The embedded finance market is predicted to be an area of prolific growth over the next decade.

Since Angela Strange, general partner at Andreessen Horowitz, uttered the famous, “Every company will become a fintech company,” in 2019, embedded finance has become ever more widely used.

In a recent report by Future Market Insights, it was forecast that the global market revenue will likely hit $63.2 billion by the end of 2023. Over the decade, this is expected to increase at a CAGR of 16.5%, reaching $291 billion by 2033.

However, embedded finance will need to go beyond its current scope to reach that level.

“Finances are at the core of every consumer decision,” said Phillip Rosen, Global CTO at MoneyLion and Business Leader of MoneyLion’s Engine product. “I think the prediction that every company will become a fintech is true, but we aren’t there yet.”

He explained that while the sector has, until now, primarily focused on payments, fraud, and bank data aggregation, targeting companies already offering financial products.

“The building blocks that non-finance and non-fintech companies need to provide those functions, smooth the flow of funds between purposes, access to more data and capabilities to enable them to act like finance companies, those aren’t really in the market at scale yet.”

Moneylion’s acquisition of Even Financial brought Engine

Rosen, the CEO and Co-founder of Even Financial until its acquisition by MoneyLion in 2021, had driven Even to target this deficit. Since the acquisition, MoneyLion has used Even to produce a new product, Engine, combining the strengths of both companies to push forward in embedded finance innovation.

Even Financial was a significant player in its own right. Founded in 2014, the company operated an online marketplace, connecting and matching consumers with real-time personalized financial product recommendations. At the time of the acquisition, Even’s network included over 400 financial institutions and 500 channel partners covering multiple vertices of the financial services ecosystem.

“The combination of Even and MoneyLion made a lot of sense because MoneyLion’s focus is really on the unbanked emerging consumer,” said Rosen.

“With Even, its focus has been on a much more prime audience. What that enabled us to do is really sort of serve their improving customers with better products, and, at the same time, MoneyLion can participate in our marketplace in a way that isn’t competitive with our client base, to acquire more consumers and do more things. That was the starting premise of the two companies.”

However, he explained that MoneyLion’s full-service banking stack, offering a range of financial services built in-house, had extended the possibilities beyond that. From this, the two companies worked to create Engine.

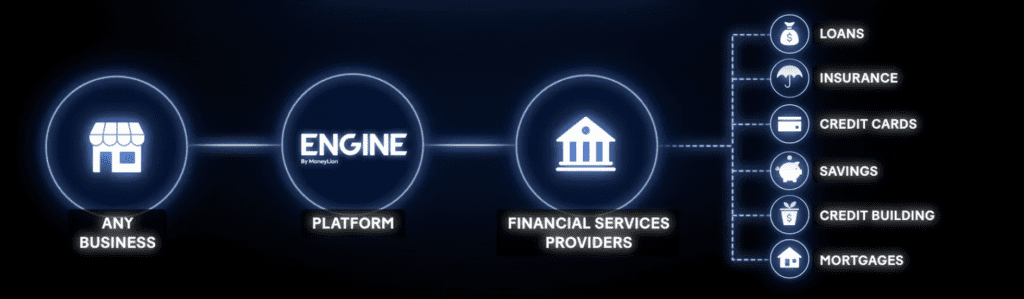

“What Engine is doing going forward is taking those capabilities that MoneyLion has built for themselves and adding them on as complementary APIs for additional functions for other fintechs to build against.”

“Right now, the Even APIs that are really around, “Is this consumer qualified?”, “What’s the probability of them getting approved?” that gives me the data, analytics, and insights on the marketplace to do better. Now we’re able to complement that with additional APIs to facilitate payments, reduce the amount of fraud, improve the accuracy of the data, that the lenders are getting an immersion into a full service, sort of a SaaS suite of products, to enable fintechs to build against as well as just acquire customers.”

Related:

The holistic approach

Rosen explained that due to this ability to provide an extended suite of APIs, Engine facilitates an environment to enable companies with no financial component to offer services.

“When you look at the functions that consumers might be doing, within a publication or an app – take an app that isn’t fintech first, and add finance capabilities to it — It’s not that they’re looking for access to banking data, They’re looking for access to additional features and capabilities that might leverage banking data. Those components haven’t really been built out at scale for the industry.”

Beyond enabling the integration of financial services, Rosen explained that he felt there was a missing piece that could drive increased adoption and customer acquisition.

“We saw the most activity in fintech was in something payments related… But I wouldn’t say it’s the most pressing need that the industry has for new entrants and payments. I see the need to educate, build trust, engage authentically with consumers, and deliver the capabilities that make moving the money necessary.”

MoneyLion’s in-house content creation has been fundamental in providing customers with information on financial products. Built to be hyper-personalized, the “Discover Feed” shows customers a selection of relevant short-form videos on financial topics while recommending products. The approach has pushed financial literacy as a significant part of their offering.

“Everybody tries to produce content that educates consumers so that they can make a better choice. Because these are complex subjects,” he explained. “We’ve seen that be expensive and time-consuming, and it’s hard to get right because there’s a couple of elements there.”

“You have to be trusted. And that’s very hard to do, especially when selling a product. It has to address what a real need is about as opposed to being too generic and hopefully be differentiated enough such that it gets some attention to potentially drive some SEO. And that’s been a pretty expensive thing for companies to do in-house. A lot of companies try, and they sort of suffer.”

While Rosen explained this would also be leveraged as an API for clients, it highlights the holistic approach the company will take with Engine.

“That’s really complementary to the other things we’re looking to embed,” he said. “These are going to be around finding the right product for that consumer, tailoring that product to their needs, and making it immediately accessible and usable within any third-party experience.”

“We will put the banking function where the consumer is—putting the content where the consumer is. Putting the advice for the consumer is. Meeting the consumer at the point of need and servicing them at that point.”