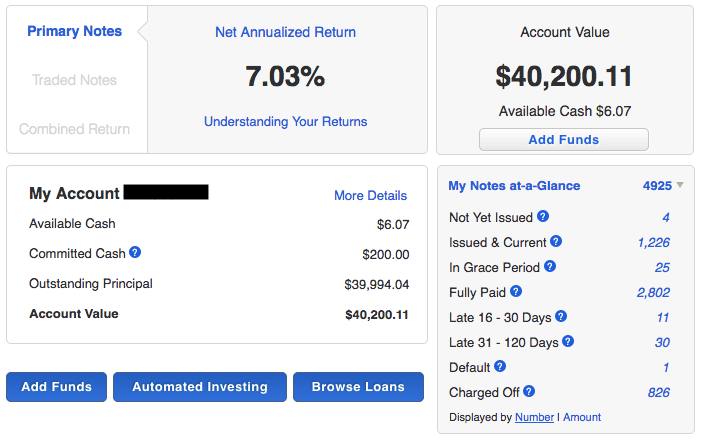

Prosper

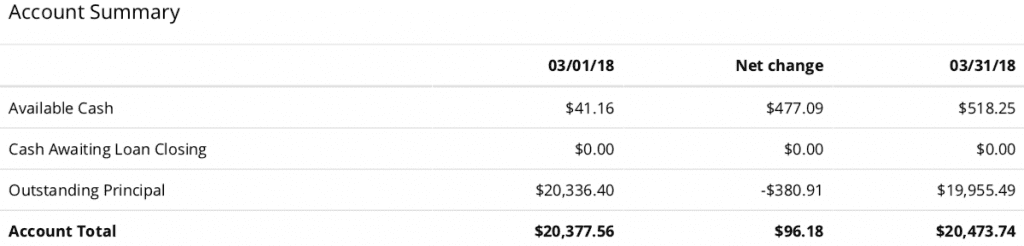

My Prosper accounts were holding up reasonably well but they have also slipped in recent months. While the above screenshot is from my Prosper Main account, originally opened in 2010, my best performing account is also my most conservative one. My Prosper New Roth IRA account was opened in 2014 with the goal of having a diversified portfolio with investments across all loan grades. This account is managed by NSR Invest using their balanced approach and it is no coincidence that it’s performance has held up well. A diversified portfolio or one that focuses on the lowest risk loans has been the best performing approach over the last couple of years.

Lend Academy P2P Fund

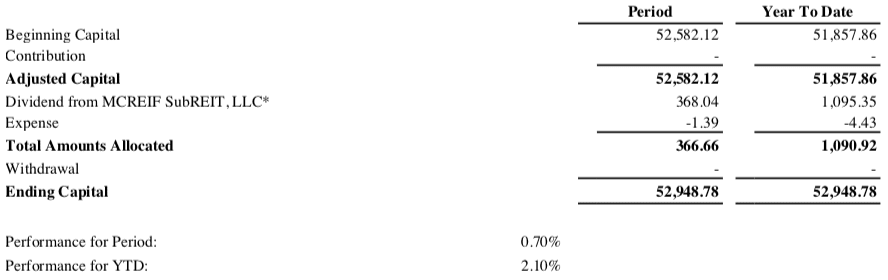

Above is revised and final numbers for Q1 2018.

P2Binvestor

P2Binvestor is an asset-backed working capital platform for small businesses that has been around for about four years. Full disclosure, I am on the advisory board of this company and have known the founders since before they began operations. P2Bi has been a very consistent performer over the years, it has consistently provided returns in the 8-10% range. I am investing in lines of credit typically backed by accounts receivable so unlike most of the investments here these are short term loans with 30-60 day liquidity.

PeerStreet

I opened my Peerstreet account about two years ago when I decided I needed to put money to work at the real estate platforms. As I said earlier in this post as the consumer lending platforms have struggled I find real estate more and more compelling. The expected returns are higher and your investment is backed by a hard asset. Peerstreet focuses on short term loans – typically 6-24 months with yield to investors in the mid to high single digits. I like the $1,000 minimum per investment at Peerstreet which has enabled me to feel comfortable starting with a relatively small investment. I have cycled through my initial capital several times already as the payback on many of these loans ends up being less than 6 months.

Streetshares

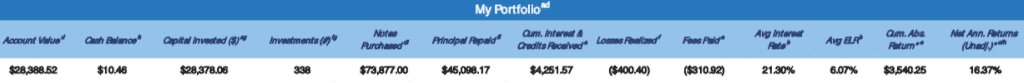

I continue to be very impressed with small business lender StreetShares. It continues to be my best performing investment by far as it is still showing a solid double digit return. Now, I realize that this return will likely come down over time so I am enjoying these 16% returns while they last. I added $20,000 to this account in June of last year and I have invested this money across the entire risk spectrum at StreetShares with $100-$150 per loan. These loans are typically 12 or 18 month terms although I am investing more and more in their new contract financing product, which is a short duration factoring type product aimed at government contractors. I believe that product is the best risk reward investment available in the market today. You are investing in invoices backed by the US government and being paid 1% per month in interest.

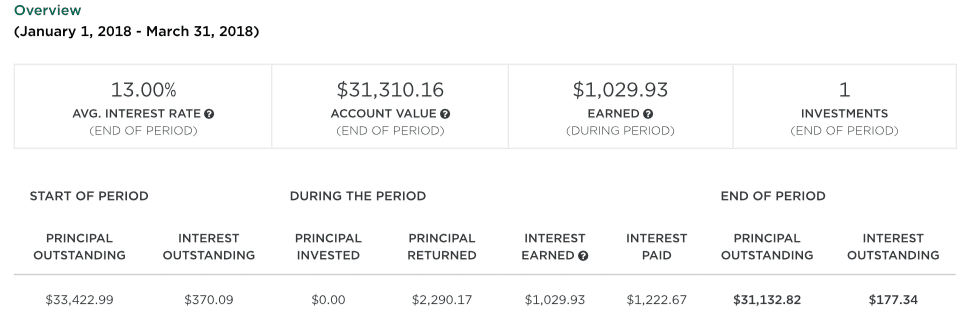

AlphaFlow

I opened my account in real estate platform AlphaFlow in August of last year when I rolled over an existing Roth IRA account. I added to this account in Q1 when I rolled over a small 401(k) I had opened with a previous company. There are two things I really like about AlphaFlow. First, you can quickly build a diversified portfolio of 75-100 properties as they deploy new money across multiple lending platforms. Second, since I know very little about real estate investing I appreciate the fact that they provide expertise in selecting the very best properties from these different platforms.

Money360

As I continue to build a more diversified portfolio across marketplace lending I appreciate additions like the Money360 fund. This was part of a group of new investments I made when I liquidated my investment in the DLI Fund in July of last year. This fund, called M360 CRE Income Fund LP, provides exposure to short term bridge loans for commercial property. These loans are in the the $1 million to $20 million range for commercial properties across the US, an area where I have had zero exposure. While it is still early days, I made the minimum $50,000 investment in August of last year, I have appreciated the consistency in the returns every month.

YieldStreet

YieldStreet is another new addition and provides my portfolio with even more diversification. They offer investments in a range of asset-backed investment products such as real estate loans, secured business loans and litigation finance. With my initial investment here I chose to invest in a litigation finance offering called Diversified Pre-Settlement Portfolio XXIII. This is a portfolio of plaintiff advances related to 365 different personal injury cases. These advances are intended to help individuals pay for essential life expenses while they await the resolution of their personal injury lawsuits. I have already received payback on many of these cases and this money has been credited directly back to my bank account which is why my principal keeps getting smaller. There is no way to easily reinvest small amounts in new offerings yet.

Fundrise

My new entrant this quarter is Fundrise. They offer a product called an eREIT which Ryan covered when they launched back in 2015. This is similar to a publicly traded REIT except it has lower costs as you don’t pay the expensive management fees these traditional REITs charge. While I invested a very small amount when they opened this offering I added $24,000 in August of last year, investing in their Income eREIT. These eREITs provide income on a quarterly basis that can be reinvested back into the fund. As I mentioned earlier one of the great things about Fundrise is that it is open to non-accredited investors.

Final Thoughts

For accredited investors there are many great options available today to invest across a variety of different asset classes in the marketplace lending space. There are some decent options for non-accredited investors as well although the number and variety are certainly more limited. While I began my investment journey in this space focused on just one asset class, unsecured consumer credit, I am now committed to building a more diversified portfolio across multiple asset classes.

Speaking of diversification I have also learned my lesson investing with LendingClub and Prosper. For many years the best performing loans were the ones with the highest interest rates. While I knew these loans were the highest risk, year after year they out performed the lower risk loans. That changed in late 2015 when the companies became too aggressive in their push to grow quickly. This caused a significant pullback in investor capital and neither company is back to the origination levels they were at two years ago.

I still like the unsecured consumer lending asset class and I still believe it provides good diversification in an overall investment portfolio. But trying to swing for the fences with the highest risk loans has proven to be a bad move. We may well return to the days when the highest risk loans provide the best returns but I will not be concentrating my investments there ever again.

Finally, I like to focus on one number, the total amount of net interest I have earned. As my returns have dropped this number has also dropped significantly. My net interest for the 12 months ended March 31, 2018 was $35,052.

Editor’s note: An earlier version of this article provided an estimated return, this has now been updated with final numbers.