The following is a guest post by Gunes Kulaligil, Managing Director and Co-Head of Structured Finance at Stout.

Marketplace lending is a rare versatile asset class.

It is held in credit opportunities funds as it is levered to recovery. It is held in income funds since it pays P&I monthly. It is also held in short-duration funds because senior bonds’ weighted average life is often 1-3 years, so MPL checks the box for both credit and risk-averse investors.

However, it is also a criticized asset class for being “untested” and is often likened to a canary in the coal mine.

Untested no more.

The canary is now 10+ years old as prominent platforms like SoFi and Upstart launched in the early 2010s, and Freedom Financial (now Achieve) has been around for two decades.

Platforms used those years to carve their niches, whether that may be lending to the HENRYs (High Earner Not Rich Yet) as was the case for SoFi or the unbanked/underbanked for Upgrade.

Though being “around” for two decades still did not faze the doubters as they claimed the asset class did not go through a 2008-like scenario, and the Covid crisis did not count since credit performance improved as borrowers received stimulus checks that were used to pay down debt.

So where does the industry stand as we go through a transitory period defined by unprecedented quantitative tightening and more challenging economic conditions than MPL borrowers and investors have ever seen before?

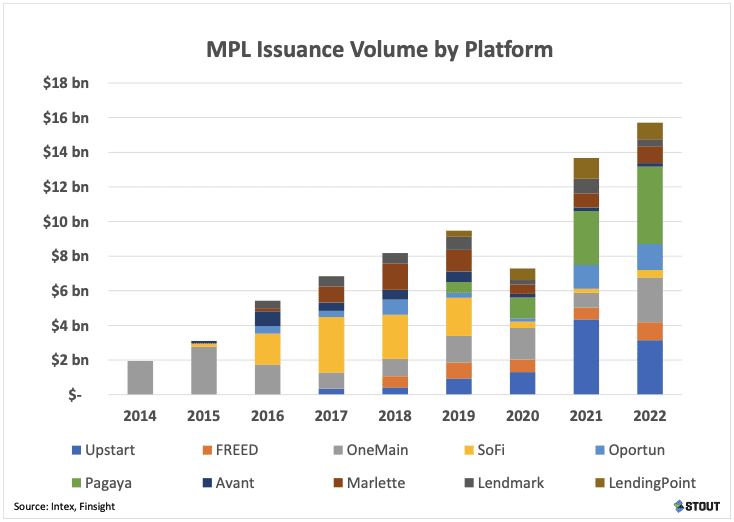

We analyzed 230 deals with an original balance of $61 billion issued since 2017 by Upstart, Freedom, OneMain, Opportun, Pagaya, Avant, Marlette, Lendmark, and Lendingpoint to summarize supply/demand technicals, collateral credit performance, trade color, and transitory challenges.

Supply-demand technicals

In a lackluster year for securitization issuance in general, MPL had a strong 2022.

While interest rate hikes and the widening of credit spreads locked some ABS issuers out of the securitization market, many MPL issuers could still access securitization funding.

The primary reason for this is the high APRs for MPL deals which are often in the 20%+ area for non-prime borrowers.

Securitization cost of funds going up a few percentage points does not make the securitization execution impossible for MPLs. It does, however, make margins slimmer.

With the cost of funds tracking less than 10%, there is still plenty of excess interest for deals that can keep losses in check. Nevertheless, $15Bn of MPL securitization was done in 2022. And that’s just public securitizations.

Related:

MPL platforms also work with private investors like hedge funds, credit unions, insurance companies, and many other institutional investors looking for exposure to US consumer credit.

Investors can deploy capital by acquiring outright portfolios and providing warehouse lines, credit facilities, or forward flow facilities.

Since these transactions are private, it is hard to quantify the overall origination, but the outstanding volume is more significant than indicated by securitization issuance alone.

Collateral credit performance

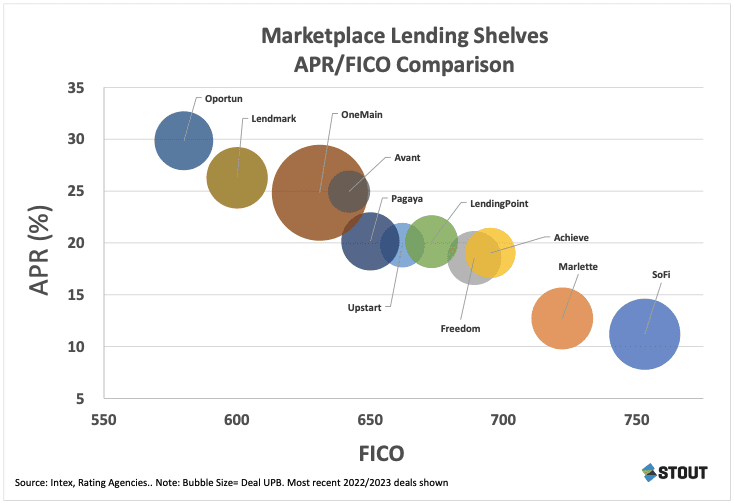

Prime, near-prime, subprime, underbanked, unbanked… all credit profiles have been securitized in MPL deals.

Thus, credit performance varies widely between shelves. MPL lenders do not rely solely on credit scores like FICO or Vantage; instead, they maintain in-house underwriting models that use both traditional and alternative data.

Though we often see credit scores in loan tapes, remember that it does not tell the whole story.

But it comes close: Issuers like SoFi and Marlette serve prime borrowers with FICOs greater than 750 offering APRs in the 10%-12% range.

Lendmark and Opportune, on the other hand, originate 25%-30% APR loans to unbanked or subprime borrowers with Vantage Scores around 620-640, which is the equivalent of sub-600 FICOs.

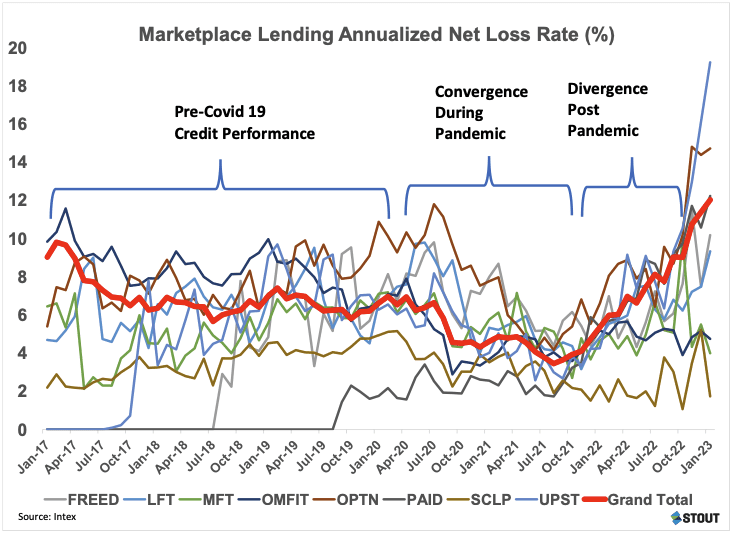

Given the extensive borrower credit profiles that get securitized in MPL, we saw a wide range of losses in the late 2010s.

Right before the pandemic, annualized net loss range was 2% on the low end for SoFi and 12% for Opportun on the high end.

When the pandemic hit, however, loss rates unexpectedly converged to a very tight prime-like 2%-6% range as subprime borrowers paid down debt with stimulus cash.

Post-pandemic, especially since the summer of 2021 (long before rate hikes), we have seen loss rates picking up as stimulus checks ceased and inflation kicked in.

Note the spike in subprime shelves in late 2022 and early 2023. Prime shelves like SoFi are mostly unaffected so far.

Trade color

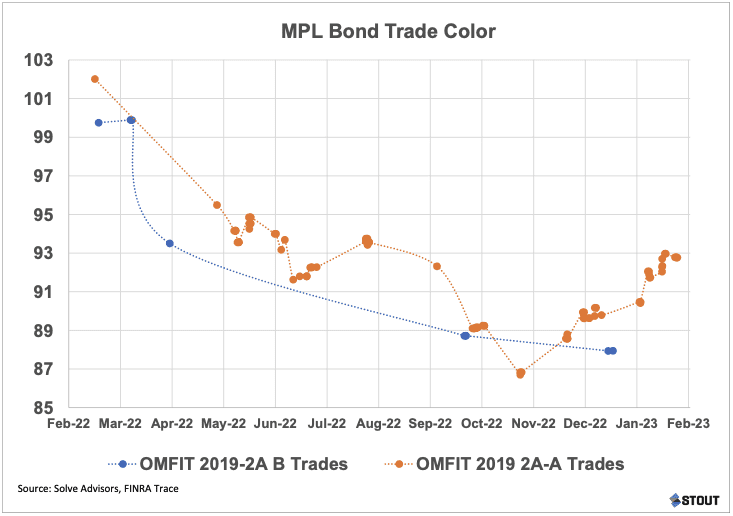

“But what about the green shoots?” There are indeed some.

Despite deteriorating collateral, senior bond prices are off their lows seen in Q4 2021 as investors put money to work.

Take One Main 2019-2A deal, for example. Senior A bond, trading above par pre-pandemic, dropped to as low as 86 price in October 2022 before recovering to 93 in late January 2023.

Subordinate bonds in the same deal did not yet rally, as investors are cautious about increasing losses and whether subordinate bonds could experience write-downs.

In other words, the rally in seniors can be construed as investors assigning a low probability to losses exceeding the current credit support of 35%. So senior investors have more confidence, but subs not so much.

Transitory challenges and the next chapter in MPL

Total origination volume may fall as platforms work to retool their underwriting models, but the transition will be tough.

While “stacking” (i.e., borrowers taking out multiple loans at the same time before they hit their credit report) is always bad for creditors, in the past, a borrower may have been able to roll their consumer loan into a new one.

This borrower-directed version of “extend-and-pretend” would thus limit loss rates. Still, this current tightening credit underwriting environment means they are more likely to default instead of rolling over debt.

This can be seen in the plunge in prepayment rates – consumer loans are usually the highest APR debt for borrowers, so we only see prepays falling this quickly due to a lack of refi rather than borrowers choosing not to prepay.

So at least some of the increase in losses is driven by the tightening of the underwriting rather than the fundamental quality of the borrowers.

Therefore, we see some of the increase in losses as “transitory” – as underwriting stabilizes, these induced losses will dissipate. But there have been some unpleasant experiences lately with calls of “transitory,” recently, so take this with a grain of salt and always do your due diligence.

Maybe 2023 is the “test” we have been talking about, but it really does not matter as some platforms may indeed retreat while others flourish, but the megatrend of non-bank lending to consumers on an unsecured basis is here to stay.