LendingClub shared their Q3 2019 earnings this afternoon. Over the past few years LendingClub has steadily been making progress on their business. While there hasn’t been any groundbreaking news from the fintech company in recent years, they continue to execute on their plans and they are now approaching GAAP profitability. They also have some interesting projects in the works which we touch on below.

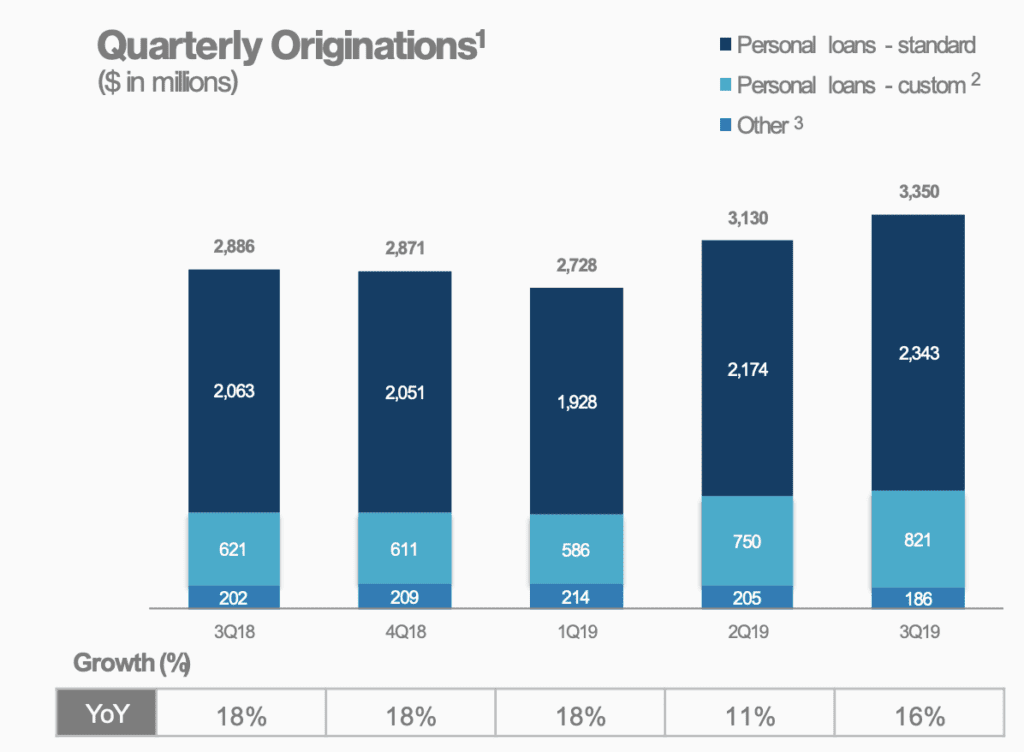

LendingClub crossed $3.3 billion in originations, up 16% year over year breaking last quarter’s record of $3.1 billion.

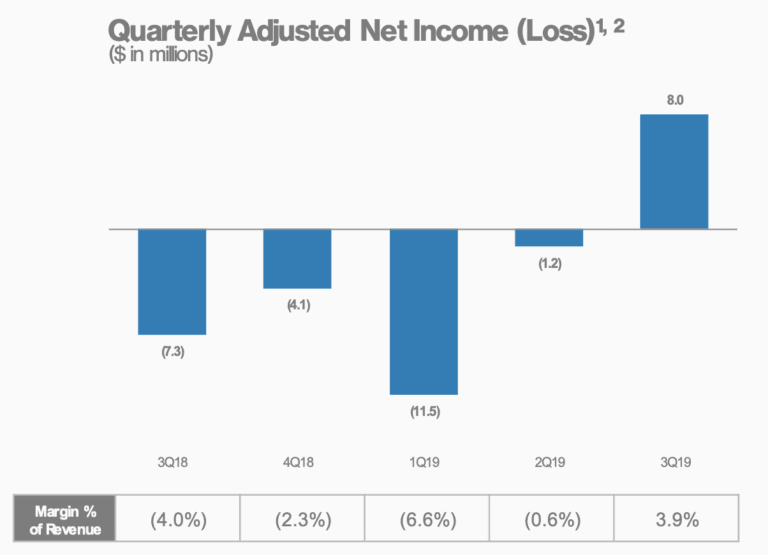

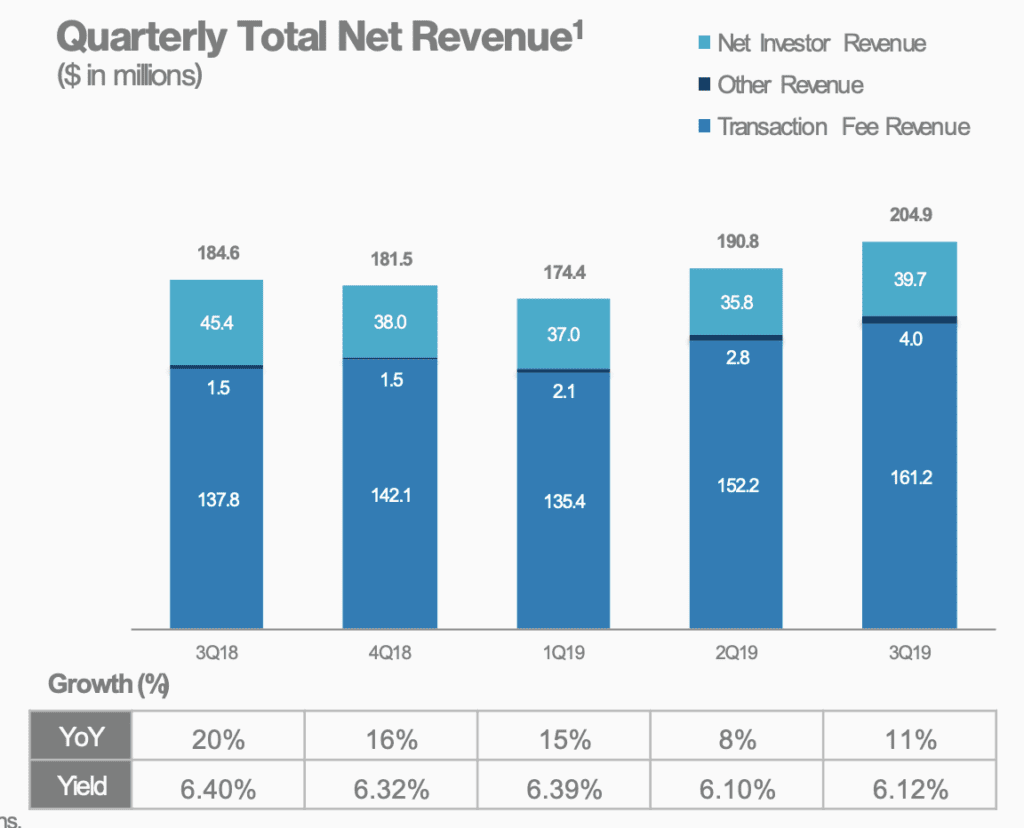

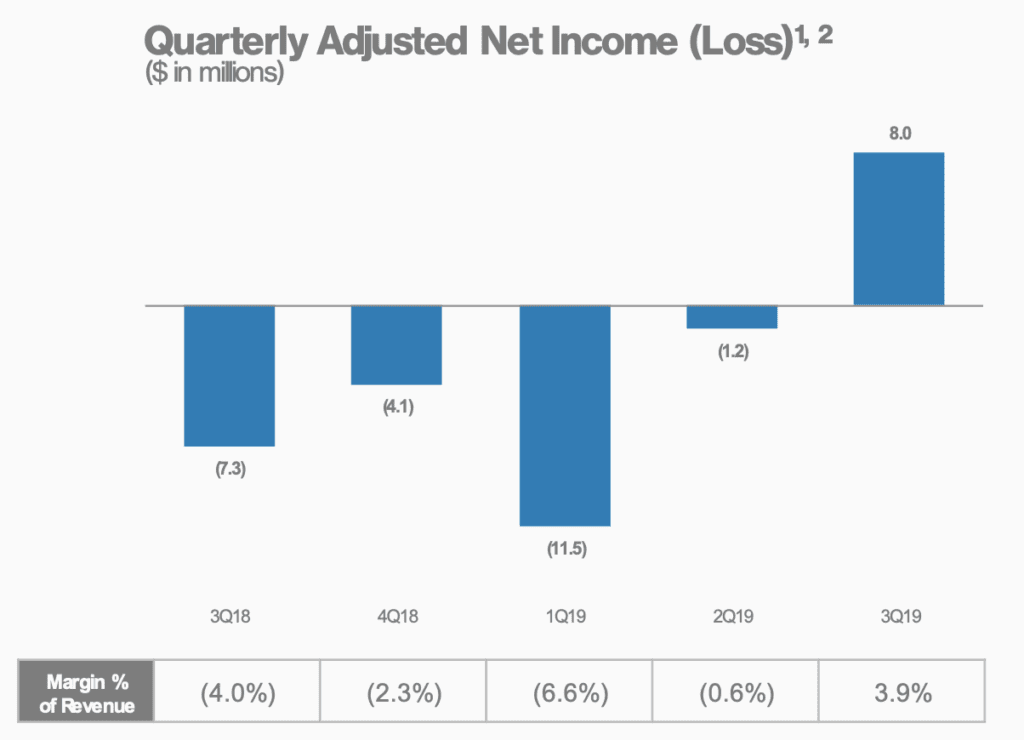

Revenue also topped records at $204.9 million, up 11% year over year. Losses narrowed to a GAAP net loss of just $400,000 compared to the prior year period where they lost $22.8 million. Adjusted net income came in at $8 million, up from a loss of $7.3 million in the prior year period. This is the first time that the company has had a positive adjusted net income since Scott Sanborn first became CEO in 2016. Sanborn noted in February of 2019 that one of the goals of this year was to drive revenue growth, something they have been successful in doing year to date.

LendingClub highlighted the launch of LCX which was announced in October 2019. They now have five distribution platforms in total: LCX, scale, select, Select Plus and retail. LCX allows investors to bid on loans at par, above par or below bar and offers seamless settlement of those loans. LendingClub’s goal with LCX was to build a broader market and bring in additional investors to something that they view as a first for the industry. Per the press release the structured programs combined have allowed the business to access new and larger pools of capital and represented over $1 billion in funding in the third quarter. LendingClub is also seeing some investors participate directly on LendingClub’s platform via whole loans or structured programs that originally participated in securitizations.

Moving on to the borrower side LendingClub has had success in growing applications and conversions as 71% of customers went from application to approval within 24 hours, up from 60% in Q3 2018. As we have seen discussed many times speed matters and this is a testament to the work LendingClub has put in over the years. While companies that give out loans typically have higher NPS scores LendingClub reported that they have an impressive 80 NPS.

Over the past couple of years LendingClub has been working on driving down costs. One of the major components of that was expanding offices outside of San Francisco. Forty-eight percent of LendingClub staff are now located outside of their San Francisco office.

From the competitive landscape perspective Sanborn noted in the earnings call that LendingClub continues to take market share in the personal loan space. They receive a whopping 53,000 applications on a daily basis and half a million members logged into their member center in September. To capitalize on this engaged audience LendingClub began offering a beta version of credit monitoring and two-thirds of users who were offered credit monitoring took advantage of it.

Looking forward LendingClub is still very focused on being a financial health platform which will allow them to have a lifetime relationship with their customers. While little action has taken place we will start to see LendingClub expand offerings further into 2020. Some of this will be done via their own product offerings and other products eventually will be offered through partnerships. Digging into what we might see in 2020 it seems that LendingClub is ready to ramp up auto originations. Sixty-one percent of their users already have an auto loan and Sanborn shared that the traction they are having in auto is ahead of where they were in personal loans over the same amount of time. In 2020 they plan to double auto originations with around one-third of originations likely coming from existing members.

Sanborn touched a little bit on how they have worked over the years to prove out the credit model for auto. One of the things they had to be careful about is the fact that there is less yield cushion when it comes to auto compared to personal loans. They have been testing loans out using their balance sheet but will be looking to add a sizable investor going forward. Despite the plans for growth it will be some time before the fruits of their labor in auto will show a meaningful impact in their financial results. There was also a question in the earnings call regarding secured lending and while it doesn’t seem this is imminent it is an area LendingClub is looking at but one of the challenges is continuing to take friction out of the process.

Last quarter we reported that LendingClub planned to pursue a national bank charter. This will have a number of benefits to the company including engaging more members, accessing more data, stability of funding, cost of funding and also regulatory clarity. This isn’t likely to happen soon, but LendingClub is in a good position internally as they continue down this path according to Sanborn.

From a credit perspective unemployment remains low and consumers continue to spend though LendingClub, like their competitors, have been increasingly picky about the loans they accept. Given the continued competitive nature of the personal loan space Sanborn noted that the smaller players are struggling more where LendingClub is seeing benefits of their scale. The spread between credit cards and personal loans is currently at a record high making it an interesting time for personal loan providers.

In the Q&A a question was asked about limiting investments from retail investors in four states which is a topic we received a number of inquiries about and covered here. In September LendingClub disallowed retail investors from four states (in the call Sanborn stated five). Sanborn stated that many people are aware that LendingClub is regulated both at the state and federal level. As part of their prep for the bank charter they took an updated view of licensing requirements. Sanborn said they are working quickly to get it resolved. With retail making up only 4% of originations overall it has had little impact on the business but certainly did disappoint the retail investment crowd.

Conclusion

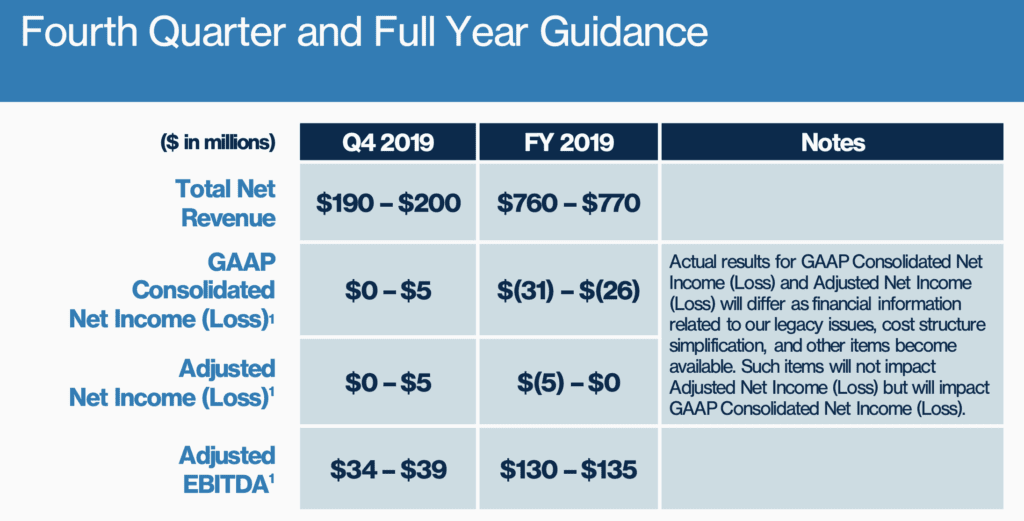

LendingClub clearly has been making progress in their personal loan business but the real exciting vision is the one set out by the team to become a financial health platform. Given their huge member base it is also a vision which could result in significant business over the long term and it’s going to be interesting to see just when they are able to pull this off. LendingClub also updated their Q4 2019 and FY 2019 guidance below.