When Kabbage pulled back from its earlier international focus, co-founder Kathryn Petralia said the strategy had paid big dividends.

At one point, Kabbage developed partnerships with banks that saw its technology power small business lending in seven countries.

Those relationships are hard to maintain, and it is a challenge to teach leadership the importance of owning the customer experience. There were plenty of opportunities stateside, and Kabbage developed a suite of cash flow tools to assist small businesses.

“There wasn’t anything like that for small businesses in the United States,” Petralia said.

She said that America boasts 30 million small businesses, 80% employing fewer than 10 employees. Together they’re a powerful economic force, but they are underserved by service providers.

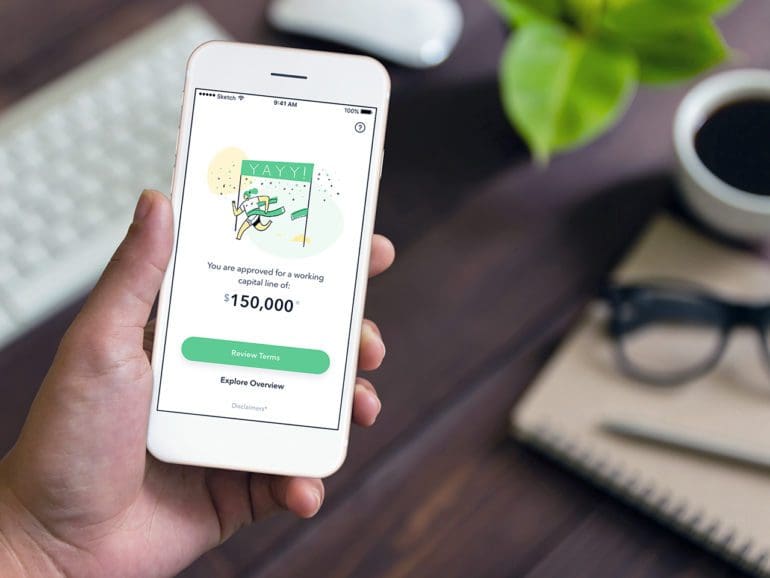

Kabbage began to focus on making financial functions easier for these entrepreneurs, who are stretched for time and do not have the luxury of CFOs, Petralia said.

They need core operating systems, checking accounts, payment and invoice processing, and bill payments.

Petralia said that a payment product was launched before the onset of the COVID-19 pandemic, perfectly positioning Kabbage to process the second-largest volume of PPP loans during the program’s first run. The average loan amount they processed was $11,000.

“That was a really exciting time for us to be able to serve those small businesses,” Petralia said.

In August of 2020, Kabbage was bought by American Express and began to develop some new products, with a focus still on the smallest businesses.

Few companies seek to meet such needs, she said. More prominent players like Square and PayPal are more monoline, but some new ones like Wayflyer and Pipe show some promise.

Petralia noted that many companies use external data sources to help assess applications, something Kabbage has been doing since they were founded in 2008.

‘What is old is new again’

Few were lending during the first 12 to 18 months of the pandemic. Add in government relief, and there was a lull. Then came the K-shaped recovery where some sectors, including many restaurants and retail establishments, fared well, Petralia observed.

Many of those success stories came from wise adaptation, with some developing an effective online strategy, others instituting delivery services and some leveraging social media.

While some companies sat on the PPP money or used it to pay off higher-interest loans, Petralia said many small businesses needed it to keep their lights on. Some even returned the money because they did not require it. Many had one issue: the rules were constantly changing, which made the forgiveness criteria unclear.

Digital finance grew because folks couldn’t go to a bank for a long time. That hurt small business operators who could not complete a mobile deposit from their phone for business accounts.

One common observation from industry watchers is to expect more partnerships between fintechs and banks, as the latter seeks to play digital catch-up and the former seeks growth.

It depends on what particular niche the fintech operates in, Petralia cautioned. BBVA shut down a pair of expensive acquisitions that did not bear fruit. She sees most such partnerships being successful in core banking services and infrastructure.

Small business interest in crypto also small

Is there much small business interest in cryptocurrency? Petralia hasn’t heard from many customers who want it. Small business owners already take on enough risk without contending with the volatility.

Petralia admitted she was in a weird position during the pandemic, given Kabbage’s sale and the launch of the PPP funding. That left many lenders uncertain about how to proceed.

She said she’s closely watching inflation, which will significantly impact small businesses, with customers telling her the price of some items has doubled of late. Supply chain issues will also persist. The total effect of some of these factors has yet to reach the consumer.

Kabbage has long employed full automatic, real-time access to third-party data along with machine learning models, Petralia said.

“It surprises me how few other Kabbages there have been.”

Is secure, multi-party computation a process that can allow competitors in the same field to collectively benefit from each other’s data without seeing it an option as companies seek to refine their lending models? Only if everyone participates, Petralia said. Otherwise, you’re only looking at a slice of the pie.

The data challenge

A challenge in financial services, especially on the consumer side, is so little actual data is available due to provisions of the Fair Credit Reporting Act, Petralia said. That act protects information collected by consumer reporting agencies such as credit bureaus, medical information companies, and tenant screening services. Information cannot be provided to anyone who doesn’t have a purpose as specified in the act. Companies providing information to agencies have obligations, including investigating disputes.

“Facebook doesn’t want to to be a credit agency,” Petralia said.

Will the open banking movement have a revolutionary effect as it heads west? For now, Petralia is reserving judgment. She noted fewer people than expected in Europe are switching banks. Companies must also educate consumers about the benefits of the process. The user experience must also be superb.

“I hope we have a better plan for how it’s going to be useful,” Petralia said.

The BNPL craze also fascinates her. She said it’s nothing new and similar to what used to be on retail branded card products.

“The fervor around that puzzles me,” Petralia concluded. “How many new BNPL companies can there possibly be?”