Less than one month after his appointment, Kwasi Kwarteng, Chancellor of the Exchequer, made his first imprint on the UK economy.

Late last week, Kwarteng unveiled his mini-budget amid the desperate cost of living crisis and crashing economy.

The mini-budget is advertised as pushing economic growth. Corporation tax raises have been canceled, income tax cuts have been brought forward, and the Stamp Duty land tax has been reduced.

In his announcement, Kwarteng stated, “The tax cuts and reforms I’ve announced today – the biggest package in generations – send a clear signal that growth is our priority.”

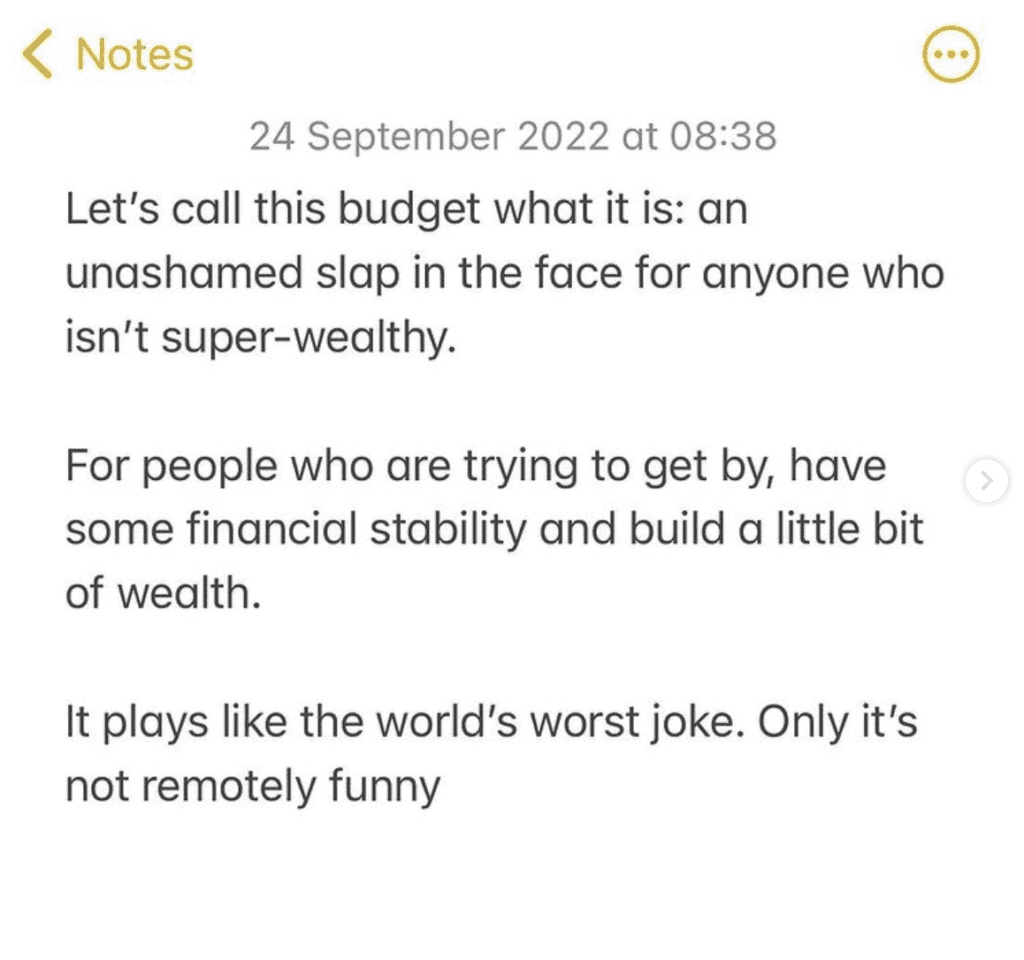

The reception has been less than positive from the general public. Memes and headlines abound joke about the illogical approach of trickle-down economics and the apparent focus on the super wealthy.

“Today, the Chancellor announced the biggest package of tax cuts in 50 years without even a semblance of an effort to make the public finance numbers add up,” said Paul Johnson, Director of the Institute of Fiscal Studies.

“Instead, the plan seems to be to borrow large sums at increasingly expensive rates, put government debt on an unsustainable rising path, and hope that we get better growth. This marks such a dramatic change in the direction of economic policy-making that some of the longer-serving cabinet ministers might be worried about getting whiplash.”

However, not everyone is critical. Janine Hirt, CEO of Innovate Finance, sees the budget as an opportunity for the growth of UK fintech.

“We are pleased to see the Chancellor’s Growth Plan has taken steps to support fast-growing and innovative businesses – including many UK FinTechs,” she said. “The business tax cuts will provide organizations with the confidence that the UK is a destination focused on providing fast-growth companies with the resources needed to thrive.”

In the wake of the announcement, however, the pound slumped against the dollar, leaving speculation on the possible effect it would have on the UK’s rising inflation.

The budget’s tax cut bonanza

All in all, the mini-budget is described by some as a tax giveaway for the rich.

Writer, Sam Bright, tweeted a series of damning posts, condemning the cuts and outlining the context.

The planned rise in corporation tax has been canceled, keeping rates at 19%, the lowest of the G20 countries. A 1.25% rise in National Insurance contributions has also been reversed, which will, the government claim, save 920,000 businesses over £10,000 next year.

Investment allowance up to £1 million has been prolonged, income taxes have been reduced, and sector-specific taxes like duty on alcohol face cuts, while investment zones throughout the UK with additional tax cuts have also been announced.

“The development of Special Investment Zones will encourage FinTechs to scale outside London,” said Hirt. “This will help create growth nationally and provide people around the country with the chance to access well-paid, skilled jobs in the sector.” This runs per the “leveling-up” plan, which has been at the forefront of the government’s plans for the better part of this year.

“If we really want to level up, we have to unleash the power of the private sector,” said the Chancellor, this opinion reflected in his tax-cutting spree.

Crashing markets and disappointed doyens

Despite some positivity between politicians and experts, markets reacted badly (to put it mildly), crashing to near-parity with the dollar. Investors have also sold UK government debt, reducing the price of bonds and pumping effective interest to unseen highs since the currency crisis of the 1950s.

Many experts are dumbfounded.

“How did the government expect the markets to react when it followed a giant energy crisis-fighting package, roughly cost £150bn, with a further £45bn in tax cuts that primarily benefit the rich?” wrote Adam Tooze in the Guardian.

“It also delivered this news at a time when inflation was running faster than at any point since the 1970s and flouted the need for vetting by the Office for Budget Responsibility. What did it expect?”

The borrowing of the current fiscal year is expected to reach 7.5% of the GDP, the third-highest level since World War Two.

The Bank of England, possibly facing requirements to introduce emergency rate increases and FX intervention to defend the sterling’s drop, has said that it is “monitoring developments in financial markets very closely.” It plans to decide on the action in its next scheduled meeting.

The jury is out on whether the budget is good for fintechs and SMEs

While Hirt’s view on the budget resounds positively for the fintech sector, some say the outlook is dismal.

“Despite much hope, and even with the reversal of the planned hike to corporation tax, real substantive and comprehensive financial support for SME businesses slipped off the agenda in the mini-budget,” said Chirag Shah, CEO of Nucleus Finance.

“While the government’s £60bn energy package will go some way to ease business cost pressures at supply level, there was precious little else delivered that would guarantee support for the SME economy.”

“The proposed creation of low-tax zones in almost 40 areas across the UK does little to help the smaller companies who still face supply chain issues, spiraling costs, and staff shortages.”

“Indeed, the coming months look extremely tough for SMEs, so a package of targeted support would have been a real lifeline to those who might otherwise be obliged to scale back or delay investment to keep afloat this year. It’s a real shame this opportunity was missed.”

The government has said in a statement that the coming weeks will see announcements for additional plans to speed up digital infrastructure, reform business regulation, and back financial services.

All of these may be welcome news for the development of the fintech sector after being highlighted as areas of weakness in last year’s Kalifa review.