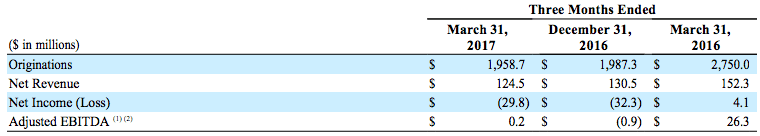

Today, Lending Club announced earnings for the first quarter of 2017. The company reported originations of $1.96 billion, down 1% from Q4 2016 originations of $1.99 billion. Revenue also fell slightly to $124.5 million from $130.5 million in Q4 2016. The company reported a net loss of $29.8 million, down from a loss of $32.3 million in the fourth quarter of 2016. These numbers beat the outlook the company provided in their last earnings call.

Scott Sanborn provided the following comment in the press release on the quarter:

We redeployed resources for growth and invested heavily in our technology platform in the first quarter. With continued strong investor demand, I am pleased with the acceleration we saw as we exited the quarter.

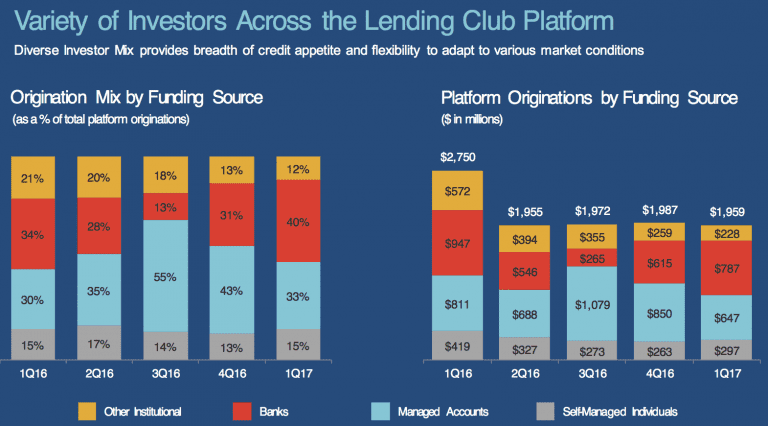

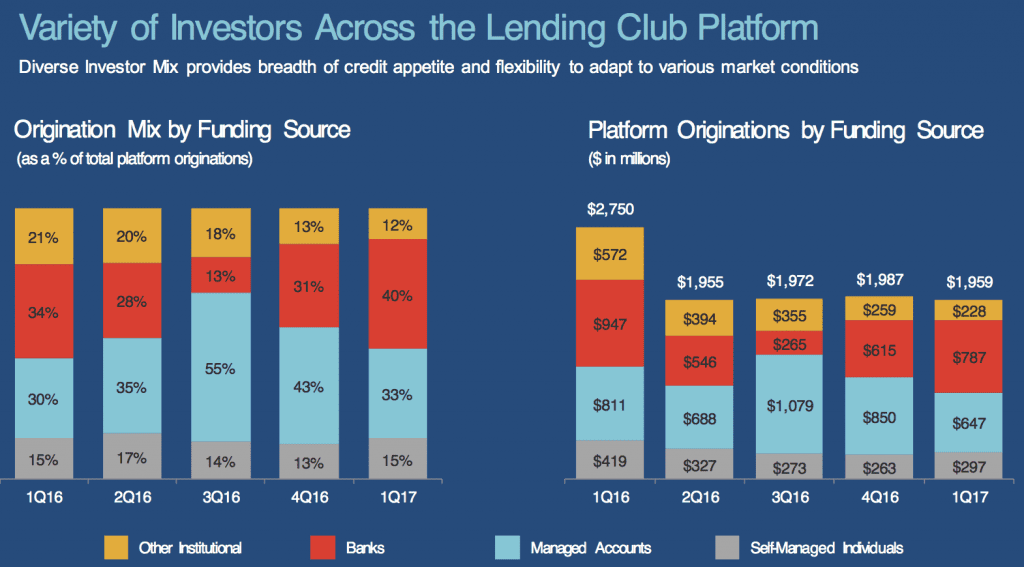

Last quarter our takeaway was that the banks were back purchasing loans at Lending Club. Bank participation edged even higher in Q1 2017, making up 40% of funding, up from 31% in the prior quarter. In Q3 2016, Lending Club announced a $1.3 billion loan purchase agreement with Credigy and according to Lending Club Credigy’s loan purchases continue to be in line with expectations. In the Q & A section of the earnings call Lending Club shared that several new banks entered the mix and the pipeline of banks continues to grow. Retail investor participation also increased in the quarter from 13% to 15%. Scott shared that they now have surplus demand for their loans.

Other successes from the company’s perspective were the release of the Lending Club Invest mobile app which we covered on Lend Academy and activities to support the securitization of Lending Club loans. According to the press release, Lending Club “made significant investment in technology infrastructure to support testing, credit decisioning, and underwriting capabilities”. The company still holds a significant amount of capital on their balance sheet with cash, cash equivalents and securities available for sale totaling $781 million at the end of the quarter.

On the topic of originations Lending Club noted that the first quarter has historically been seasonally difficult. In addition, Lending Club instituted a credit update in January of 2017 which affected approximately 6% of the borrower funnel, mostly in the higher risk loans. Both of these worked against Lending Club in the first quarter and it’s not surprising to see more bank participation if the majority of the loans are skewed towards the higher quality borrowers.

While there were no announcements on driving more borrowers to the platform, the topic came up several times during the earnings call. Lending Club’s enhanced version of the joint application loan program was mentioned in the press release and Scott Sanborn teased that similar types of programs are in the works. The joint application product both reduced risk for lenders by including two borrowers on the loan and allowed borrowers to get a loan when they otherwise might not have been able to. The borrowers may also receive a lower rate by bringing on a cosigner.

They are looking to open up new channels, go deeper into current channels as well as increase the current borrower take rate through pricing optimization and removing friction from the user experience. One way they may be looking to reduce friction is through further automating employment and income verification which was brought up in the call. The company is also exploring other data sources which will give a better view to an individual’s financial condition and stability.

Earlier this year I wrote a two part series on performance trends at Lending Club. There have been many changes to interest rates and Lending Club’s credit policy over the past few years. With their earnings release Lending Club announced new rates, which increased by a weighted average of 30 basis points. The rate changes were predominantly in loan grades C and D. The new rates are available here. Lending Club’s Chief Investment Officer published a blog post providing an update on platform performance and updated forecasts. On recent vintages Scott Sanborn stated early delinquency rates are in line with expectations and they are encouraged by signs of early credit stabilization.

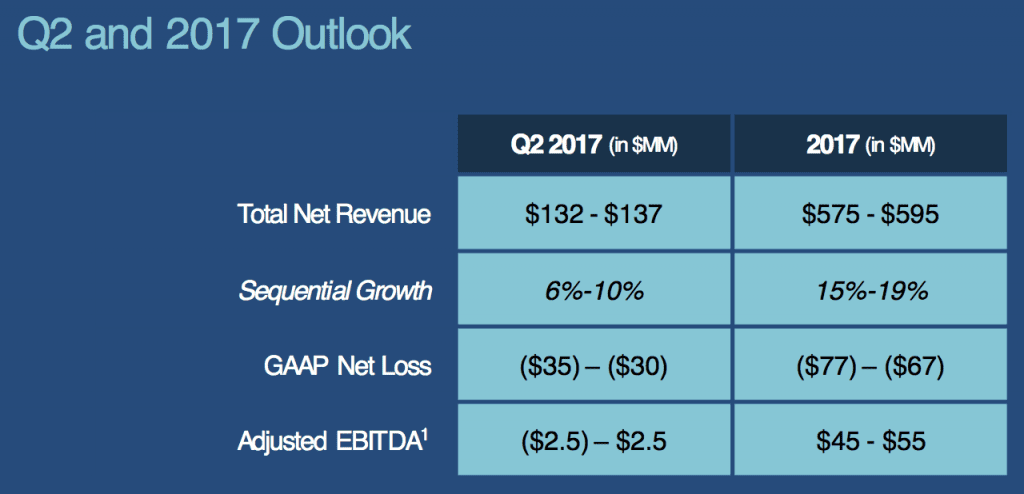

After a better than expected Q1 2017, Lending Club provided better guidance for 2017.

Conclusion

It was a stagnant quarter for Lending Club and the company has now reported originations of just under $2 billion for three straight quarters. Having bank participation on the platform reach 40% is impressive given where they were a year ago. The company beat their estimates for the quarter but it would be good to see them begin to grow the business quarter over quarter even if it is incremental. I look forward to hearing more about the new initiatives Lending Club has in the pipeline.

Disclosure: Peter Renton, the founder and CEO of Lend Academy, and Ryan Lichtenwald, the author of this article both own LC stock.